Messari is a research institution that provides encrypted real-time data as well as encrypted indicators, news and top reports. Its team regularly publishes analysis reports and insights in all dimensions of the industry.

The following is the text:

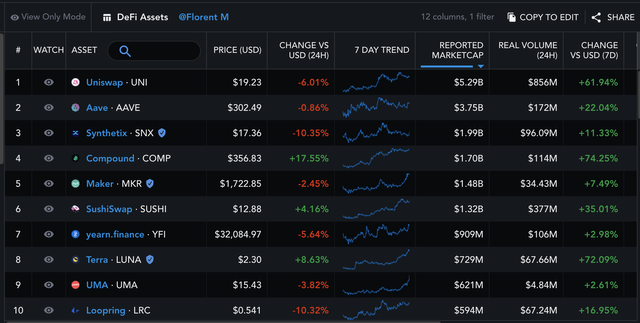

DeFi asset prices have skyrocketed.

In the past month, the average asset value of DeFi has tripled. Six DeFi unicorns have been born: Uniswap and Sushiswap (decentralized exchanges), Aave, Compound and MakerDAO (DeFi lending) and Synthetix (DeFi synthetic assets).

The leader Uniswap was valued at 5.5 billion U.S. dollars as of February 1, and its fully diluted value was nearly 20 billion U.S. dollars. Its transaction volume reached 30 billion U.S. dollars in January.

This is crazy.

There is real value in these markets. And we have argued that although the value of certain DeFi assets is ridiculously high, their valuations are still supported by fundamentals (ie, network profitability), which is especially important when considering long-term growth potential.

But how high is the upper limit of DeFi assets? Can they one day compete with the world's largest financial institutions? Or is the upper limit lower?

I think it depends on three variables:

1) Global coverage

2) Market structure

3) Value capture

Global coverage

The DeFi protocol should expand in various markets more effectively than traditional financial institutions. Just like the Internet protocols (TCP/IP, HTTP) we are used to today, the DeFi protocol is an open standard that transfers value on a global scale. They are not subject to any particular jurisdiction; they are available everywhere (easy to access); there is no physical "home" (hard to be wiped out).

For disruptive technology, this is a king-bombing combination.

market structure

Will DeFi become a "winner takes all" market? This is a trillion-dollar question, perhaps the most difficult question to answer.

It is not yet clear how many leading agreements in each vertical field, or whether there will be an "all-inclusive agreement" to absorb all competitors. There are already some early signs that the latter is a potential result.

Value capture

Even if we assume that DeFi can scale globally and show the potential of "winner takes all", this is not important to investors for agreements that lack long-term viable value capture mechanisms.

Open source development can reduce exchange costs, so as competition intensifies, the agreement is likely to earn very little value from the services it provides. In DeFi, there is a delicate balance in the management incentive mechanism of stakeholders. It is not clear how much value can be withdrawn by token holders now or in the future (or should).

My prediction?

I predict that within 15 to 20 years, the scale of DeFi agreements will far exceed the current large financial institutions.

Borderlessness and economic democratization will help them develop at a faster rate on a global scale. As the protocol maintainers reap the rewards for their contributions, we will get at least some value from each new financial instrument.

It doesn't matter whether the vertical industry becomes a "winner takes all" or an "all-inclusive agreement": investors can invest in the vertical industry winners early and get a piece of the pie as they beat their competitors.

DeFi's "all-inclusive store" will be much larger than JPMorgan Chase.

Source of this article: Messari