As ETH has risen in recent weeks, NXM has followed suit. In the past 60 days, the price of Ethereum has risen by nearly 200%, while wNXM has risen by 190%. The reason for this kind of cross-asset lock-in appreciation is that Nexus's fund pool is almost entirely composed of ETH. As the value of the ETH held and controlled by the agreement increases, the tokens that own it also increase in value.

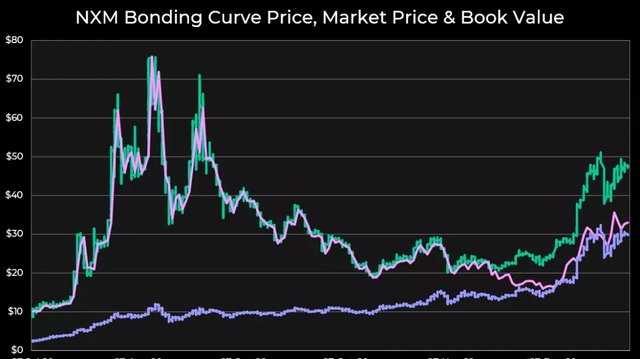

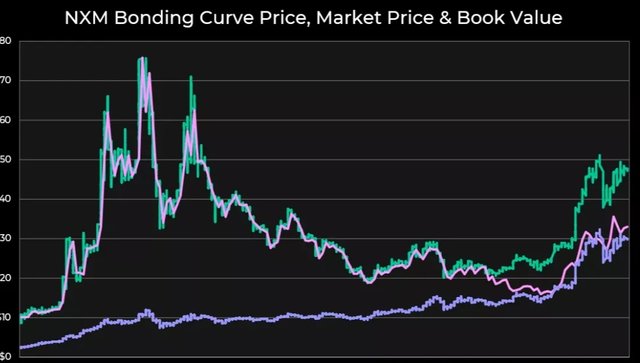

This is to be expected. In the Institutional Nexus report in July, we outlined our investment thesis and pointed out that we see NXM as a direct research variable of "leverage" for ETH . If the change in the ETH price represents DeFi's beta research variable , then the price performance of NXM above this value is alpha. If we look at the chart below, the recent gains of Nexus can be entirely attributed to its beta component, as the dollar price has soared while the bond curve price denominated in ETH has remained stable.

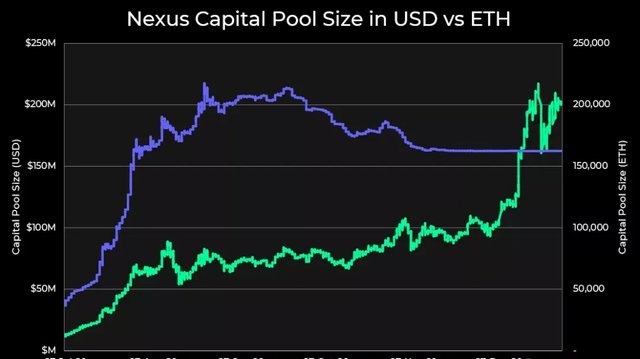

Now, the $ price of the NXM bonding curve shown above may be misleading; this is a price at which you can buy NXM from the combined curve, not the current saleable price, because the MCR% is at its 100% lower limit. To find the true price, it is best to analyze the price of wNXM, which is traded on the open market, rather than priced on the joint curve. Ideally, when the joint curve redemption is not frozen, NXM and wNXM should be traded at par, otherwise there are arbitrage opportunities. However, as joint curve redemptions are currently frozen, these prices have been decoupled in recent months. In addition to NXM's joint curve redemption and market price, there is a third method of evaluating tokens-book value. It can be calculated by dividing the value in the capital pool by the total supply of NXM (currently approximately US$200 million and US$6.7 million, respectively).

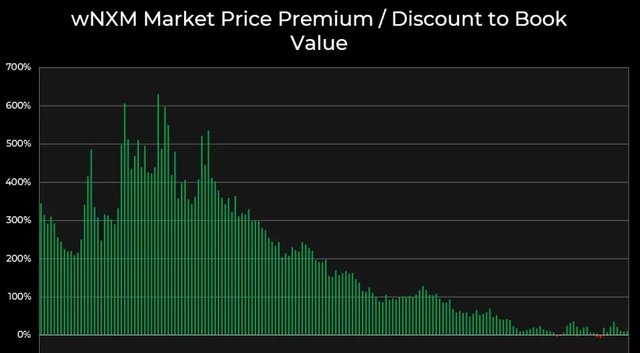

An interesting thing has happened in the past few weeks, the price of ETH has risen, while the joint curve redemption freezes. In other words, the book value of NXM has actually converged with the market price. To illustrate how unusual this is, we have plotted the premium and discount charts of market prices versus book value over time below. Tokens that were once traded at 5 to 6 times their book value are now traded at a premium of about 11%. In fact, in recent days, before savvy investors bought the spot, the price of wNXM was actually lower than its book value.

This is a few reasons worth noting. First of all, after the price adjustment of wNXM, the market value of Nexus is completely diluted to 225 million US dollars, and its transaction price is almost completely "guaranteed" by the value of 200 million US dollars in the capital pool. This is better than most recent stablecoin projects. However, we should clarify that due to the current active guarantee of approximately US$117 million, the US$200 million in the capital pool is not idle, but is used to fund ongoing operations. These risk capitals can be offset when analyzing the book value, but the reimbursement expenses are usually small and may be only a small part of this amount. If Nexus ceases operations completely, NXM holders will file a claim for the $200 million in the capital pool (deducting any remaining insurance payments).

Although the market’s demand for Nexus’ products is stable, industry competition is minimal, and its percentage of total supply continues to increase, the market’s pricing of the value of Nexus over the capital pool is almost zero. Due to the recent appreciation of ETH and the rise of DeFi TVL, This funding is more than ever before, which should be a leading indicator. In addition, for those familiar with the joint curve, the MCR is now frozen and will not start to grow until the effective coverage is 779,639 ETH. The growth of MCR will weaken the price of the joint curve. Currently, there is only an effective coverage of 94,987 ETH, which is currently a favorable situation.

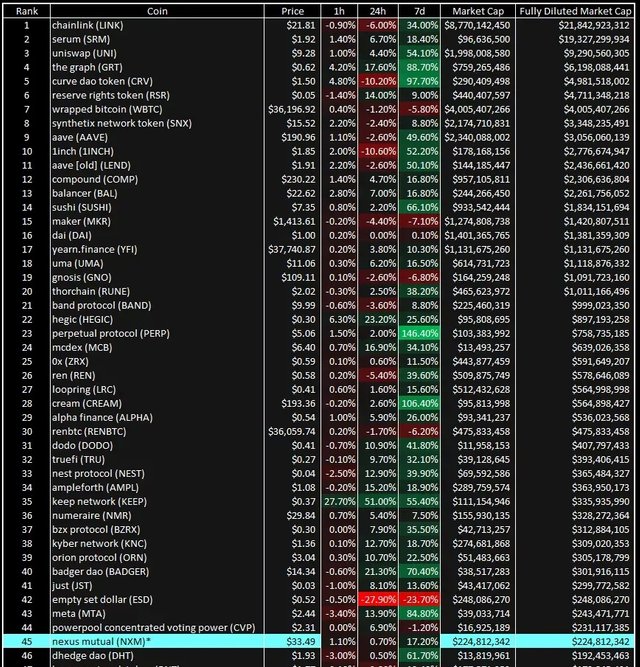

To further illustrate, below I used CoinGecko's data and adjusted it according to the price of wNXM, and ranked the top DeFi tokens based on the fully diluted market value. As you can see, Nexus has just entered the top 50 of DeFi tokens, even though almost the entire market value is "cash" on the balance sheet. How many more valuable projects can say the same thing?