In the context of the increasing congestion of the Ethereum network and the repeated highs of Gas, more and more DeFi protocols and users have begun to look for "outlets" outside of Ethereum, and have gone to other public chain ecosystems such as BSC, HECO, and Polkadot. It is precisely this dilemma of Ethereum that the decentralized exchange Sifchain, which successfully completed the public offering on February 26, has attracted great attention from the industry.

The first full-chain decentralized exchange to maximize the liquidity of blockchain assets

Sifchain is the first omni-chain decentralized exchange (DEX) that can mobilize the liquidity of isolated blockchain assets and help people free themselves from inefficient transactions and high fees.

This is possible because the underlying network of Sifchain uses the Tendermint Byzantine fault-tolerant consensus algorithm and the Cosmos public chain that advocates weaving the blockchain Internet. It has high throughput and scalability, and can achieve tens of thousands of levels per second. Processing power. In addition, Sifchain supports inter-chain communication protocol (IBC), which can conduct cross-chain transactions with major blockchain assets.

According to DeBank data, the real lock-up volume of Ethereum's DeFi reached a new high of US$44.7 billion on February 21, and the daily transaction volume of DeFi projects was 14.4 billion, accounting for 9.59% of the total global cryptocurrency market transaction volume (Coinmarketcap data on February 25). But DeFi is facing a series of bottlenecks that hinder its growth. Taking the DeFi portal decentralized exchange as an example, the transaction assets are basically concentrated on one chain, namely Ethereum; the insufficient performance of the Ethereum network and the continuous soaring of Gas have led to a sharp increase in transaction costs, preventing more users from participating, and inhibiting Trading activity; the impermanent loss brought by the automatic market maker model also makes users daunting.

Sifchain is confident that it can solve the above problems. Sifchain believes that cross-chain interoperability should be a standard, not a function. In the future, an unlimited scale of cross-chain compatibility (such as anchoring areas and continuous liquidity pools) will be required. Therefore, Sifchain, created based on the Cosmos SDK, attempts to customize a standard for the entire chain, for cross-chain integration of 20 to 25 blockchains (such as Ethereum and Stellar), and inter-chain communication (IBC) protocol with other Cosmos blockchains (Such as Kava, Akash and Terra) are compatible, not only brings the liquidity of Ethereum to Sifchain, but also to other Cosmos projects, and the transaction speed is 100 times higher than that of Ethereum-based DEX such as Uniswap, but the cost is only 100% For one, it can also enable DEX to support margin trading and limit orders.

Sifchain uses a two-way anchoring protocol for the swap transaction of anchored tokens. Its Continuous Liquidity Pool (CLP) combines the advantages of both the liquidity pool model of the decentralized exchange and the order book of the centralized exchange to achieve the best The execution of the best order. Although the current DEX currently uses a liquidity pool algorithm optimized for token swaps, Sifchain rethinks the design and implements an adaptive AMM algorithm that is suitable for restricted orders and token swaps.

Sifchain also provides margin trading products, allowing traders to borrow from the liquidity pool to use margin in transactions. Interest is determined according to market demand and liquidity supply, which increases the return of liquidity providers (LP) in two ways-in addition to swap handling fees, interest is also provided as a second source of income, and swaps are added And the scale of the swap fee.

Use DAO to promote the establishment of industry standards for cross-chain liquidity

Sifchain has just completed the public offering and distribution of the native token Rowan, which is crucial for Sifchain to grow into a decentralized autonomous organization (DAO). SifDAO and Rowan's public offering were launched at the same time, and Rowan, which is independent of the Sifchain team's reserve fund, will be obtained. The SifDAO community will play an increasing role in the direction of the Sifchain exchange, and will gradually inherit the responsibilities of the core team until it is fully responsible for the continuous management of Sifchain.

Sifchain's network ecology will be maintained and expanded by the following roles, and will be motivated and operated with the help of Rowan (RWN):

- Verifier: Obtain block rewards by running the Sifchain network. Therefore, such participants hope to increase the number of transactions on Sifchain as much as possible to maximize the transaction fees paid to the verifier.

- Delegator: Obtain a certain percentage of block rewards by transferring funds to the verifier for custody.

- Trader: Profit by buying and selling cryptocurrencies on the Sifchain main network and bridged external chains.

- Arbitrage: Another type of trader who makes arbitrage through the spread of the same asset on different exchanges on Sifchain and external chains at the same time.

- Liquidity provider: Get commissions from users who swap Rowan and Ethereum anchored assets.

- Centralized exchanges: through integration measures such as sharing liquidity with excellent decentralized exchanges to list and trade high-quality assets and improve their technology stack.

- Developers: Create and develop Sifchain according to the wishes of investors and the broad software development community, and continue to implement the most elegant, secure, and extensible complete code.

- Tester: Check the security of Sifchain and how well its implementation matches the expected implementation.

- Protocol "politicians": monitor the economic behavior of cryptocurrencies such as transactions and swaps, key indicators such as hash rate, transaction fees, and swap fees, and the equations and algorithms that they affect or are affected by them. They also hope to provide improvement proposals that contribute to the well-being of cryptocurrencies in the decentralized distribution of contributors and their available budgets.

- Investor: The most important part of the community. Investors of Rowan tokens are responsible for voting on improvement proposals, providing funds and attracting other investors to provide funds, researching crypto economic activities in the market and related markets, and determining ways to increase the Rowan price of other assets in their portfolio. Investors are also responsible for supporting the activities carried out by the other participants mentioned above to make the entire ecosystem run smoothly.

- Other parties: The above list does not include operations support personnel, business development, legal and other roles served by the Sifchain core team. As the Sifchain core team transfers its responsibilities to SifDAO, its functions must continue in some way.

On March 8, Bware Labs, which provides payment services for blockchain API users and node suppliers, announced that it has reached a strategic cooperation with Sifchain to support the decentralization and safe operation of the Sifchain network, becoming its fourth largest verification node, so far there are 49 A verification node joined the Sifchain network.

What is the value of Rowan token?

Rowan, as the multi-value token of Sifchain, will play multiple roles in the following ways:

- Pledge: Become a Sifchain network verifier to ensure the safe operation of the network and obtain a passive income of 10% to 30% of the APR (if the network traffic is extremely high, it can be as high as 100%), but if the block is wrong, it will be based on the Tendermint proof of stake consensus algorithm , Rowan who pledged will be fined.

- Commission: Verifiers can earn commissions by attracting delegators. Delegators are people who are interested in making money from staking, but cannot run verification nodes themselves. They can delegate Rowan to validators who can pledge on their behalf. Verifiers can set their own commissions according to their own business model, and active verifiers who are interested in funding Sifchain's independent projects can charge higher commissions.

- Delegation: As mentioned above, the delegator gets a pledge reward minus the commission retained by the validator. Encourage the delegator to support Sifchain's technological innovation capabilities based on the verifier's capabilities.

- Swap: Token exchange is the core of Sifchain. Users can exchange any asset on any bridge chain (such as Ethereum) for any asset. Rowan is the settlement token for all liquidity pools of Sifchain. Therefore, all liquidity pools contain external assets such as ETH or MKR and Rowan. The swap between two external assets requires two swaps for the two liquidity pools. Traders can use Rowan to save swap fees.

- Liquidity pool validator subsidy: Sifchain will run a 12-week validator subsidy program for pool managers to incentivize early users. And will provide all validators with up to 30 million additional Rowan rewards, depending on the number of Rowan they pledge to the network.

- SifDAO reward: After the token sale, Sifchain will consider using Rowan as a community reward token for social mining at its discretion. The token will start operations after the public token sale. The team will start a discussion with the community on how to best operate SifDAO.

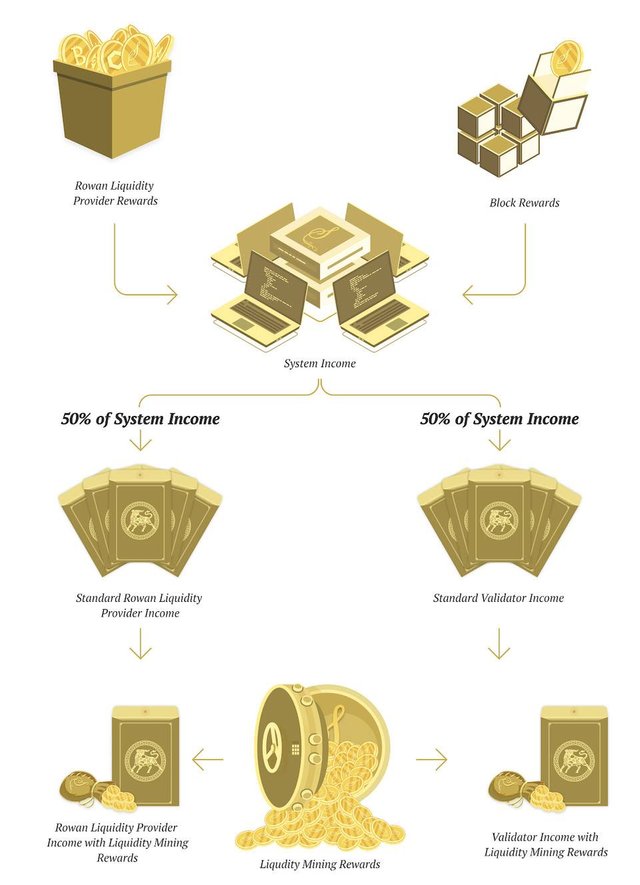

As shown in the figure above, the income of the validator and the income of the liquidity pool (Rowan provider) will be rebalanced so that they are always equal.

Project background and near-term planning

Sifchain was established in 2020 and has successively received investment from 13 well-known investment institutions and individuals including NGC Ventures, Kenetic Capital, Alameda Research, Kosmos, Mechanism Capital, AU21 Capital, Bitscale, and Danish Chaudhry, the managing director of Bitcoin.com.

Sifchain founder Jazear Brooks is the blockchain architect of the early cross-chain project Thorchain. He participates in and supports the Cosmos official Ethereum and Cosmos cross-chain bridge for Interchain Foundation and the Polkadot and Ethereum cross-chain bridge for Web 3. In the development of Chain Bridge, the R&D team led by it comes from well-known projects such as Coinbase, Cosmos, Polkadot, Tezos and Thorchain, and has the industry's first-class cross-chain transaction R&D experience and capabilities.

Sifchain has currently completed the multi-chain support for the Continuous Liquidity Pool (CLP), Ethereum anchoring, liquidity pool, swap, block explorer, etc. development and test online, as well as token public offerings. SifDAO will be launched soon, giving participants the right to vote governance, pledge delegation, and mining. In the first and second quarters of this year, the IBC protocol will be launched, Peg Zones will be added, margin trading, limit orders and other functional products will be opened. .