.jpeg)

The elegance of DeFi lies in its ability to provide the best financial solutions for each category. But nowadays, when users are looking for a decentralized stablecoin, they have to choose among frustrating options. On the one hand, they are bloated, debt-driven super-collateralized stablecoins, which are difficult to scale to meet demand. On the other hand, unsecured algorithmic stablecoins will increase volatility and continuously focus rewards on the earliest holdings. In the hands of those who have. To truly establish the vision of DeFi's global interoperable financial access, it is necessary to have a decentralized, fair, liquid and scalable stablecoin that can exhibit high-precision anchoring.

Inspiration of Fei Protocol

Stablecoins are the foundation of DeFi, and users want to access dapps like Compound and Aave without worrying about volatility. However, every existing stablecoin model has some serious flaws. Fiat-collateralized stablecoins like USDC and USDT are centralized, while mortgage-based stablecoins like DAI exist due to inefficient capital. Scalability issues (in other words, generating collateralized stablecoins requires too much collateral). Seigniorage types (or algorithmic stablecoins), such as ESD and Basis Cash, have the problem of centralized supply expansion rewards, which causes the unfair distribution of stablecoin growth. In addition, once there are signs of danger, liquidity providers tend to withdraw.

The Fei Agreement was born to solve these problems. It was inspired by an ancient stone currency-Rai on the island of Micronesia, or Fei. We hope that the FEI stablecoin has the same stability, simplicity and universality as the stone currency.

How does FEI supply expand

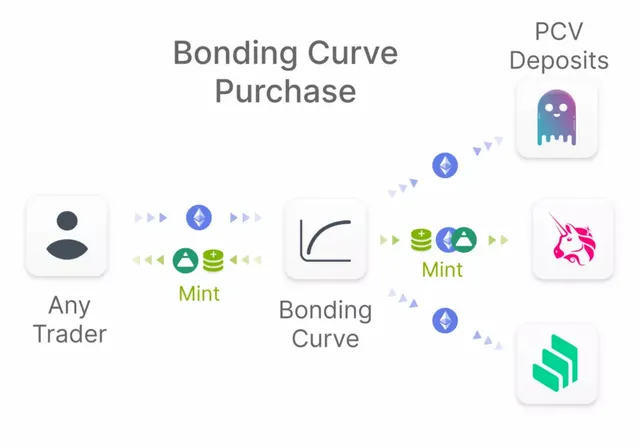

The FEI stablecoin has an uncapped supply that tracks demand, and it enters circulation through a joint curve sale. This curve approaches and is fixed at a $1 anchor price. When new FEI needs arise, users can purchase them on the joint curve. The price function will start to reward early adopters who buy FEI at low prices. The Fei protocol will support the creation of a joint curve with any ERC20 token, but only a single curve denominated in ETH will be included when it goes live.

The mission of the Fei protocol is to create a fully decentralized stablecoin. Therefore, it is essential that tokens issued by trusted third parties (such as USDC, USDT, wBTC) will not be used as collateral on the joint curve , This is the position that the development team hopes to be shared by the governance community after the release.

Before fixing the price at 1 USD, the ETH joint curve will have a target FEI supply for bootstrapping. This goal is called "Scale", and reaching "Scale" signifies the end of the bootstrapping phase. According to the introduction, "Scale" will be set to 250,000,000 FEI. After the "Scale" phase is completed, the joint curve price will be fixed at the manageable buffer above the anchor price. This price creates a restriction in the entire ecosystem that if prices are higher elsewhere, arbitrageurs can buy on the joint curve and sell on the secondary market.

It should be noted that users cannot sell FEI on the joint curve. On the contrary, the protocol keeps the incoming ETH as the protocol control value (PCV). The Fei protocol deployed PCV to create a liquid secondary market where users can sell FEI back as ETH. We will explore how PCV supports the FEI ecosystem below.

Protocol control value (PCV)

Most DeFi platforms use the Total Value Lock (TVL) model. On these platforms, users will receive IOUs and can withdraw assets at any time . Locking is becoming more and more common, and agreements can motivate TVL through token distribution rewards. Although this may lead to a large amount of capital, it also creates the problem of "mercenary capital". When incentivizing liquidity, DeFi platforms need inflation and provide generous returns to maintain it. Then, only if the reward is active, the deposited capital is loyal. But in the long run, this is unsustainable, because every day there will be shiny new income opportunities. When rewards dry up and funds are transferred to other places, people always worry that funds will be drained.

Fei protocol has developed a "Protocol Control Value (PCV)" model to solve these problems. PCV is a subset of the TVL concept, in which the platform completely owns the assets locked in the smart contract. This is a more powerful use case than the IOU common to most TVL applications, because PCV is permanent.

PCV provides greater flexibility to the agreement, allowing it to engage in non-profit activities. These activities can meet more basic goals, such as maintaining anchoring stability. As we have defined, common use cases such as governance vaults and insurance funds are PCV types. Other possibilities include providing guaranteed liquidity or price support for DeFi users. Unlike IOU mode, PCV cannot be changed. The governance token in the PCV platform brings deeper value capture and corresponding responsibilities.

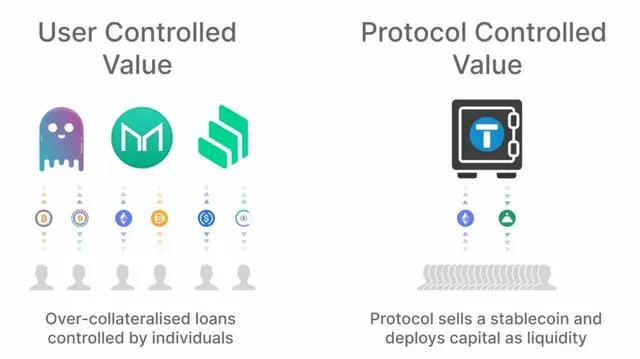

User-controlled TVL method vs. mortgaged PCV method

The Fei protocol is an ideal application for generalized PCV. The joint curve and other incentive mechanisms provide funds for the PCV pool. It first allocates 100% PCV of ETH joint curve financing to the Uniswap pool with ETH/FEI assets. The development team chose Uniswap because of its low barriers to entry, and ordinary DeFi users are more familiar with it. If the use case is clear, governance can redistribute PCV to other platforms in the future. Compared with relying on the stability mechanism provided by external liquidity, this approach has two key advantages:

- With guaranteed liquidity, FEI holders can rest assured because they know that no whale can take away the liquidity owned by the agreement. It is funded by the joint curve and placed in the Uniswap ETH/FEI asset pair.

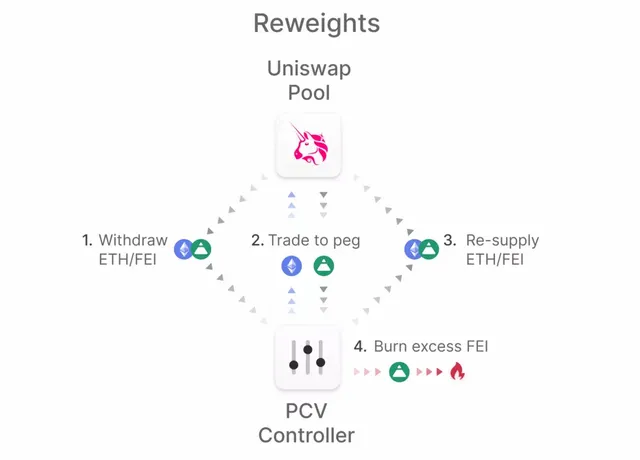

- Peg Reweights — If the Peg Reweights is lower than the Peg Reweights for a long time, the Fei Agreement can reset the Uniswap price to the Peg Reweights. It achieves this by performing the following atomic transactions: (1) Withdraw the liquidity owned by all agreements, (2) Use the proposed ETH to purchase FEI, returning the price to anchor pricing (3) Replenish the remaining PCV as liquid funds ( 4) Burn excess FEI. When the price is low for a period of time, any keeper can trigger anchor repricing. The agreement uses FEI to create incentives and rewards for liquidators (keeper).

PCV re-adjusted FEI/ETH Uniswap pool to anchor price

Through governance, future use cases for PCV can be more creative. The agreement can maintain a collateral balance in lending platforms such as Aave. Then, it can adjust the interest rate in the FEI market by offering and borrowing FEI tokens, and so on.

Direct Incentives

Direct Incentives

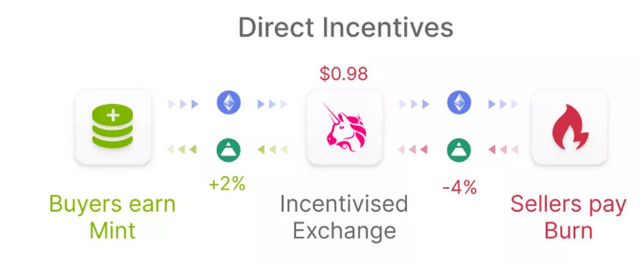

FEI is stabilized through a new mechanism called Direct Incentives.

The following paragraph comes from the white paper from the Fei Agreement:

"Directly incentivized stablecoin is a currency in which both trading activities and stablecoin use are incentivized, in which rewards and penalties make the price move closer to anchor pricing. Generally speaking, there will be at least one incentive exchange as the hub center, and all Other exchanges and secondary markets can use this incentive exchange for arbitrage. This helps maintain the anchor of the entire ecosystem."

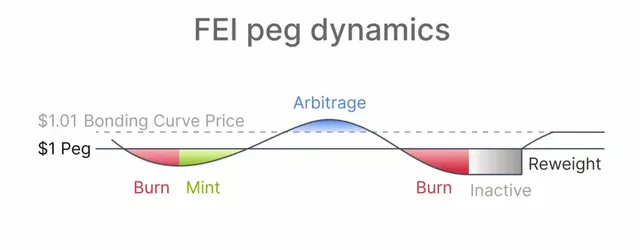

The Fei protocol achieves this goal by incentivizing Uniswap transaction volume through mint and burn. These incentives apply directly to the trader's balance and are proportional to the distance to the pegged exchange rate, which means that larger selling will lead to greater burn.

The agreement motivates traders through mint and restores the price to anchor pricing. The formula used ensures that all fluctuations below the anchor exchange rate are net deflation. This will help reduce supply to an appropriate level relative to current demand.

Direct incentives to maintain a pegged exchange rate

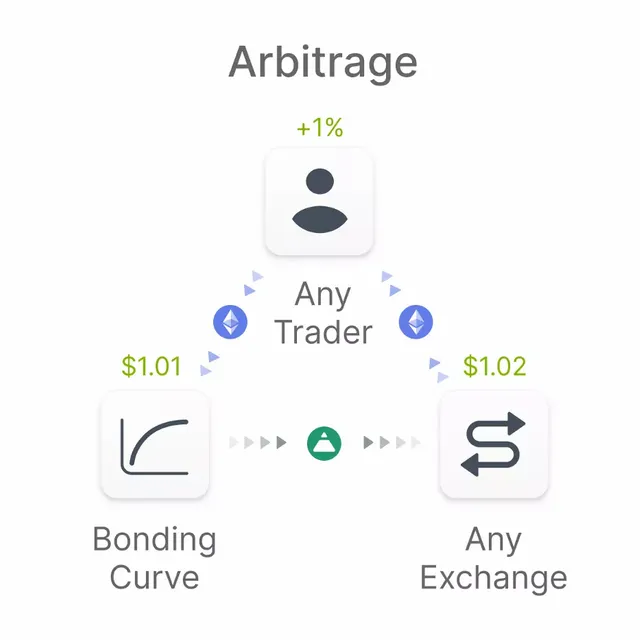

These incentives only apply to transactions where the spot price is lower than the anchor exchange rate. The situation of exceeding the pegged exchange rate is dealt with by an arbitrage cycle with a joint curve.

Arbitrage cycle above anchor pricing

The direct incentive implementation of the Fei protocol is like a cousin of flexible coins (such as AMPL and YAM). It does operate directly on user balances, but only on users who actively participate in incentive behaviors. When combined with agreement repricing support, this has a very good game theory nature. Once there is high FEI selling pressure, the seller will bear the corresponding deflationary costs. If no traders recover the price, the holder can be confident in the agreement to support the price. These novel properties have led to FEI's high accuracy anchoring.

FEI stablecoin anchor summary chart

TRIBE token and Fei protocol governance

The Fei protocol will be launched as a fully decentralized DAO on the first day. TRIBE tokens control this DAO , and TRIBE holders can vote on the following actions:

- Add a new joint curve with new tokens, or adjust the price function of an existing curve;

- Adjust PCV allocation for new capital or existing PCV;

The governance of the Fei Agreement DAO is based on the concept of minimization, and the stability of FEI does not require any active intervention by governance. The development team encourages the use of autonomous and algorithmic mechanisms, rather than rigid and governed mechanisms. We believe that this method of minimizing governance can create a more predictable and efficient system.

The agreement allocates a part of TRIBE tokens to the FEI pledge pool. Users can deposit FEI and receive TRIBE rewards in proportion. The development team and investors retain another part, and then the Genesis Group part and the first DeFi issuance part, and the remaining TRIBE tokens will be kept in the governance vault.

Genesis Group and the first DeFi release

In order to alleviate the problems of preemptive transactions and unequal distribution, the Fei protocol will have a "Genesis" founding period. This Genesis founding period will be a period of 2-3 days. Early adopters can invest their ETH during this period. Then this group is called the Genesis Group. The members of the Genesis Group get a proportional share in the first joint curve transaction, which is similar to Hegic IBCO. Using this method, everyone has an equal opportunity to obtain the earliest FEI. According to the introduction, Genesis Group will receive 10% of the total TRIBE supply proportionally.

After the Genesis Group phase is completed, the first DeFi supply phase of TRIBE tokens will be launched. It will be launched on Uniswap with FEI and TRIBE as trading pairs. IDO's FEI is cast by agreement, and the FEI and TRIBE circulating in the Genesis Group can be used for effective price discovery in IDO. And this time IDO's Uniswap liquidity token will be stored in the development fund, which will have a linear lock-up period of more than 4 years.

More details will be officially released in the first quarter of 2021.

FEI and the future of stablecoins

As mentioned above, compared with the existing stablecoin model, the FEI protocol has some new features. It is designed as a stablecoin mechanism with irrevocable, deep liquidity and strong anchoring. All deflation costs are passed on to traders who sell below the anchor price , so holders can have confidence in the long-term price of one dollar. In addition, PCV funds controlled by the agreement will be used to benefit the FEI ecosystem, rather than locked in a vault. Genesis Group and the initial DeFi release can make the distribution of TRIBE more equitable. All the benefits of inflation are socialized, rather than concentrated in the hands of minority shareholders.

Nevertheless, whether the FEI agreement can be implemented in accordance with the content described in the white paper remains to be further observed.