Hello, everyone. In the future article analysis, I will mainly show the operation strategies of Bitcoin and Ethereum in the form of data, try to avoid subjective views and analyze in more detail.

Bitcoin

- Chart

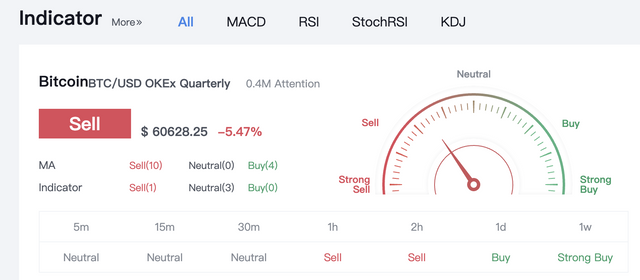

- Indicator display

- U.S. dollar index

- The number of bitcoins in the exchange

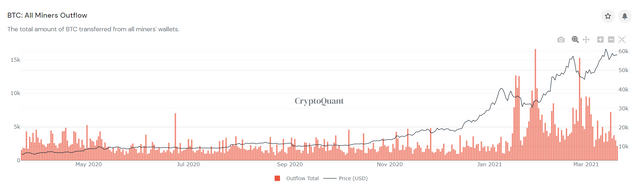

- The number of bitcoins transferred from the wallet by the miners

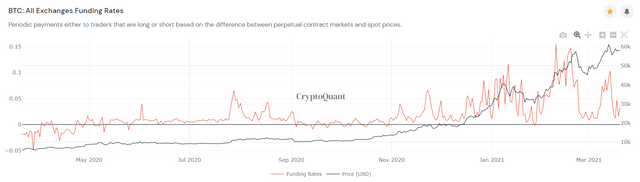

- Bitcoin perpetual contract funding rate

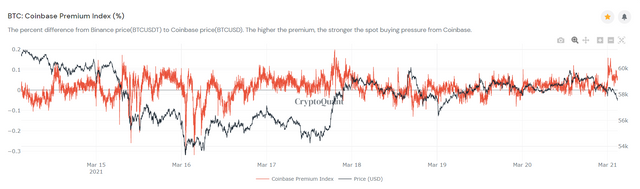

- Coinbase premium rate

Ethereum

- Chart

- Index analysis

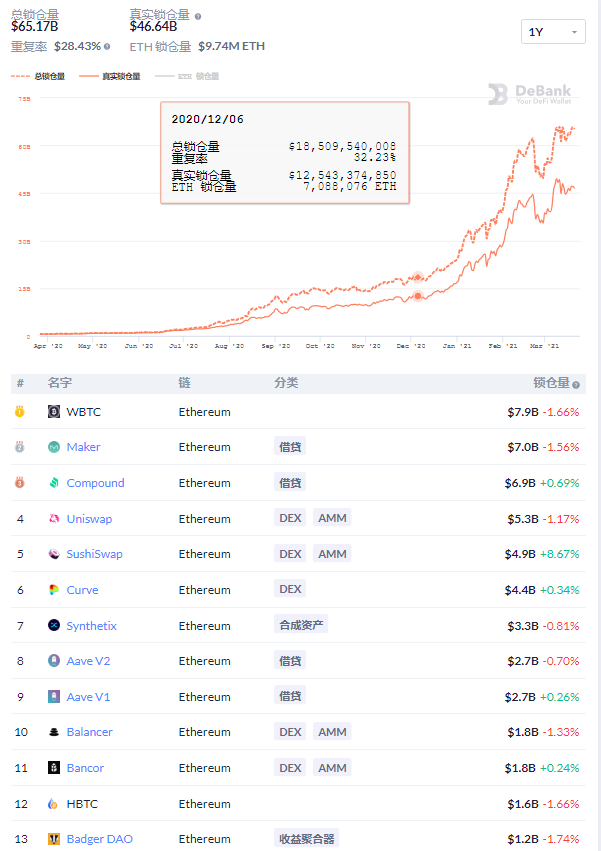

- DEFI lock-up amount

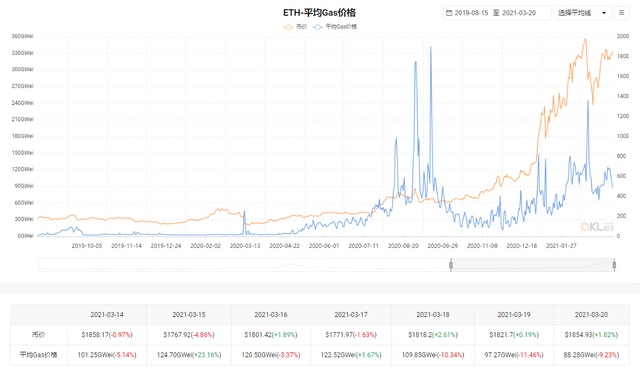

- Average Gas Fee

Altcoins index

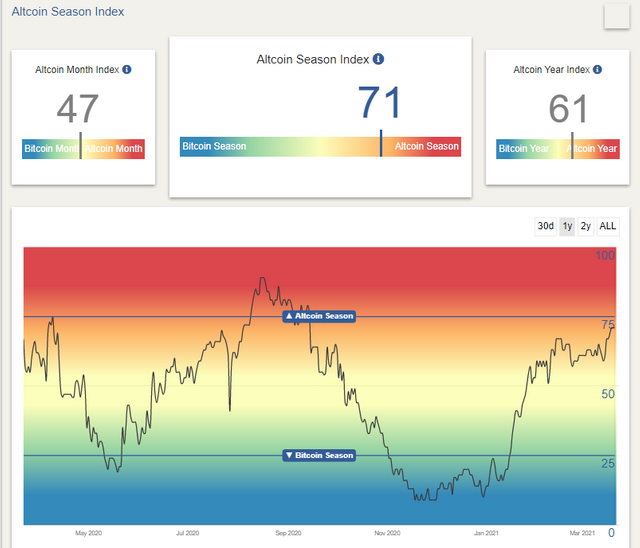

- altcoins seasonal index

- The popularity of the altcoins sector

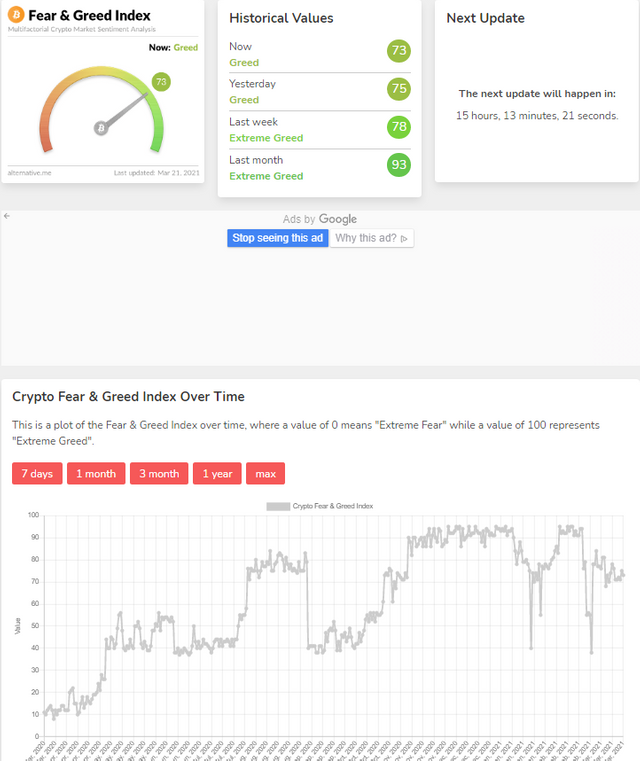

- Greed and Fear Index

Notes:

Under normal circumstances, the U.S. dollar index and Bitcoin price show an inverse relationship

Under normal circumstances, the number of bitcoins in the exchange is inversely proportional to the price of bitcoins

Under normal circumstances, the number of bitcoins transferred from the wallet by miners is inversely proportional to the price of bitcoins

Under normal circumstances, the exchange rate of Bitcoin funds is inversely proportional to the price of Bitcoin

Under normal circumstances, the higher the Coinbase premium rate, the greater the possibility that Bitcoin will rise

Under normal circumstances, the greater the amount of DEFI lock-up, the better the development of the ETH ecosystem

The higher the gas fee of Ethereum, the stronger the price will be

The seasonal index of altcoins is greater than 75, the market is in a frenetic state, and risks need to be paid attention to; an index below 25 is often a good opportunity to ambush altcoins

The greater the greed and fear index, the greater the probability that the market will peak, and vice versa. Invest in digital currency, follow Weibo: the big devil of the currency circle 2020

News:

- In just one month since its launch, Purpose Investment's Bitcoin ETF has exceeded the 1 billion Canadian dollar (800 million US dollar) mark. This ETF is the first exchange-traded fund in North America, enabling institutional investors to enter the Bitcoin market in a regulated way. As the Canadian company revealed, investors have shown great interest in the product and, therefore, it has reached an important milestone.

This Bitcoin ETF was launched on February 18 and hit a new high of nearly $165 million on the first day of listing. A week later, it has already held more than 10,000 BTC, indicating that professional investors have a great interest in cryptocurrencies. Today, this ETF has exceeded 1 billion Canadian dollars in just one month after its establishment.

The Canadian listed company Ether Capital Corporation (NEO:ETHC) has bought 11,264 ETH last week, with a total expenditure of 19,616,110 US dollars (approximately 24,500,000 Canadian dollars). Based on this calculation, the company’s unit price for buying ETH is 1,741 US dollars. A total of 43,512 ETH is held, and Ether Capital has become an ETH2.0 verification node.

Fortress Investment Group, an investment management company, is willing to provide creditors of the collapsed cryptocurrency trading platform Mt. Gox with an advance payment and pay up to 80% of the debts owed by creditors. The trust agency that manages Mt. Gox’s debt has proposed that creditors may also receive 90% of the value of their claims, but it is estimated that the payment will not be implemented until 2022. Fortress general manager Michael Hourigan stated in the letter: “We now provide a liquidity option for creditors who want to get cash or bitcoin immediately, instead of waiting another 1 to 1.5 years.” According to the company’s understanding, the company has allocated 1 US$100 million was used to purchase these claims.