Today, NFT publishing platforms and market platforms have become one of the largest categories of NFT agreements (except for the NFT project itself), and from a business model perspective they are also one of the most obvious market opportunities. When it comes to investing, it can be difficult to accurately determine which NFT will perform better, so they look directly at the distribution platform.

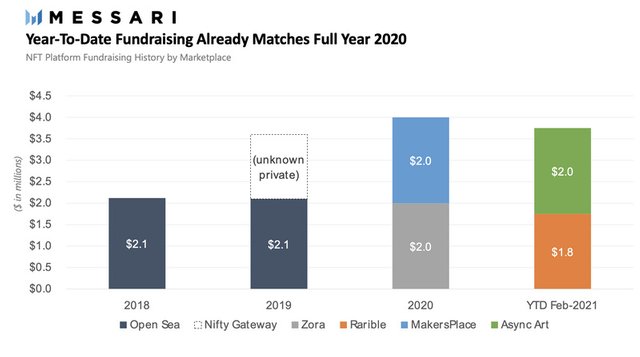

Strong evidence of this is that one of the most successful types of financing this year is the (publishing) platform. The amount of funds raised for platform projects in the first two months was almost the same as for the whole of 2020.

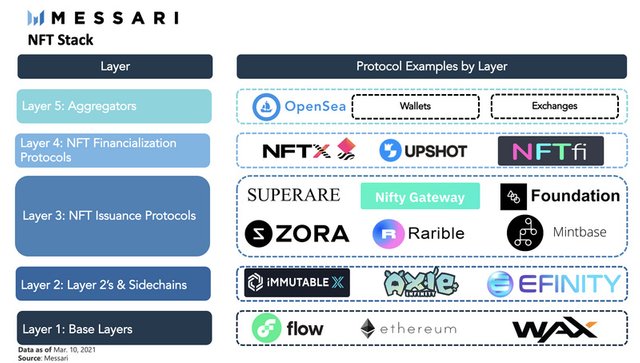

This distribution platform can be broadly divided into several categories:

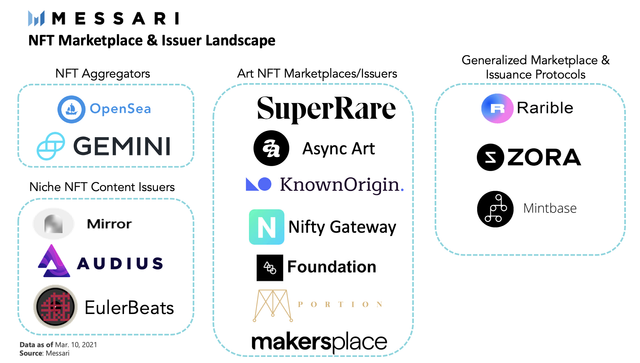

NFT Aggregator: A platform that facilitates buying and selling of NFTs. Note that Gemini has a Nifty Gateway. Likewise, over time, the exchange is likely to increase the NFT market.

Universal Publishing Agreement: A platform to facilitate the creation of various types of NFTs

Specialized markets: The most common are art markets or publishers, but new types of publishers such as NFT blogs (like Mirror) and music (like EulerBeats) are slowly developing

Since the NFT market is the first to achieve a good product market fit, in this report, we will have an in-depth understanding of these platforms, their differences, and compare their business with traditional markets.

Art platforms and markets

The global fine arts market is worth more than 65 billion US dollars, and the demand for virtual art is also on the rise. There must be market space here. However, 7 may be the upper bound, as markets tend to shape network effects over time. There may be differentiation, some will be strong, and some will be special high-value galleries.

Perhaps the most apt metaphor for the art market is to compare it to a combination of auction houses, galleries and distributors. Similar to a gallery or an auction house, Nifty Gateway and SuperRare  SuperRareNFT invite creators to enter their platforms, which is like supporting their work and telling the market that these creators have a good reputation. Others like OpenSea and Rarible are universal. Like Etsy or eBay. All authors can publish their work here. While the curatorial and exclusivity approaches of Nifty Gateway and SuperRare limit the number of artists who can be on the platform, this strategy helps create brand awareness compared to openness-focused platforms like OpenSea and Rarible.

SuperRareNFT invite creators to enter their platforms, which is like supporting their work and telling the market that these creators have a good reputation. Others like OpenSea and Rarible are universal. Like Etsy or eBay. All authors can publish their work here. While the curatorial and exclusivity approaches of Nifty Gateway and SuperRare limit the number of artists who can be on the platform, this strategy helps create brand awareness compared to openness-focused platforms like OpenSea and Rarible.

The following are some of the leading art platforms and marketplaces:

Async Art: Async Art allows artwork to have a "level". Through this platform, different NFTs can be superimposed on each other to create new works of art. The novelty of Async Art lies in its programmability. Few competitors have such characteristics.

SuperRare: To date, SuperRare has maintained its record for highest volume. Like most competitors, SuperRare is a curatorial platform, where there is only one version of the NFT (not multiple versions of the same target).

MakersPlace: MakersPlace was originally founded in 2016 and is one of the oldest digital art marketplaces. The commission charged by this platform is tied to Foundation and Known Origin, highest - 15%. It also collaborated with Beeple (one of NFT's most famous creators) and auction house Christie's to hold a landmark release worth US $ 7 million. It is one of the few NFT platforms that accepts fiat currency payments.

KnownOrigin: Among the market platforms being examined, KnownOrigin was the third company launched (April 2018), but compared to its competitors, so far failed to gain significant market share. Although KnownOrigin was one of the early players to enter the market, it was ranked below the crypto arts market in terms of transaction volume.

Foundation: As the self-proclaimed "Cultural Stock Exchange" of the Internet, the Foundation was launched in May 2020. It is a marketplace for limited edition products. Products are dispensed according to a composite curve. Recently, the Foundation launched its art marketplace, and sales of its NFTs competed with long-term newcomer MakersPlace and surpassed Famous Origin and Async Art.

Nifty Gateway: Beeple conducted a $ 3.5 million auction on Nifty Gateway, making the platform one of the main locations for artists to place (publicly release) their NFTs. In February 2021, Nifty Gateway posted sales of more than $ 55 million, and a new NFT is launched every day. She has celebrity power and has the full support of Gemini. Compared to other markets, the possibility of integration with other Gemini products is a potential competitive advantage.

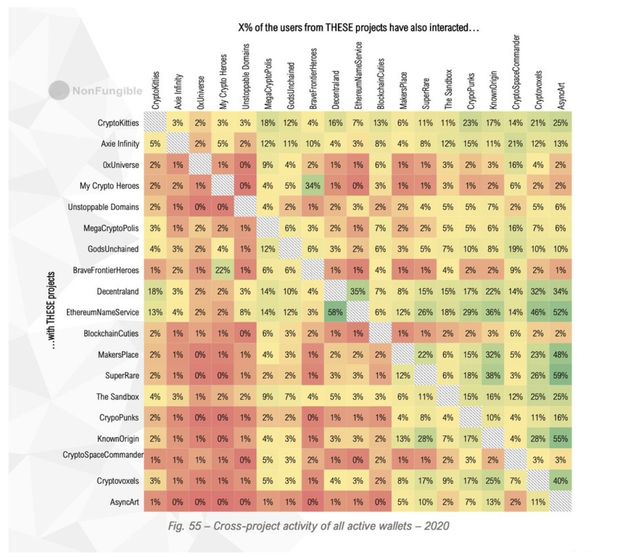

The latest 2020 data from Nonfungible shows that most users (buyers and sellers) are not yet focused on a particular art market. Compared to all other NFT categories, with the exception of Ethereum Name Services, the art markets (SuperRare, Async, MakersPlace and Known Origin) have the highest cross-wallet activity. For example, 59% of wallets that interact with SuperRare also interact with Async, indicating that there are no clear market winners in this segment, and users still want to try multiple platforms.

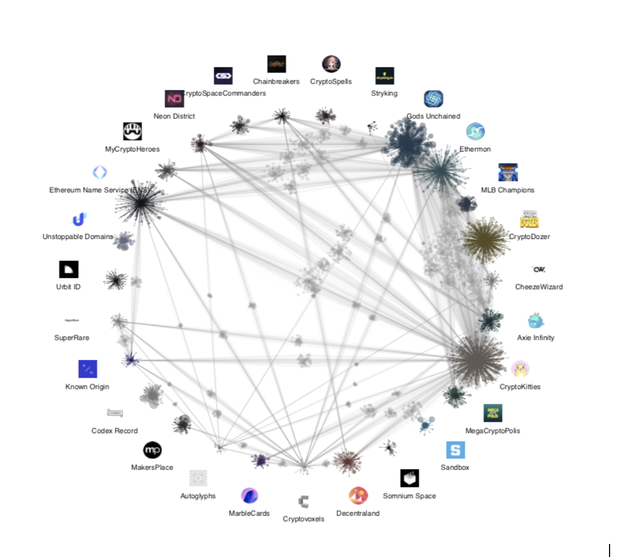

As you can see in the image below, there are 400,000 OpenSea addresses with one type of NFT, and how these addresses interact with other platforms. The nodes in the graph are sized according to the number of NFTs they have, and the lines between the nodes indicate the advantages of shared mode.

General market

The variety of content types available for purchase means that the total addressable market is larger, and therefore the general market has a greater opportunity for development.

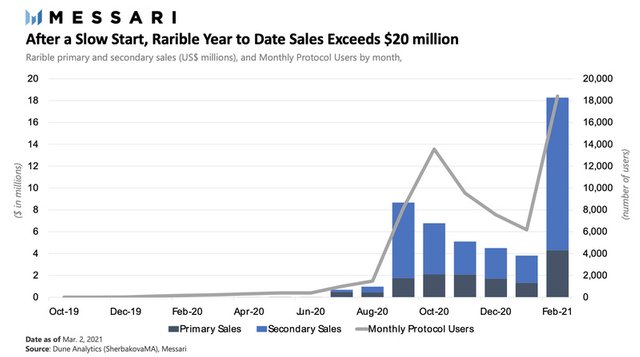

Rarible: Rarible is arguably the most open and permit-free market. Any creator can submit new NFTs and proposals directly to the community operated platform managed by Rarible DAO

DAO . The DAO structure provides a mechanism for community content management and provides a framework for the Rarible Treasury. Rarible Treasury has accumulated $ 4.5 million in market spending. Last month, Mark Cuban and Lindsay Lohan launched their NFT on the market for the first time.

DAO . The DAO structure provides a mechanism for community content management and provides a framework for the Rarible Treasury. Rarible Treasury has accumulated $ 4.5 million in market spending. Last month, Mark Cuban and Lindsay Lohan launched their NFT on the market for the first time.

As the only tokenized platform among its peers, Rarible sits in a unique position. Rarible distributes RARI to top buyers and sellers every month to provide liquidity incentives for NFTs printed on its platform. RARI's NFT liquidity mining was marketed early on, and has the potential to be shared equally with OpenSea. However, in recent months, despite Rarible's incentives, it has not been able to compete with the aggregators. This may be because most of OpenSea's transaction volume comes from non-Rarible projects such as CryptoPunks and HashMasks, and Rarible is not an aggregator and does not provide non-Rarible NFTs in its market.

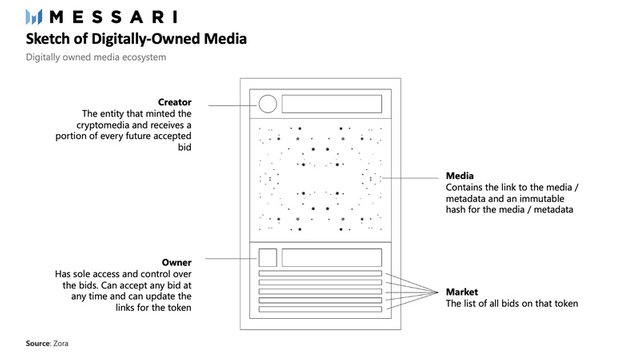

Zora: Zora describes the agreement as a "universal market agreement for media ownership". So far, creators have been able to issue their own tokens, which represent art, written articles, or music.

The Zora protocol implements an enhanced version of the standard ERC-721 NFT, which they call zNFT. zNFT adds an order book to the NFT and gives creators and collectors the added benefit of pre-installed royalties.

Recently, Zora is trying out NFT crowdfunding via a decentralized publishing platform called Mirror. The ability of other protocols to use the Zora protocol for NFTs gives it a clear advantage over other markets. Although Zora is still at the invitation, the platform has started working with music studio IAMSOUND to tokenize the original work of the music gallery into an NFT for auction.

Aggregator

OpenSea. Platforms like OpenSea have publishing functions, and more importantly, they can facilitate all NFT transactions on Ethereum. In a traditional stock market, matchmakers often get the most of the value. Although for NFT the terminal value acquisition status has not been determined, OpenSea's current market position puts it in an advantageous position to obtain NFT market value.

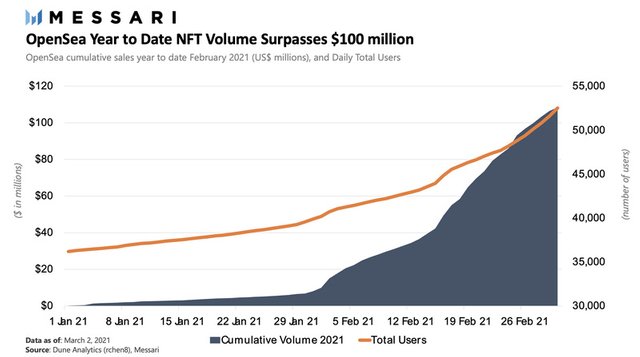

OpenSea transaction volume in the first two months of this year can only be described as the explosive annual sales of the NFT exceeding 100 million US dollars, and the independent platform users reaching nearly 50,000.

OpenSea recently announced a new feature - OpenSea Drops, working hard to improve the NFT auction functionality. This strategy was especially effective for SuperRare and Nifty Gateway, which work with different artists to release exclusive work via auction.

NFT market sales

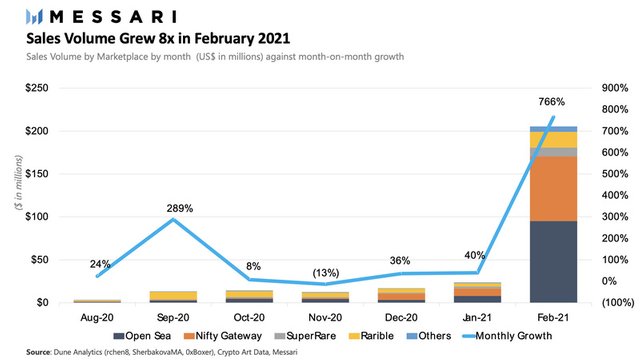

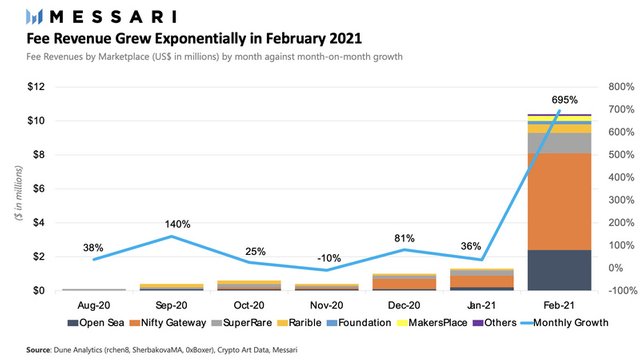

Although in September 2020, when the NFT first received widespread attention, sales increased significantly, the results for February 2021 were even more astonishing. The total sales of the market platforms we are focused on increased compared to January. Almost 8 times that. This proves that more and more people are becoming interested in this market, including traditional market platforms and Christie's auction houses.

Click here to view spreadsheets for historical and estimated data.

Market revenue comes from transaction costs

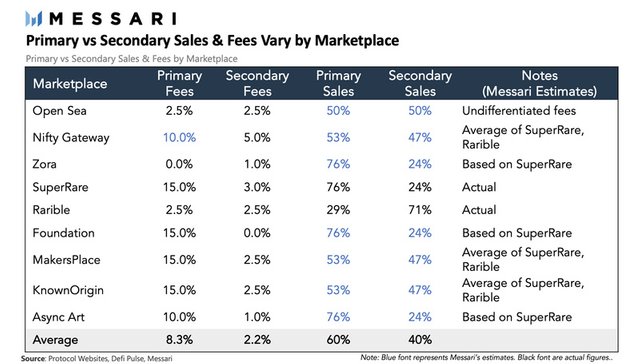

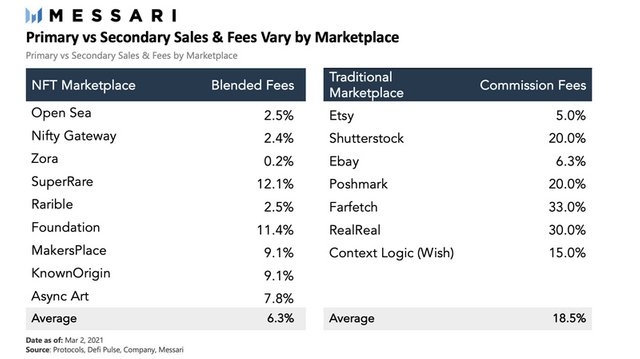

Market platforms have different strategies. Some allow all creators to enter, while others are by invitation. Some focus on selling the first, while others focus on selling the second. The average cost of the first sale (first hand transaction) was 8.3%, and the average cost of the second sale was 2.2%. SuperRare and Rarible have actual data to make predictions, and other protocol predictions will be based on both. More recent agreements tend to rely more on first sales, consistent with the distribution of SuperRare sales.

This market is not only efficient, transactions are usually carried out on a chain, and their costs are about one-third that of traditional markets such as esty.com and wish.com. For example, if a photographer wants to sell on shutterstock.com, the fee is 20%. The average cost in the NFT market is 6.3%, and the fee in the traditional market is 18.5%.

Because the weights of the first and second sales are different, the costs incurred are also different, and the revenue growth is not as fast as the platform sales growth. However, the monthly growth in February 2020 is still more than 8 times. On the market platforms we track, last month's expense revenue exceeded 10 million.

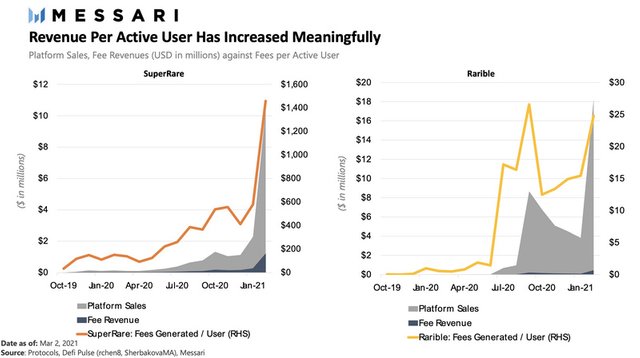

Not only does income increase, the income of each active user also increases. SuperRare had 1,500 active users as of February 2021, which resulted in $ 1,500 in revenue for each active user, an increase of 152% year over year. Rarible has more active users, up to 18,000, but due to its lower fees, Rarible has generated $ 25 in revenue for each active user - an increase of 61% year over year.

NFT market evaluation

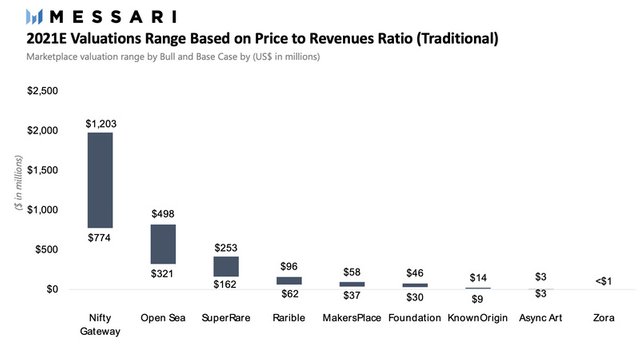

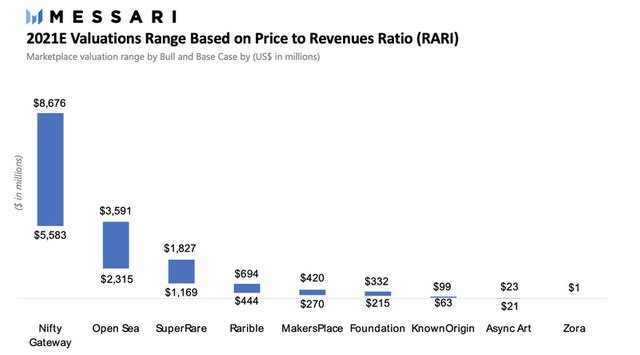

We assess the NFT market from the following aspects based on price / revenue ratios

1. Compare with stocks listed on the retail market. This platform includes both a curatorial platform and a platform that allows any creator to sell goods, including third party products, including retail and photography, and curated retail products made by third parties. We excluded large companies like Alibaba or Amazon because they have large logistics and other lines of business.

2. The target of comparison chosen in the encryption field, Rarible, the market value of the RARI token is 99 million US dollars.

We also estimate revenues for 2021E based on two scenarios

1. Extreme situation ("bull stock"): Assuming a compound monthly growth rate of 10% from March to December 2021, we can conclude that the total cost revenue of all 9 platforms we track increases by 31 year over year to December Time. We think this is reasonable because, by comparison, the growth rate for the two months from December 2020 to February 2021 is 11 times.

2. Base situation: We use the largest monthly sales to calculate the yearly to reflect higher growth.

The average "price to income ratio" (price / income ratio) of the following items averaged 11.2 times. Based on these multiples, we obtain an approximate range based on both extreme and baseline conditions. The largest is Nifty Gateway, which has a valuation range of US $ 774 million to US $ 1.2 billion in both basic and extreme conditions. Rarible's governance token, $ RARI, has a market value of US $ 99 million at the time of writing. By the end of 2021, the market value may be between US $ 444 million and US $ 694 million, with a market space of 5-7 time.

The RARI (2020) price / income ratio is much higher than 81 times the traditional market ratio. RARI is a governance token that gives holders the right to participate in the governance of the agreement, but unlike securities, RARI does not provide direct ownership. RARI is the only market token that can be used to invest in this field. As more and more tokens are released, their monopoly position may weaken. Based on RARI's current valuation, the expected valuation range for 2021 will be higher, as follows.

The conclusion

Participants' interest in NFT has increased, and the development of NFT itself has accelerated significantly. We hope to see the emergence of new NFTs, as the product market fit will not be limited to the sphere of art, but will extend to all digital assets, such as music and documents. However, we would also like to see more competition in the market, as some of the current most popular projects were not around a year ago. Success will depend on business strategy, whether the goal is openness or curation, and the ability to attract users and creators. The value of one NFT is difficult to measure, but the accumulated value will continue to flow to the market platform.

Source: Nonfungible

Source: Nonfungible Source: OpenSea

Source: OpenSea