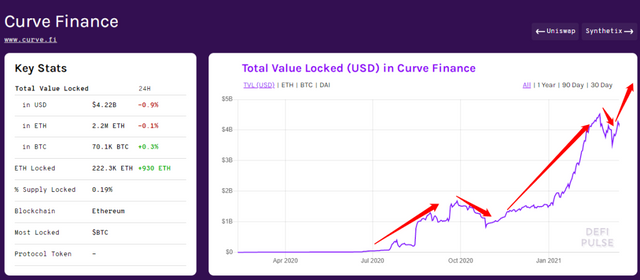

In the current fierce competition for lock-up volume, Curve has reached more than 4 billion U.S. dollars, and basically all of them are currencies with stable value. Let's take a look at the recent update of Curve and the changes in its fundamental value over time.

Two updates:

)

)

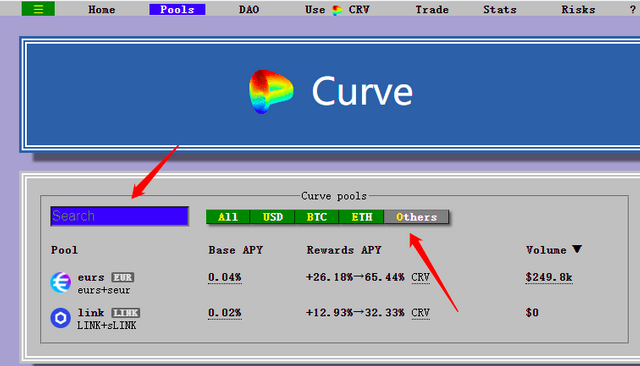

First, the UI interface is updated. Pools has added a search function and a column for corresponding items;

Second, the Uni token proposal (the proposal goes to the Curve platform for voting on the currency) has been submitted by the relevant team, and the launch of Uni on Curve should also be a recent event.

The advantage of Curve is that it has low slippage and can accept large transactions.

Crv lockup ratio increased, almost no inflation

Crv is deflation, this fundamental is very good.

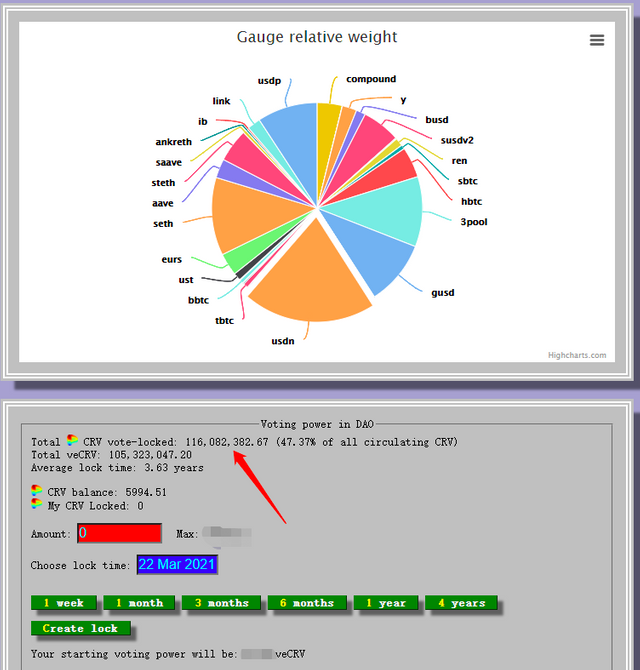

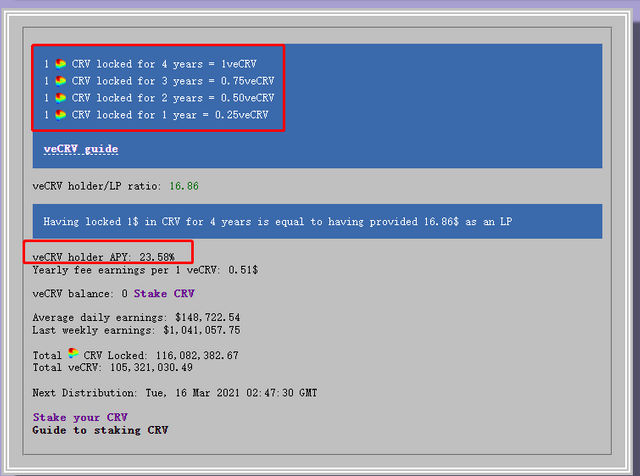

veCrv must be locked to obtain. At present, it is locked for four years to obtain a 1:1 veCrv (as shown in the figure below), voting rights and half of the transaction fee of all pools (0.04%÷2=0.02%, according to the lock ratio).

The Crv lock to obtain veCrv here is not static, and the future veCrv acquisition will be more demanding. At present, the Crv is locked for 4 years, and veCRV can be obtained 1:1; the lock for 3 years is 1:0.75, that is, 10,000 CRV3s are locked. In the year, 7500 veCRV will be obtained; and so on, just look at the data in the picture.

The current annualized income of locked veCRV is relatively stable at 23.58%. However, the lock-ups are more of the large institutional accounts. Because they need to vote to launch their own liquidity pools, it is normal for the institutional team to put out 1 million to 3 million Crv (or even 5 million Crv) for lock-up.

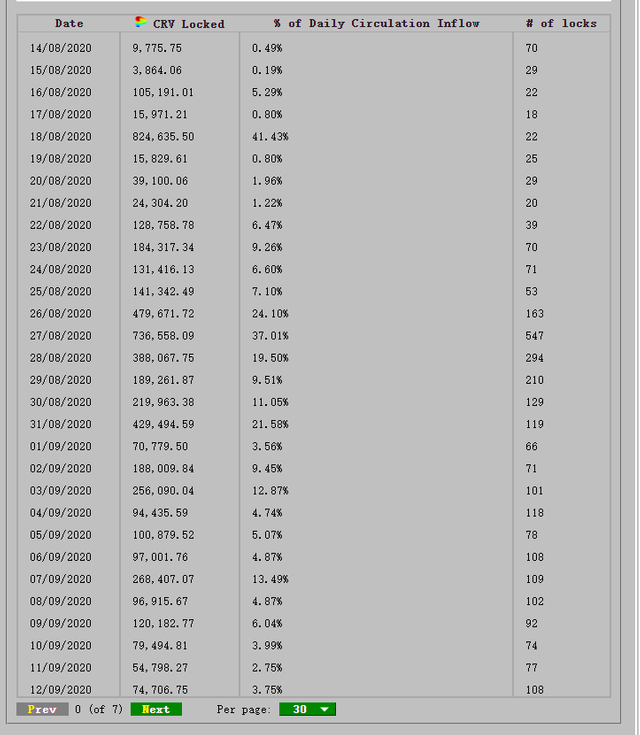

This is the data of the recently locked Crv (turned into veCRV). The following is the table I compiled myself:

In the past week, the circulation of Crv has actually been decreasing. When about 2 million Crvs were released every day, the circulation did not increase, even in deflation. It can be seen that from March 9th 135.55 million in circulation to today's 129.181 million in circulation, why? Because of the comparison of the release amount, more Crv locks became veCRV, and the locks accounted for 46.37% to 47.36%.

Increasing Trend of Total Lock-up Volume (TVL)

At present, the lock-up volume (TVL) has reached 4.2 billion US dollars. Among them are mainly BTC, stable coins (such as USDC, DAI, husd, Gusd, busd), ETH, etc.

Technical analysis is beyond the scope of this article, but K-line pattern analysis is also very important for the rise and fall of tokens. From the perspective of K-line pattern, Crv may not be vigorously pulled up in the near future. It is more about fluctuations in the price of 1.9-3U. There are selling pressures and locked positions, forming a short-term balance. The application of the Curve platform is getting stronger and stronger, and it is slowly monopolizing the large-value transactions of mainstream ERC20. If you compare its current market value with the fundamentals, its market value is at a low level. What we have to do is keep paying attention.

to sum up

Therefore, the increase in the "lock-up amount" in the title refers to two lock-up amounts. The first refers to the overall lock-up amount TVL of the Curve platform that has continuously increased to more than 4 billion U.S. dollars; the second refers to the Curve platform token (CRV). The lock-up volume of Crv continues to increase, and the overall Crv volume continues to inflate while ensuring its market circulation remains flat or even reduced. This is a project whose K-line technical analysis is not good, but the fundamentals are very strong.

Disclaimer: This article has no commercial cooperation with projects such as Curve.