.jpeg)

From the current point of view, Alpha’s products are mainly leveraged liquidity mining, which helps providers of encrypted assets (ETH, etc.) earn income and helps liquidity miners increase their income. It is essentially a lending market, but it also It is not an ordinary lending market, it is combined with liquidity mining to open up a new territory in the lending market.

If you look at Alpha's official website, it says Alpha Finance Lab. It does not say that it is fixed on leveraged liquid mining products, but will come up with a series of DeFi products, whose goal is to maximize user benefits while minimizing users risk. In other words, for Alpha, it may output a lot of DeFi products, as long as it meets the needs of users.

Alpha's products focus on capturing user needs that have not been fully satisfied. In order to meet these needs, Alpha is also trying to find a variety of implementation paths, by improving user experience, which is also reflected in the new product mechanism.

From the perspective of the development of DeFi, not only DeFi thinking is needed, but also product thinking.

Alpha Homora currently has V2. Users can leverage mining on Sushiswap, Uniswap, Curve and Balancer to increase mining revenue. Asset providers can also provide ETH, DAI, USDT, USDC and other assets to obtain higher returns. Of course, there are currently various attacks on DeFi, which may also cause potential losses. The last time Alpha Hormora V2 had a vulnerability, the attacker used Flash Loan and Cream's Iron Bank to complete the attack. Therefore, when participating in DeFi, participants must have sufficient risk control to avoid excessive losses.

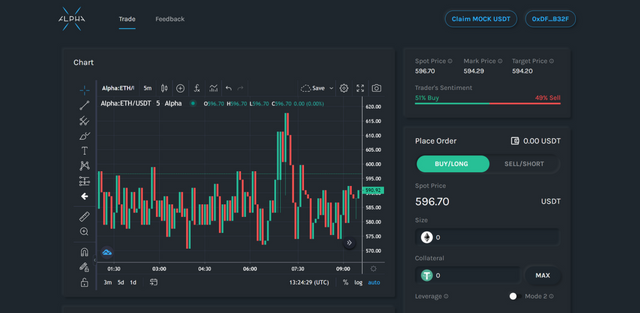

Currently, Alpha's next product is aimed at the hot area of DeFi: perpetual contracts.

AlphaX's perpetual contract

AlphaX is a decentralized non-order book perpetual contract product. On AlphaX, users can leverage long or short various crypto assets. AlphaX enters the perpetual contract field. On the one hand, there is a great demand in this field. The launch of AlphaX can capture more DeFi users. At the same time, it can also help those users who use leverage to hedge their positions in Alpha Homora, such as users. When borrowing ETH for mining, short ETH at the same time, which can help users realize hedging without worrying about the rise and fall of the market. That is, from the user's point of view, AlhpaX can help Alpha Homora users reduce the risk of asset decline.

Judging from the news released by Alpha, it is different from dydx and so on. In addition to traditional functions, it also introduces some new things:

*Non-order book mode

This is similar to the spot transaction of Uniswap and Sushiswap, in which users interact with the fund pool of the smart contract. Judging from the current practice of DEX, this model is suitable for the current DeFi market and also reflects its advantages.

*No "explicit" funding rate

Funding rate is the key to maintaining the balance of contract transactions. For ordinary users, if they want to participate in perpetual contract transactions, they need to understand the concept of funding rate and why they should pay or receive fees.

Funding rate is very important for the perpetual contract market. If it is not designed well, the risk of the perpetual contract will increase, the volatility will increase, and the market efficiency will become lower. Funding rate itself is a balance between short and long positions, through the adjustment of fees to promote the price of the perpetual contract to closely follow the price of the underlying asset. If the market price of a perpetual contract is higher than the spot price of its underlying asset, the funding rate is positive, and the longs need to pay the shorts to curb the long positions and incentivize the short positions to achieve balance. vice versa.

However, for many users, especially spot trading users, this concept is somewhat difficult to understand from the beginning. AlphaX's solution is to simplify the concept and remove the "explicit" funding rate concept. It integrates the concept of funding rate payment into the price of traders opening and closing positions, and its price will be automatically adjusted according to the funding rate payment, that is, it does not require long or short traders to explicitly pay for fees , And its price will closely follow the price of the underlying asset.

Of course, Alphax is not without capital rates, it just integrates it into spot quotations from the product level and from the user's perception point of view, making it easier for ordinary users to understand. The result of this is that users trading perpetual contracts on AlphaX have a similar experience to playing spot transactions. In spot transactions, users buy or sell without considering issues such as capital rates, which is very intuitive for ordinary users.

Specifically, how does AlphaX do it?

In the perpetual contract market, people conduct leveraged contract transactions. What people trade is not the real digital asset itself, but the price change of the digital asset. There needs to be a transaction price in the perpetual contract market, which is a marked price, which can track the actual price or price index of an external exchange.

In order to balance the trading market, the fund rate is paid at regular intervals (for example, BitMEX uses the fund rate payment to be executed every 8 hours). If the mark price is lower than the index price when the funding rate is paid, the short trader will pay the long trader. This will incentivize long traders to open positions or short traders to close them because they know it will bring them gains or losses. In this way, through the mechanism of fund rate, the mark price will be pushed up, thus approaching the index price. If, conversely, the marked price is higher than the index price, the long trader needs to pay a fee to the short trader.

AlphaX incorporates the funding rate into the marked price, allowing users to ignore concepts other than the opening and closing prices. The way AlphaX incorporates funding costs into the marked price: Like all perpetual contract platforms, longs and shorts still need to pay each other fees, but it is done by automatically adjusting the marked price. As the marked price deviates from the index price, once a certain threshold is reached, the marked price will be readjusted. The price adjustment will gradually converge to the index price.

For example, if the mark price is lower than the index price, in this case, half of the shorts pay the longs, and the mark price on AlphaX will be adjusted upwards. At this time, if the long traders close their positions, they can close their positions at a higher price than before the marked price adjustment, that is, the long traders will have higher returns than before the adjustment. At the same time, if short traders close their positions, they will close their positions at a higher price than before the marked price adjustment, which is equivalent to the airdrop traders' income being lower than before the adjustment. Through this income adjustment mechanism, long-sellers are encouraged to close their positions, and short-selling closes are inhibited, thereby balancing the long and short markets.

In other words, under this mechanism of AlphaX, traders' income is only affected by the entry and exit prices, and there is no need to pay attention to the regular expense rate.

If there is an extreme imbalance between longs and shorts, the marked price may temporarily deviate from the index price. The AlphaX agreement will automatically adjust the mark price to incentivize it to track the index price.

Of course, the adjustment of the mark price will also bring various arbitrage opportunities for arbitrageurs. They can open or close positions at a better price to rebalance this price deviation.

* Tokenize long and short positions

Alphax tokenizes the long and short positions of traders, both of which meet the ERC-1155 standard. Alpha plans to package them and then turn them into ERC20 tokens. In this way, long and short positions can be traded, pledged, or borrowed as collateral in other agreements.

By tokenizing long and short positions, there is an opportunity to increase the utilization of user assets, thereby attracting more users to participate. In addition, by tokenizing the leveraged position of the perpetual contract, it becomes easier for users to participate in the Alphax perpetual contract. You don’t even need to open a position in AlphaX, just go to Sushiswap or Uniswa to buy the long or short contract position of the perpetual contract. Tokens are fine. Alpha Homora users can hedge their downside risks by holding these contract position tokens. Assuming that the current ETH price is 1500 USDT, a trader opens a 3x long position in AlphaX. The trader deposits 1500USDT into AlphaX and chooses 3 times long. The trader will get 3 ETH-1000 tokens, and each ETH-1000 token is currently worth 500USDT (1500-1000=500). Then, the current user's 3 ETH-1000 tokens are worth 1500USDT.

Assuming that the USDT price rises to 2000USDT, the value of each ETH-1000 token is now 1000 USDT (2000-1000=1000); the user owns 3 ETH-1000 tokens, then the user has a value of 3000 USDT at this time The user’s net income is 1500 USDT (3000-1500=1500), which is 3 times the price change. The price of ETH has increased by 500 USDT, 3 times more, and the user finally got 1500 USDT. . Of course, if the price drops, users will have to bear corresponding losses.

* No robot, automatic on-chain clearing mechanism

AlphaX is a perpetual contract market without an order book. It uses a constant product X*Y=K model. AlphaX tries to allow K to be dynamically adjusted, and the K value determines the coefficient of liquidity, which will affect the trading slippage of opening and closing positions.

If K is set too high, and traders will suffer lower slippage, they need a lot of funds to promote price changes, which leads to lower efficiency; if K is set too low, traders will bear higher Slippage, which makes the perpetual contract market unable to support larger positions and large-scale transactions.

In other words, too high or too low K value is not conducive to the sustainable development of the perpetual contract market. Based on this situation, AlphaX dynamically adjusts the K coefficient to avoid slippage that is too high or too low, and to avoid the situation where the market cannot continue to grow.

AlphaX plans to manually adjust the K value through administrators or community governance. With the enrichment of practice, it will use algorithms to adjust the K coefficient through smart contracts in the future.

The last one is a question that Alpha token holders are more concerned about. What is the use of Alpha tokens?

Alpha token usage

Alpha tokens will be applied to various protocols under Alpha. In addition to Alpha Homora for leveraged mining, it will also be applied to AlphaX and new products in the future.

The main purpose of Alpha tokens is to promote the growth of the Alpha ecosystem. Its first and foremost role is to guide liquidity and promote the growth of the value of the agreement. In this regard, most DeFi tokens have a similar effect, and Alpha tokens are no exception. In addition, Alpha tokens have the following uses:

*Governance Token

Almost all DeFi project tokens have governance functions. Ultimately, DeFi projects will move towards DAO governance, and the important medium for governance is tokens. The governance role of Alpha tokens will become increasingly important because it can make decisions on the development direction of Alpha at multiple levels:

- Product-level governance, Alpha token holders can manage the core parameters of each Alpha product.

- At the financial level, Alpha token holders can manage the interoperability of Alpha product portfolios.

Alpha token holders can vote on the Alpha public proposal on Snapshot.page, thereby affecting Alpha's development roadmap.

*Value capture

A certain percentage of the agreement fee is obtained by staking Alpha tokens. According to Alpha's plan, it is still being implemented. If implemented, it will lock a part of Alpha tokens, thereby reducing the number of Alpha tokens in circulation, which will help increase prices.

*Safety value

Alpha tokens can also be used as insurance pool funds, which is still being implemented.

*Work token

For example, only token holders can use more features on Alpha products. If Alpha's products are good enough, this will encourage more users to buy ALPHA tokens. This is being implemented.

Of course, since the Alpha protocol is developed through community governance, ALPHA token holders can also use their imagination to promote more utility of ALPHA tokens, and it will continue to move forward with the development of the Alpha protocol ecology.