Will Bancor become a dark horse for DEX in 2021? If it is based on the performance of several months ago, we will make this assessment, but because if the high cost of gas is not resolved, the liquidity gained from this capability will also be lost by that capability.

Mars Investment Research is optimistic about Bancor based on our assessment of the trends of Bancor, Uniswap, and other DeFi projects in the implementation of Ethereum Layer2 , as this will encourage the entire DEX ecosystem where Bancor and Uniswap are located to overhaul and reshape its pattern . As for why we are more optimistic about Bancor's opportunities in this new situation, we will discuss them in detail in the second half of this article.

Mars Investment Research introduces Bancor to you, first of all because of the opportunities of wealth that can be administered LSD to us ; but we want to explain this story in detail to everyone - birth is the pinnacle, rapid decline, is questionable, does not forget the real heart. Iteration after a hard time, and finally rely on the ability to win back a BATTLE lord and a chance to regain lost land . I hope that such stories can serve as inspiration for colleagues in the domestic crypto world.

1. The current situation: a country that is lost due to ability

Switzerland-based Bancor raised $ 153 million from investors such as the Traper Team and Blockchain Capital in just three hours. This happened in June 2017. That year, in North America, the average amount of ICO financing was US $ 31.5 million, Asia averaged US $ 30.7 million, and Europe an average US $ 16.7 million.

Why is it so favored by investors? Look at his ambition: The word comes from British economist John Maynard Keynes Bancor who was conceived during World War II of the post-war international currency settlement - the prototype of a super sovereign currency , later replaced by the Bretton Woods system.

Satoshi Nakamoto's BTC started as a government additional issuance to save the economy after the financial crisis in 2007. BTC is a crypto currency to withstand dangerous additional issuances, currency depreciation and inflation ; The Bancor protocol is the realization of a decentralized exchange (DEX).) One way, from a visionary perspective, it wants to solve is the liquidity problem of cryptocurrencies in the future . Therefore, we can see that the main concept of Bancor is to provide liquidity:

The first is crypto currency traders, end users of the Bancor protocol, who can convert tokens via the Bancor pricing algorithm, and trade via multiple channels; second, publishers, individuals, companies, communities and organizations can issue cryptocurrencies; once again People looking for asset securitization, by creating proxy tokens, combination tokens, etc., mapping real world assets or other chain token assets into smart tokens, with a ratio of 1: 1. There are two very important concepts here., First is asset securitization, and others are cross-chain assets; Finally, statistical arbitrage, also known as driving bricks, is required by the system and plays an important role in stabilizing the price of tokens in the system. Once the price deviates, the opportunity to make money will come.

After Bancor went online, it was not understood by most people , there was even some doubts, especially in 2019 due to uncertainty of SEC surveillance and forced ban on US users. We can only say that the age of making heroes - despite winning ICOs, DEX is still the future in a big trend DEX is not standing on the center stage right now.

Then, Uniswap's "Automatic Market Maker" (AMM) and Constant Product Market Maker (CPMM) are all based on Bancor's continued practice. Automated market makers (AMM) use a "Money Robot" algorithm to simulate price behavior in markets such as DeFi; constant product market maker (CPMM) was promoted in the first batch of AMM-based DEX Bancor and Uniswap.

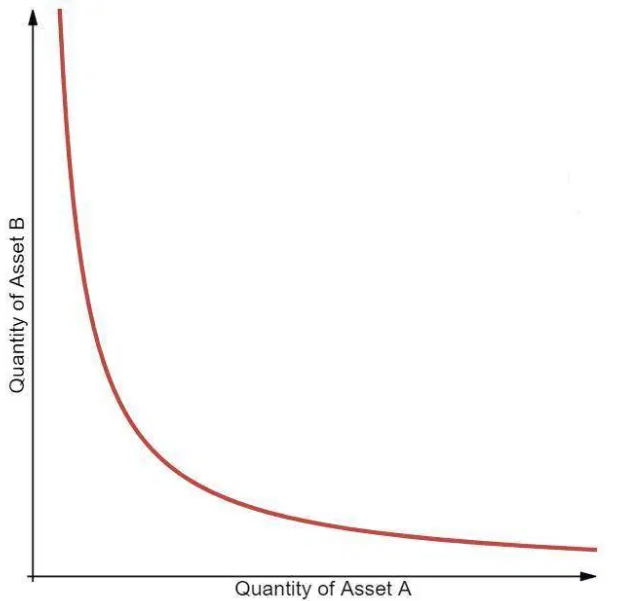

CPMM is based on the function x * y = k, which determines the price range of two tokens based on the available quantity (liquidity) of each token. When supply X increases, supply Y must decrease, and vice versa, to keep the product from k unchanged. When a curve is drawn, the result is a hyperbole where liquidity is always available, but as the price gets higher, the two ends will approach infinity.

We have to admit that the ancestor of AMM in the field of encryption is Bancor; we must also admit that the popularity of this model stems from Uniswap, and Uniswap continues it. Objective analysis, there are certain reasons that the simplicity of Uniswap really helps more people to participate, and the user experience becomes better. But the more important reason is that Uniswap, which was just born after Bancor was blocked, took advantage of Synthetix and other DeFi in the 2020s. Bancor, the ancestor of AMM, is at the forefront of an era and is thus passing through an era .

2. Iteration: The opportunity the ability reclaims

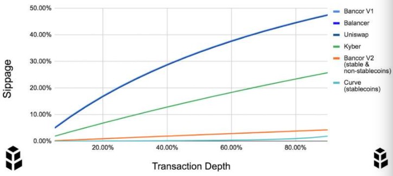

After Uniswap made several improvements to Bancor to dominate the DEX market, the Bancor development team successively launched Bancor V2 and Bancor V2.1, which solve the problem of impermanence, liquidity token exposure, and transactions that market makers are most concerned about. the slippage concerned is whether the slippage is low enough.

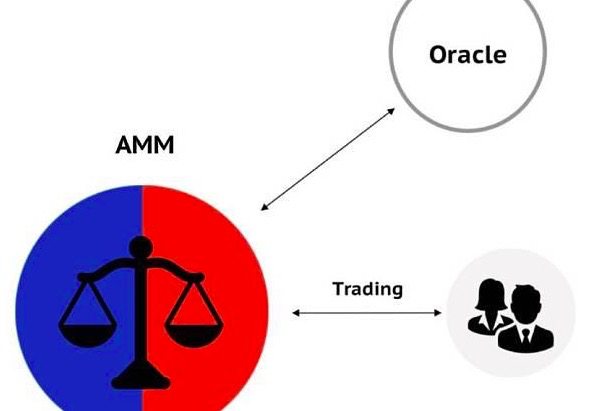

01 for the AMM oracle feed price , for example, Bancor V2 violates the traditional AMM, from both sides the AMM token value is unequal. V2 uses the oracle to feed the price to adjust the weight on both sides of the token, that is, the number of tokens A * The price does not have to be the same as the number of tokens B * the price of B, and the arbitrage opportunity is leveled by the oracle.

02 Taking stable curves as an example, Bancor V2 draws on Curves. The Bancor curve sits between Curve and Uniswap, and the algebraic formula is between X * Y = K and X + Y = K. Use smoother curves to reduce slippage. The simple understanding is that it is 20 times bigger than a swap under the same liquidity.

03Based on both, let us analyze how Bancor V2 realizes the principle of avoiding impermanence losses . Bancor V2 uses the oracle to dispel arbitration. The main point is to let AMM unbalance and adjust asset ratios in real time.

After the BNT price has quadrupled, Uniswap should be arbitraged by ¥ 10000 arbitrage, bringing the asset ratio back to 50% / 50%, while Bancor, which introduced oracle quotations, perfectly avoided arbitrage and adjusted the asset ratio according to the price. That is all.

04 Bancor V2.1 also extends its competitive tentacles to loan agreements. To overcome the impermanent loss of liquidity, Bancor V2 can provide liquidity of one token. With Bancor V2.1, liquidity providers can now mortgage assets unilaterally and earn 60-100% of revenue while receiving complete non-permanent loss protection.

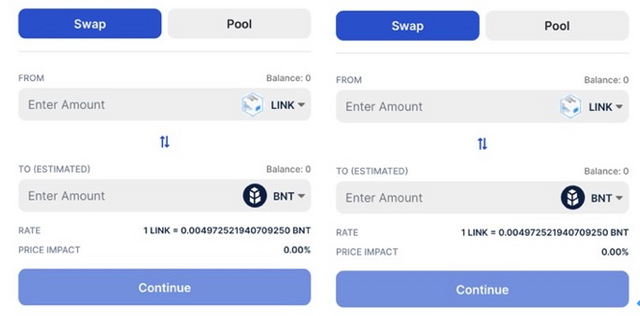

The image on the left is from Uniswap. To provide liquidity to the LINK-WETH pool, users need to inject 50% of the LINK and 50% of the WETH. The image on the right is from Bancor. Users can deposit their LINK in the BNT-LINK liquidity pool to provide liquidity for the pool, thus earning additional pool liquidity fees and BNT rewards (here mentioned BNT in ecology Motivation, the next section will detail the design of the Bancor team which we consider trivial or even questionable. in the past) It's basically similar to an encrypted lending business, similar to a user depositing a LINK to Aave or Compound .

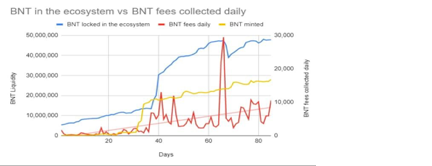

Since the launch of Bancor V2.1, the locking volume has increased 70 times, and the transaction volume has increased 55 times. Based on that, some people rate Bancor as the dark horse with the greatest potential in 2021. But this assessment clearly ignores the most important issue currently plaguing all DEX projects - high fuel costs.

In the past, the main motivation to attract Liquidity Providers to participate in Bancor has been exclusive single currency mining and non-permanent loss protection schemes. But these users will also quickly disappear, due to Ethereum's poor efficiency, and very high contract fees. Take the following image as an example, it is still when the network is not stuck.

In fact, high fuel costs annoy all DEX project developers such as Uniswap, and therefore limit user participation. According to Dune Analytics data, Ethereum DeFi users have reached one million, but compared to the total number of cryptocurrency users, this is a very small share. According to a new report released by Crypto.com, the total number of global cryptocurrency users increased from 66 million in May 2020 to 106 million in January 2021.

The development of DeFi has outpaced the ecological carrying capacity of Ethereum Layer 1 , and V God has also become an ant in the hot pot. Because of this, he has recently been busy promoting Layer 2 development and miners to reduce gas costs. In this context, Bancor and Uniswap respectively chose the more mature Arbitrum Rollup and Optimistic Rollup.

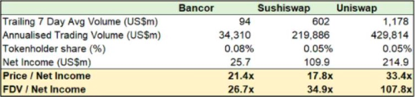

If their plans go well, Bancor and Uniswap will be able to implement the Ethereum Layer 2 migration in the next few months. This means that the biggest problem limiting the entire DEX industry will be resolved, and the number of Defi users will be resolved. into millions. Leap forward ten million levels - we judge that a new battlefield will begin. Yes, this is a new battleground, because previously, due to high fuel costs, DEX users were dominated by a small number of large users. Therefore, even Uniswap and Sushiswap, which had secured the leading position, had not yet built a strong trench. Bancor doesn't even have to worry about user inertia at all .

It could be said that in this new stage, they are at the same starting point. This is very important for Bancor. This is in contrast to a number of projects that have evolved from the ICO era but have long since died or been defective or are operating in dismal operations. This is an opportunity for the Bancor team to continue to struggle in the face of many doubts and many problems.

So, since they are at the same starting point, why do we judge this to be an opportunity for Bancor?

3. Value: BNT finally we understand

In v2.1, in addition to the aforementioned settings for the liquidity of a single token, there are a few changes on the basis of v1 which are worthy of careful analysis: LP only needs to include one token in the liquidity pool, and the other is the liquidity pool. Half is provided by the Bancor protocol and is in the form of the newly issued BNT (Bancor Protocol Token); fees are not all given to LP, because LP only invests half of the value in the liquidity pool, so they only receive Half of the transaction fees and the other half is included in the Bancor Agreement. These costs will eventually be burned when the detention is released; on this basis, the biggest change would be that Bancor would compensate IL LP by casting new BNT to make up for losses.

There is no doubt that this arrangement will enable a large number of encrypted world users to join Bancor , and v2.1's performance four months after launch also illustrates all of this. Until now, the advantages of the Bancor token model have begun to be recognized - by integrating BNT as a basic asset, LP and token holders have the same personal interests, because BNT token holders will also be providers of unilateral promise Liquidity, and therefore impermanence losses will occur. to be a thing of the past. BNT token holders can get an annual rate of return of up to 50-100% without irreversible losses, so LP will have a great incentive to pledge their BNT tokens. Starting from version V2.1, BNT funds pledged on the Bancor platform have surged, and currently reach 61% of the total pledged tokens.

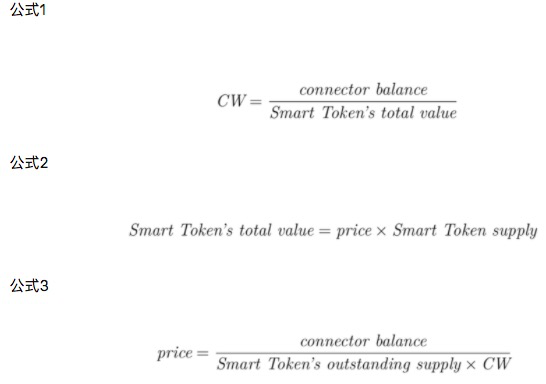

Time to review the Bancor token economy model. Regarding the explanation and explanation of the calculation of the bancor protocol, the white paper and explanation of the calculation of the bancor formula are very clear, the point is to explain the CW pricing mechanism.

Many articles and commentaries focus on the formula, calculation, and analysis of the CW curve fitting of the bancor protocol. After all, this is the essence of the decision of the price mechanism, and the most critical in terms of profit from speculation. But if you want to understand the bancor protocol from a high dimensional perspective, you just need to understand that the price calculation formula is still "engineering".

Understanding the essence of the bancor protocol , we must first understand the importance of "liquidity" in Finance. All Bancor use cases and algorithms are ultimately developed in multiple dimensions around liquidity depth, cost and implementation difficulties.

Therefore, in the earliest Bancor protocol, BNT played the role of an intermediary currency in this ecosystem - to automate its AMM services, Bancor aimed to incentivize users to store assets in one pool, each set consisting of a pair of tokens and one The composition of the BNT cryptocurrency reserves. When users deposit coins in the pool, they will receive new tokens in return. This token is called a pool token, and it allows users to recover the original amount they locked in the agreement. When each token is traded, the BNT token is used as an intermediate currency. It should be noted that Bancor allows users to lock tokens (not a pair) in one of their pools. For example, in another AMM, users may be required to lock token pairs with each other at a certain ratio in order to access the pool. In a pool consisting of ETH and DAI at Bancor, users can only deposit ETH or DAI. In Uniswap, as an option, users have to deposit ETH and DAI at the same time. However, users must also store BNT in any Bancor pool.

This BNT arrangement in the Bancor protocol was called the "token converter" model by early crypto researchers. BNT is issued with ETH support, and then BNT is used as a link to issue other certificates. They believe that this cannot basically be To. To solve the liquidity problem of marginal varieties, the value of BNT lacks effective support. This model may have room for improvement and development in terms of expanding the project business.

Even supporters can only do a general evaluation in the past. The BNT governance token participates in the operation of the lower layer of the protocol economy, and the BNT value capture function is stronger. However, after many iterations of the Bancor team, Bancor V2.1 has started to unleash the vitality of BNT in this ecosystem , and the Bancor Vortex mechanism has made BNT more competitive with the role of the UNI token of Uniswap governance in the ecosystem.

The Bancor Vortex mechanism allows BNT assets to be pledged as collateral in a whitelist of assets, vBNT is loaned from an asset pool token, and vBNT can be used to exchange other tokens on bancor.network. By selling vBNT, users can increase capital utilization, such as improved liquidity provision, thus earning more BNT fees and rewards.

Bancor Vortex introduces governance in two parts. BIP9 discusses the leverage function in general and proposes a vBNT combustion mechanism; importantly, its unique whitelist status has been approved, which allows vBNT liquidity providers to earn transaction fees and hence can benefit from Vortex, No need to use secured BNT.

Under this model arrangement, based on data as of March 2021, BNT insurers can get the highest fee exchange income among all DEXs .

However, it is risky to use Vortex to borrow and guarantee BNT. Simplify all the risks into a simple idea: What are the opportunities to spend more money on round trips than making money? More precisely, the total selling price of vBNT + the profits earned must be at least equal to the repurchase costs to reach the balance of payments.

Therefore, returning to the starting position we mentioned at the beginning of this article, for Bancor, this is not enough to win. The key to the success of the Bancor model set-up lies in a substantial increase in the efficiency of the Ethereum network, otherwise the high gas costs will quickly deplete this LP. Once the efficiency of the Ethereum network is improved and gas costs have been greatly reduced, the BNT value of the Bancor protocol will be released, and the DEX structure will also be reshaped.

The good news is that V God and Rollup developers continue to promote Ethereum Layer 2 and reduce gas costs; Bancor and Uniswap are accelerating their respective Layer 2 Rollup solutions