.jpeg)

This article will analyze the likelihood of SUSHI reaching $ 100 through a financial valuation model.

The dividend discount model is investing them by predicting future dividend payments, the traditional model for measuring the value of assets. Although this model is based on assumptions about future growth, it can be used as the basis for the present value of any productive asset.

This model does not apply to all DeFi tokens, only tokens that issue bonuses to token holders, such as MKR, SUSHI, and KNC.

This article analyzes the value of SUSHI through a financial model, and examines the possibility of a SUSHI price of up to 100 US dollars, the current price of just under 20 US dollars.

SUSHI assessment analysis model

SushiSwap is Ethernet Square built on DEX, also maintained by the AMM community.

In the last 6 months, SushiSwap has become the DEX with the largest transaction volume and total liquidity. To date, SushiSwap has an average daily nominal trading volume of US $ 200 million to US $ 200 million Since its launch, its cumulative revenue has exceeded US $ 100 million.

Recently, SushiSwap launched a project to distribute a portion of the transaction fees across the platform to currency holders. At an early stage, investors and market participants can now earn token rewards by pledge. In addition, the token valuation can be calculated because modeling can be used to predict future token prices.

This article analyzes the intrinsic value of the SushiSwap platform and its native SUSHI tokens through a valuation model.

SushiSwap Tokens: SUSHI and xSUSHI

SushiSwap's original token is SUSHI, which is used for community governance. Through the SUDHI token, the community can vote on all major changes to the protocol. Although many DEXs provide similar structured governance tokens, SushiSwap was one of the first companies to distribute dividends to token holders, derived from the platform's collection of transaction fees.

When marketers trade at SushiSwa, they need to charge a fee of 30 basis points. A 5 basis point fee is added to SushiBar's pool of funds in the form of liquidity provider tokens, and these tokens will then be used to purchase SUSHI. SUSHI purchased will be distributed proportionally to xSUSHI holders in the fund pool, and holders will receive SUSHI.

The net effect of dividends is similar to dividends in the traditional stock market, allowing currency holders to continue to profit through tokens.

SushiSwap is the first in this regard, as it has an incentive mechanism, and currency holders can share the transaction costs of the agreement. I hope that in the future, other governance tokens will have a similar model, so that token holders can share a portion of the transaction fees.

The basic principles and assumptions of the valuation model

In a traditional stock market, for stocks that would pay dividends, people would use an expected discount rate to discount future cash flows to their present value to value the stock. This model is also called the "dividend discount model."

The discounted amount of future cash flows is the net present value. In this model, I use historical transaction volume and transaction costs as starting points for calculating cash flow.

Since the timing of dividend distribution for the first year is not clear, I expect dividends to be paid for the remainder of the year, assuming that in the remainder of 2021, the volume of transactions will increase by the last three months. This is the period 0 model.

In the first 1-5 cycles, I hope that the DEX market becomes more mature and saturated, the cash flow will gradually decrease in 3-5 years. Hence, the rate of growth in the volume of future transactions is similar to the J-curve model. The initial development of the company will show this pattern, then the pace will be accelerated, and then gradually slow down over time.

SushiSwap final score after 5th year can be calculated.

Hypothetical value

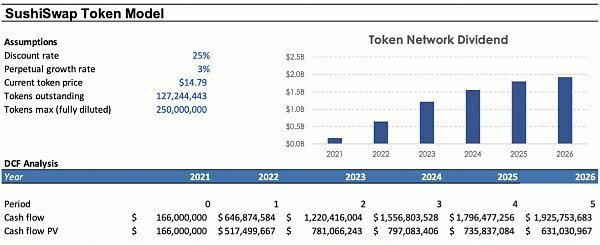

Discount rate: 25%

Terminal growth rate: 3%

The increase in transaction fees in the period 1-5: about 10 times

Transaction fees: stable at 5 basis points

The terminal growth rate is modeled at a rate of 3% per annum, which is in line with the overall industry and economy. In this model, the terminal growth rate is usually equal to the GDP of the country where the company is located. In the United States, the annual economic growth rate is typically 1.5-4%.

The discount rate is set at 25%. In the early development stages of blockchain networks and companies, the discount rate is usually 25%.

The method of calculating the discount rate combines bond yields and several risk factors. Bond yields typically take a 10 year cycle and are not affected by risk. However, SushiSwap is a new entity, so it is riskier than traditional companies and more mature blockchain networks.

However, SushiSwap has been born for almost a year, has a reliable user base, a team and a very transparent governance structure, therefore, the risk will not be much higher than similar projects.

This ratio can still be adjusted under different assumptions, and the discount rate is usually between 20-40%. In the past, I have worked on calculating different discount rates for different projects. The discount rate can be calculated as a "token fee".

It should be noted that as bond yields increase, the discount rate will also increase, so the value of the blockchain network will decrease, especially when most of the blockchain network's cash flow is based on future discounts. In the last six months, bond yields have risen sharply from 0.6% to 1.6%.

Since SushiSwap's discount rate is still higher than bond yields, even though most of the bonds are revalued, it will not have a significant impact on SUSHI's net present value.

SushiSwap assessment model

As shown in the image above, based on my reasonable assumptions, if the overall market continues to grow, SushiSwap's current intrinsic value is around US $ 12.64 billion, while its token value is around US $ 100.

The market there is a considerable risk, for example, DeFi encryption currency trading may be reduced, which will greatly affect the trading volume of SushiSwap, resulting in decreased transaction fee revenue.

The number of competitors will also increase, and similar projects will be produced, as well as competition in terms of liquidity, costs and transaction volume which will have a negative impact on SUSHI.

This article does not constitute any investment advice, please do a thorough research before investing.