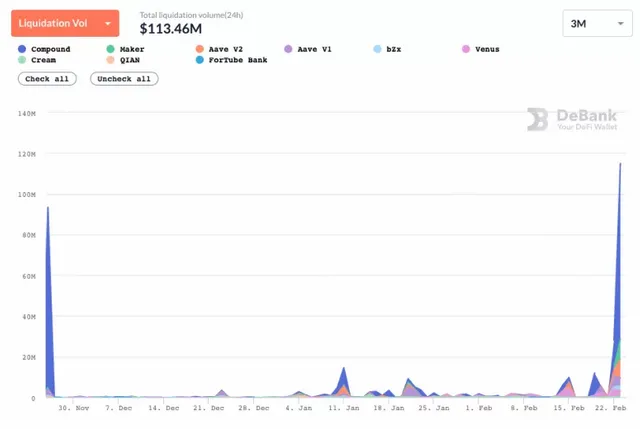

On Tuesday, after the price of Ethereum continued to pull back to US$1,406, a record high of US$131 million in decentralized finance (DeFi) lending positions was liquidated. According to CoinDesk 20, this cryptocurrency has fallen 9% in the past 24 hours.

According to data from data provider DeBank, Compound Finance has the largest number of liquidation positions, about $86 million, accounting for 75% of the total liquidation of the platform.

MakerDAO followed closely, with a liquidation amount of approximately US$10 million, accounting for 8% of the total. The sum of Aave v1 and v2 is USD 13 million, accounting for 11% of the total liquidation.

Historically, high gas fees may be one of the reasons for large-scale liquidation on lending platforms. According to data from the data provider Blockchair, the average transaction cost hit a new high again on Tuesday, with a basic ether transaction cost of $39. For many borrowings, due to the high transaction costs, the cost of compulsory liquidation through non-liquidation or liquidation may eventually be lower.

According to Messari's data, the DeFi asset class as a whole also experienced a sharp sell-off, with a drop of about 13%. However, as can be seen from the DeFi Impulse Index (DPI), the index of this asset class has been rising in the past 30 days, with an increase of nearly 50%.

Disclaimer: As a blockchain information platform, the information provided on this site does not represent any investment hint. The articles published on this site only represent personal opinions and have nothing to do with the official position of Mars Finance. Given that China has not yet issued policies and regulations related to digital assets, users in mainland China are requested to be cautious in their digital currency investments.