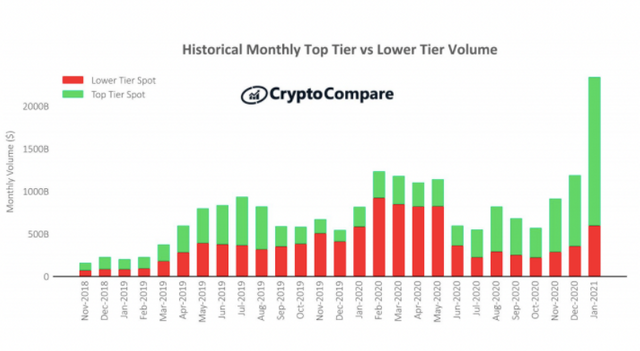

According to a report released today by CryptoCompare Research, the market share of top cryptocurrency exchanges has exceeded $1 trillion.

According to the report, from October to January last year, the market share of top cryptocurrency exchanges increased by 13%.

The report ranks more than 160 global spot exchanges, of which 76 are rated as "top" exchanges, controlling approximately 88% of the market share. Six exchanges were rated AA grade, namely Coinbase, Gemini, Bitstamp, Kraken, itBit and Luno.

The report attributed the increase in market share to retail and professional crypto traders switching to seemingly less risky exchanges, as the price of Bitcoin soared to $20,000 in late December and to $30,000 in January.

The report pointed out that the exchange’s KYC and AML standards have greatly improved in the past four months. 44% of the 160 exchanges provided the ability to "check complete historical transaction data through public API endpoints", compared to only 37% in July.

In addition, CipherTrace statistics show that the proportion of exchanges rated as having a "bad or insufficient" KYC system has dropped from 44% in July to 33% in January.

Many exchanges are now complying with "stricter" KYC and AML requirements. At the same time, it has increased transparency and improved overall operations.

The report specifically mentions Coinbase, Gemini, Bitamp, Kraken, itBit and Luno as the "lowest risk exchanges." Binance, FTX, OKCoin, Huobi Global and Bitfinex are listed in the next "lower level" category.