Three years ago, DeFiner was founded in Apolis, Minnesota, United States, aspiring to become a decentralized bank in the crypto world, providing digital asset financial services for small and medium-sized enterprises and ordinary consumers. At that time, DeFi was still unknown. Three years later, DeFiner won all the way. Techstars, Signum, Alphabit, SNZ and other well-known venture capital funds invested and formed a team with members from the Federal Reserve, Microsoft, Symantec, Qualcomm and other US government and Fortune 500 companies, with a deep financial and technology industry background. Private equity distribution of FIN, the savings pool locked up US$5.2 million, and the digital asset savings product Taurus (Taurus) was successfully launched, which attracted US$2 million in assets, and was named one of the 8 most noteworthy financial technology startups in the United States in 2020 by FinTech News First, just take advantage of the explosive development of DeFi.

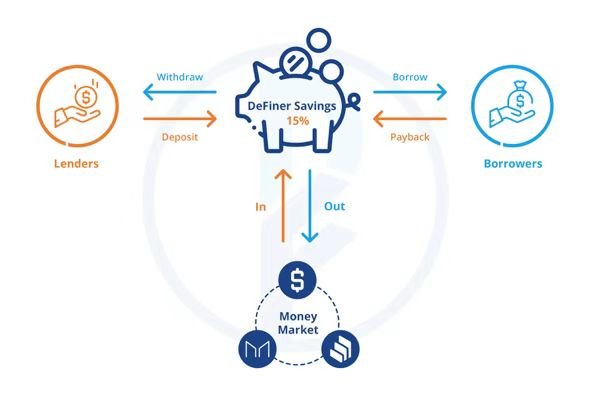

DeFiner is a platform that provides debt financing for decentralized digital assets, that is, a lending platform. Its biggest role is to provide liquidity and activate assets. At present, DeFiner's funding end serves users who have idle stablecoin crypto assets and pursue a steady income (annualized rate of return 10%-30%), while the borrowing end serves companies and individuals in the encryption/blockchain industry that need funds. user.

In the traditional financial market, most of the world's financing is done through borrowing, not equity financing. Existing loan products in the DeFi market are very limited and cannot provide mortgage loans for low-liquid assets. At present, there are more than 3,000 kinds of tokens in the entire cryptocurrency market, but less than 20 types provide lending support on mainstream platforms, which is less than 1%. In contrast to the DeFi trading track, decentralized exchanges such as Uniswap and Sushiswap in the AMM model have realized that any token can open trading pairs. In the DeFi lending track, there is an urgent need for an extremely decentralized and extremely open product to meet the mortgage lending and credit lending needs of more encrypted assets.

In 2021, DeFiner will introduce more innovations, focusing on solving this problem: for example, mining machines and computing power, corporate and personal credit in mines can all be tokenized and used as collateral for lending on the DeFiner platform ; Companies, mines, project parties and individuals can all issue debt financing on DeFiner, not just limited to mainstream currencies. And, at the same time, effective management of default risk can be realized. In this way, DeFi lending products can be effectively promoted outside the circle.

DeFiner founder and CEO Jason Wu gave an example in an interview with Chain News and pointed out that Compound’s borrowing interest rate is 5-7% higher than the deposit interest rate, and the general fund utilization rate is 40%-75%; that is, there are 25%-60% of funds. Idle there and get nothing, DeFiner's product Taurus successfully solved the low liquidity problem of DeFi lending. Taurus's smart contract deposits excess funds in DeFi currency markets like Compound, and optimizes the utilization rate of funds to always exceed 85%.

Last year Compound issued coins and started liquid mining, which detonated the rapid development of DeFi. Thanks to this, DeFiner successfully completed the distribution of FIN tokens in October last year, taking the first step towards realizing the true decentralization of the DeFiner platform. Through the FIN token, the DeFiner ecological network distributes its three rights and interests, namely, profit distribution, loan mining and governance voting, to all participants in the ecosystem, such as developers, operators, investors, and users, in order to achieve real Mutual benefit and win-win situation.

According to reports, the value support of FIN token comes from the growth of DeFiner ecology and business. Since the launch of FIN, DeFiner has achieved more than $60,000 in cash flow through lending business and LP liquidity business for FIN, and all of it has been used for FIN repurchase in the secondary market, and its repurchase amount exceeds the total circulation 5%, which provides a strong support for the value of FIN. DeFiner's loan mining (POP, Proof of Premium) allows borrowers and lenders who actively participate in the platform business to get more rewards, so that they can continue to participate in DeFiner's core business experience. Users who hold FIN are also the guardians of the entire ecosystem and participate in platform governance by voting to grasp the development direction of DeFiner.

Jason Wu said that as the entire cryptocurrency market and DeFi enter the bull market in 2021, in the face of Ethereum network congestion and rising gas fees, which are common troubles faced by all DeFi projects based on the development of the Ethereum network, DeFiner is on one hand Reduce gas consumption by continuously optimizing the internal gas limit of the contract, and actively explore the Ethereum Layer 2 solution; on the other hand, DeFiner adopts cooperation with centralized exchanges to make it an aggregator of funds, converging small funds into large funds , Thereby reducing the cost of a single fund. The fact that Ethereum has become the DeFi hub that gathers the most digital assets is undoubtedly. DeFiner continues to cultivate on the Ethereum platform, while also keeping an eye on the emergence of new DeFi public chains such as Polkadot.

Regardless of whether the market is bull or bear, DeFiner’s original intention to provide digital asset management services for more companies and individuals has not changed since its establishment. The decentralized lending field, which is still insufficient, is expected to become one of the leading DeFi lending platforms in the field of decentralized transactions like Uniswap.

DeFiner is a fully decentralized crypto asset savings, financing and payment platform. The team was established in February 2018 in Minneapolis, USA. It won the American Fintech Challenge in 2019 and was named one of the 8 most noteworthy fintech startups in the United States in 2020 by Fintech News. DeFiner has successively received investments from well-known start-up companies such as Techstars, Signum, Alphabit, SNZ, etc. The team members have profound financial and technology industry backgrounds and come from Fortune 500 companies such as Microsoft, Symantec, Qualcomm and the Federal Reserve.