We also believe that there are many people of insight outside the circle, including the elites in the political and business circles, including the backbone of the traditional financial industries. You should also be full of curiosity about "BTC+DeFi", because if you can't find your own place here, I am afraid there is nothing to play in the future ...

Therefore, we believe that the blockchain is bound to "go out of the circle" and start from "BTC+DeFi", because this matter is of great importance (we will discuss it further in the first part). Let's put aside the imagination of the revolutionary scene that blockchain technology and encryption economy will bring long-term prospects to industries and times, and sort out the wealth opportunities visible to the naked eye brought by "BTC+DeFi", as well as the decentralized governance of finance and the corresponding technological iteration process.

- The first part of the test

Is there any technical path for reference?

Many people's understanding of blockchain still stays in the ICO boom a few years ago, but in fact, blockchain has been iterative, evolving and advanced, and we have entered the era of commercial application driven by blockchain technology progress. According to Dune Analytics data, as of February 2021, there were already 1.5 million DeFi users in Taifang alone, and it showed an accelerated growth trend (100,000 in 2019 and one million by the end of 2020); The largest part of these users mainly focus on bitcoin loans, margin loans, and stable currency which was originally built on bitcoin and uses OmniLayer protocol. These applications are just part of the "BTC+DeFi" ecology that we are going to discuss today.

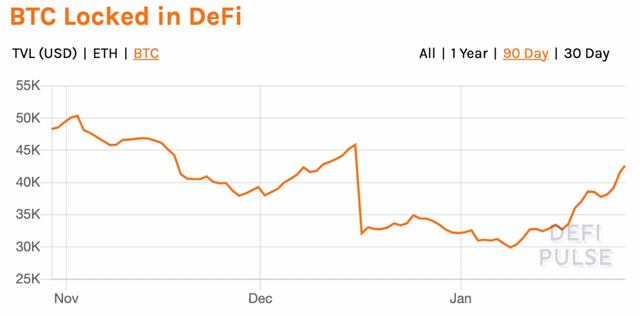

In the report of Badger DAO, a typical project of "BTC+DeFi", we once explained "a larger market space of DeFi" from the perspective of wealth opportunities. Although the DeFi market is growing rapidly, compared with the total market value of the digital asset market of trillions of dollars, the capital volume carried by DeFi Ecology only accounts for a single digit percentage at most; When BTC, the encryption asset with the highest market value and the largest consensus, is integrated with the most active and innovative DeFi ecosystem, this field is full of imagination ...

However, "BTC+DeFi" brings us more than "a larger market space for DeFi". In order to get a share of this larger market, investors and developers need to explore and practice more technology, products and ecological development of BTC public chain and DeFi. This process is even more significant, and this process is bound to enlarge us. Looking forward to the arrival of the era of encryption economy, accelerate the pace of blockchain technology change in the realistic centralized financial era ...

We will see the emergence of new "BTC + defi" products, and the underlying protocol of these products is the financial infrastructure established on the basic public chain such as Ethereum in the past few years.The vision of "BTC + defi" starts from the first step of implementing the defi product on the public chain. After considering the value of the original assets of the public chain, the throughput of the public chain, and smart contracts, early developers and investors found that bitcoin has an overwhelming advantage in the value of the original assets, but it has obvious shortcomings in terms of transaction throughput and smart contracts.

Early explorers came to the conclusion that realizing DeFi on Bitcoin has natural disadvantages. Therefore, their starting point is to solve the possibility of realizing rich DeFi based on Bitcoin. However, there are still attempts to develop smart contracts on BTC public chain.

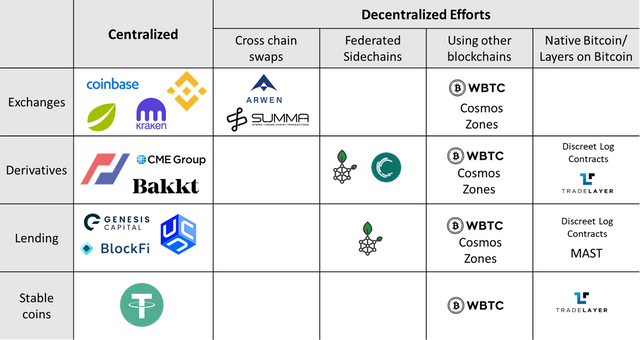

Before we start to discuss the defi path of bitcoin, let's first clarify the concept of DFI, its relationship with the current BTC usage scenarios, and the ability it can bring to solve the pain points.The products include decentralized loans, decentralized exchanges, decentralized derivatives, and even the issuance of decentralized stable currency.In fact, decentralized payment itself is a defi product.This is also the most important application scenario of BTC, which allows businesses to receive BTC directly without a third-party payment processor.

Therefore, this paper focuses on how bitcoin can expand its defi footprint beyond decentralized Payments - for a long time, bitcoin centric financial products mainly include bitcoin loans (companies like Genesis capital, which allow investors to borrow bitcoin and other encrypted currencies for trading or market making, or such offers as blockfi and unchained capital)BTC guaranteed loan companies), margin loans (a case of mortgage loans for leveraged transactions, mainly involving exchanges such as bitmex, Kraken, bitfinex and poloniex), stable currency represented by tether (usdt), initially established on bitcoin and using omnilayer protocol, and wbtc operating on Ethereum (which can be used in any Ethereum defi project),But centralized third-party hosting is needed)

Take open finance as an example. It will create a one-way process from BTC to Ethereum, and open finance will have great attraction compared with special currency.The value of Ethereum BTC (ebtc) will be higher than that of bbtc when someone can receive a loan with BTC as collateral or pay interest according to BTC provided by you.Bbtc will be a static asset because ebtc can earn interest or use it in other ways.Dormant bbtc may also migrate to Ethereum and borrow compound, dydx or Dharma to obtain loan interest with unlimited potential.

However, these are centralized financial services using bitcoin.But this gives an expectation in one direction - once defi can be implemented on bitcoin, these will be the main targets of decentralization, along with, of course, decentralised exchanges (dexs) and related decentralised derivatives.

For a long time, the path of technology implementation has restricted the imagination of early investors and developers, but there are still many attempts for reference.The early technical approaches to implement bitcoin difi mainly include: using the current functions of bitcoin, such as hash time locking contracts (HTLcs), to facilitate direct cross chain atomic exchange, and to establish decentralized exchanges with other cryptocurrencies; and bitcoin's joint side chain services, such as liquid of blockstream, which use the bi-directional linkage of bitcoin blockchain,It also allows the use of linked BTC in various financial activities, the use of bitcoin in Ethereum or cosmos and other protocols to interact with difi products, and the use of protocol layers based on the bitcoin protocol, such as omnilayer or lightning network

- Part II open source

Class cross chain and asset exchange in encryption world

In a more grand historical advanced scene, commodity trading is the driving force of the development of the commercial world, and asset exchange is the driving force of the encryption world.If it is impossible to cross the chain of assets, free flow and low friction exchange between chains, blockchain technology will never come out of the circle, and the transformative force of the application of blockchain technology will also be delayed.This is the basis for my writing this paper to explore the infinite wealth potential of the crypto world brought by "BTC + defi" and the iterative prospect of sovereign governance optimization.Therefore, the efforts of these cross chain projects are particularly important.

The real cross chain has not yet taken shape, but the "class cross chain" mode has gradually opened the hidden attributes with the development of difi, and has emerged in the field of defi. The underlying logic of the rise of cross chain assets is that the supply of the original asset platform BTC is separated from the demand of the open financial platform eth, and the supply of the underlying assets is insufficient: due to the segmentation of the blockchain chains, it is necessary to cross the chain of assets, and the lack of underlying assets will restrict the development of defi.

Although the digital asset market is huge, due to the existence of various subdivision ecology, the actual available assets are insufficient;Cross chain assets, original creation on the chain and external assets on the chain are the three directions to solve the shortage of assets. At present, cross chain assets have the most advantages. As a public chain with the most consensus, bitcoin has become the preferred target of cross chain assets. However, the actual proportion of bitcoin that can flow is only 20%, and it will be less and less,Bitcoin will be the digital asset with the largest market value and the best liquidity for a long time, but it has no way to carry a complex smart contract and can not convert the asset market value to the bottom of the application.

These barriers limit the exit of defi.We hope that cross chain assets or anchored assets are solving this problem - introducing bitcoin value to other public chains.

Thanks to the bull market environment and the expectation that Ethereum 2.0 is considered to be a semi-finished product, these spaces give the new public chain a rare driving force and opportunity to catch up.On the one hand, there are more active public chains with cross chain concepts such as Polkadot and cosmos; on the other hand, the head exchange is also trying to join the public chain track, such as heco, BSC, okexchain, etc.In this general trend, it is easier to reach a consensus in the capital and investment circles to try to bring BTC into the defi ecosystem.

- 0201 Thorchain

Thorchain is a cross chain asset exchange pool, which can be used as the exchange layer of anchored assets. For example, BTC is converted to wbtc, BTC is converted to renbtc, and the token Rune acts as the settlement currency in the middle.

Thorchain first launched bepswap, which gives people the imagination of building a decentralized exchange from a cross chain perspective. If it succeeds, it will have a certain impact on the current DEX from a higher dimension. On the other hand, time is running out. At present, Ethereum is the largest ecosystem. With the emergence of technologies such as TaiFang 2.0 and layer2 expansion, Ethereum network will be continuously optimized. Will thorchain still have opportunities?

- 0202 ChainX

Many people believe that Boca has not shown competitiveness for the time being compared with the highly competitive defi ecology on the Ethereum public chain.Chain x seems to be an exception, trying to win back some face for Boca ecology.

Chainx is committed to becoming a cross chain hub of digital assets. It will transfer cross chain assets in a completely decentralized way, so that BTC, ETH, EOS and ADA can freely flow to other chain systems.

The latest news is that chainx 2.0 has completed the sherpax parallel chain test and fixed known problems, completed the BTC hosting 2.0 technical solution, and reached a strategic cooperation with platform to jointly promote the platdot projectPlatform is the underlying infrastructure supporting the transfer of data assets and password assets. This cooperation is also to further promote the free and low friction asset flow between chains.

Compared with many cross chain projects that try to bring BTC to Ethereum ecology, will chainx, which has been running for more than a year, have any advantages?

- 0203 platform test network Alaya

The platform test network Alaya also officially released the cross chain system of financial infrastructure assets in December 2020.The Alaya cross chain system allows users to anchor the assets on Ethereum, such as ether and usdt, to Alaya directly.

- 0204 Kava-Hard protocol

In 2020, kava launched hard protocol, a cross chain difi protocol based on kava, which supports the cross chain of bitcoin, coin security chain and ripple.On October 15, 2020, the upgrade of kava 4 gateway will be synchronized with the launch of hard protocol.In addition to cross chain, BTC, XRP, BNB, busd, kava and USDX can be borrowed and mined.At the beginning of 2021, kava will be launched, and the V2 version of hard protocol will also be launched.

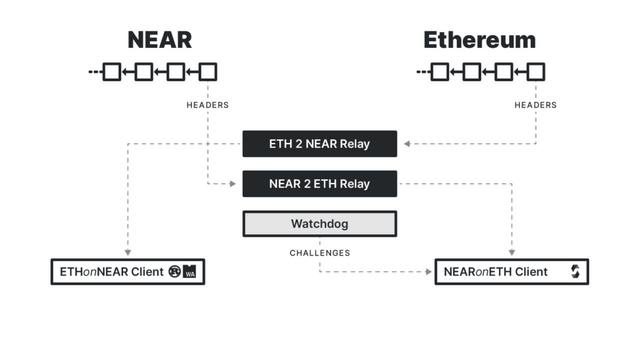

- 0205 near Rainbow Bridge

Rainbow Bridge introduced by near is a cross chain interoperability bridge, which can realize the cross chain flow of assets on near and Ethereum.Users do not need to trust anyone, only need to trust the decentralized client, so it is also a non trust cross chain.

Because near and Ethereum are Turing complete, both sides can track each other's asset movements in the other's chain.There are some preconditions for the implementation of rainbow bridge: near wants Ethereum to pass eip665, but before passing through, users can only believe that the gas fee of each block has increased by more than twice within four hours, which is impossible.However, it may be difficult to pass eip665, and 2 / 3 of the nodes on near are honest.

0206 Moonbeam

Moonbeam's direct reproduction of the development environment on Ethereum on Polkadot is a larger application than cross chain assets and a direct "migration" of ecology.All protocols and applications can be reproduced on the wave card through moonbeam. It is not only the migration of assets, but also the reproduction of assets. For example, AAVE on Ethereum becomes paave on the wave card.It all depends on the development of moonbeam parallel chains.

- 0207 Cosmos

Of course, the most powerful asset cross chain still hopes to realize heterogeneous cross chain in cosmos and Polkadot.On January 28, cosmos "Stargate" was upgraded, and cosmos SDK v0.40 was released.

- 0208 Blockstream vs RSK

Bitcoin side chain is a concept proposed by blockstream in 2014. Its idea is to introduce new functions of bitcoin without changing the underlying protocol.Since then, the concept has developed significantly.Simply put, the side chain is to create a separate chain with a small number of verifiers (called alliances) and use a token linked to the BTC through a two-way hook.The benefits of joint side chains include faster transaction confirmation and the realization of potentially controversial functions, such as tokenization of confidential transactions, other assets or smart contracts.The main disadvantage of the side chain is the need to trust a small consortium to run and maintain the side chain.If, for some reason, the side chain verifier decides to give up the chain, then there is a risk of losing money when using the side chain.In this case, the linked assets will be in trouble and cannot be redeemed in the form of BTC.

RSK is a famous side chain dedicated to bringing smart contract function to bitcoin.It supports the solid smart contract, which simplifies the difficulty of migrating the Ethereum profi protocol to RSK.In addition to RSK, blockstream also launched commercial liquid side chain products in 2018.Blockstream initially focused on asset tokenization and faster transactions, but the concept can be extended to support defi applications.

- 0209 Arwen vs Summa

There are also a lot of projects that are working on iterations in the transaction chain.In trading, the simple premise of decentralizing exchanges is to execute transactions between bitcoin and fiat money, or between bitcoin and other cryptocurrencies, while you keep your own token until the transaction is completed.Although such transactions can be carried out using platforms such as localbitcoins or openbazaar, these platforms are only suitable for occasional slow transactions, and are not suitable for fast or high-frequency transactions requiring efficient price discovery.For high-frequency transactions, a centralized order book and corresponding ability to quickly settle transactions are needed.Building a truly decentralised exchange is one of the toughest challenges for defi, with Arwen and summary taking the lead.

Arwen can access the centralized exchange's order book without trust in chain and cross-chain atomic exchange. In this sense, it is possible to trade efficiently in the centralized order book, while maintaining the custody of assets until the transaction is executed. At present, this product only supports cryptocurrencies with the same code base as Bitcoin, such as Litecoin and Bitcoin Cash. They are working to realize cross-chain atomic exchange between Bitcoin and Ethereum and ERC-20 tokens. Arwen is currently available on Kucoin exchange (beta version).

Summa invented stateless SPV technology, which provides financial services without trust for Bitcoin and other blockchain. Stateless SPV allows verification of bitcoin transactions using Ethereum smart contracts, making it possible to perform a wide range of financial transactions using bitcoin. Using this technology, Summa's team conducted an auction to bid for tokens issued by Ethereum with bitcoin. The team is studying the general cross-chain exchange among Bitcoin, Ethereum and ERC-20 tokens.

The asset winding on 0210 Tezos and the development of tzBTC have brought Bitcoin and other assets into the Ethereum ecology. In the ecological expansion stage, these measures are also attempts to apply different possibilities to the public chain ...