Hello, everyone. In the future article analysis, I will mainly show the operation strategies of Bitcoin and Ethereum in the form of data, try to avoid subjective views and analyze in more detail.

Bitcoin

- Chart

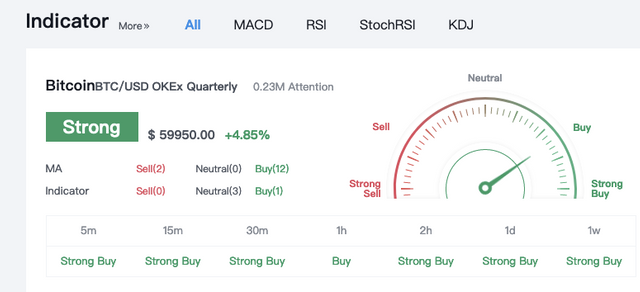

- Indicator display

- U.S. dollar index

- The number of bitcoins in the exchange

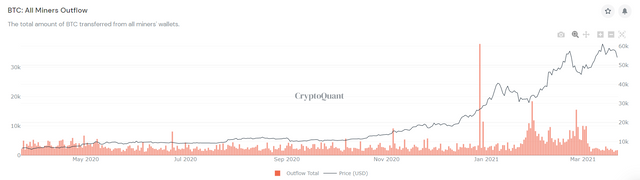

- The number of bitcoins transferred from the wallet by the miners

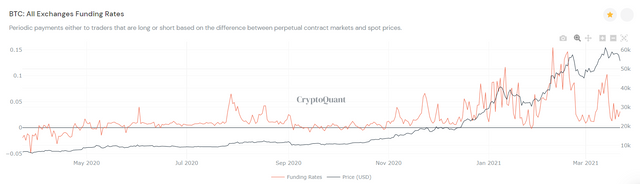

- Bitcoin perpetual contract funding rate

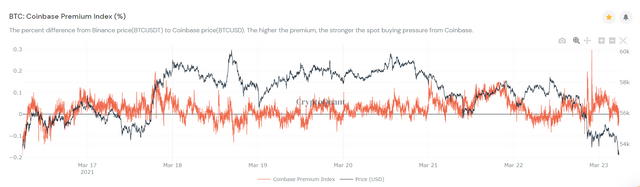

- Coinbase premium rate

Ethereum

- Chart

- Index analysis

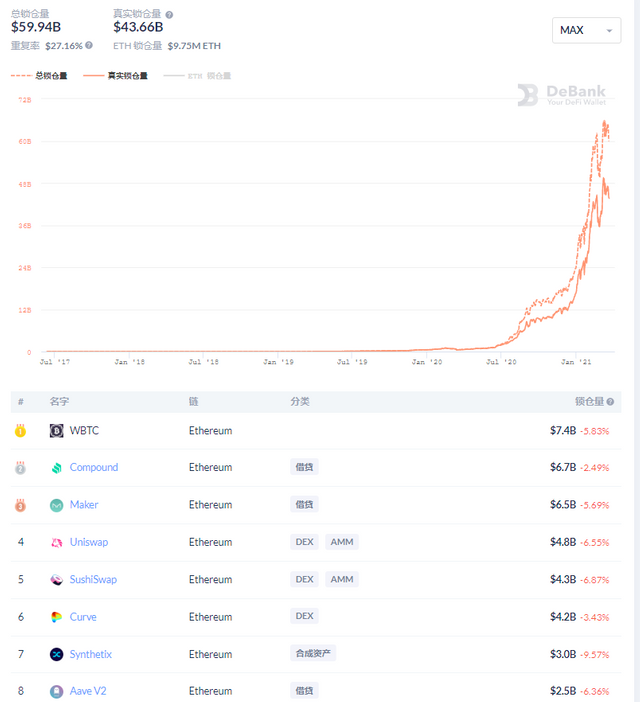

- DEFI lock-up amount

- Average Gas Fee

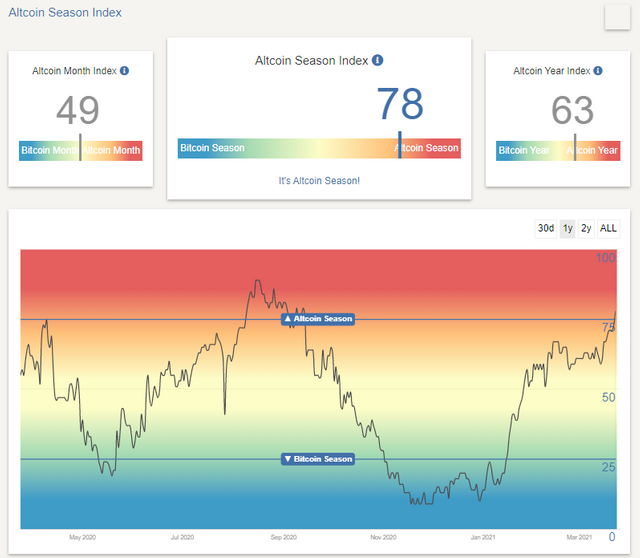

Altcoins index

- altcoins seasonal index

- The popularity of the altcoins sector

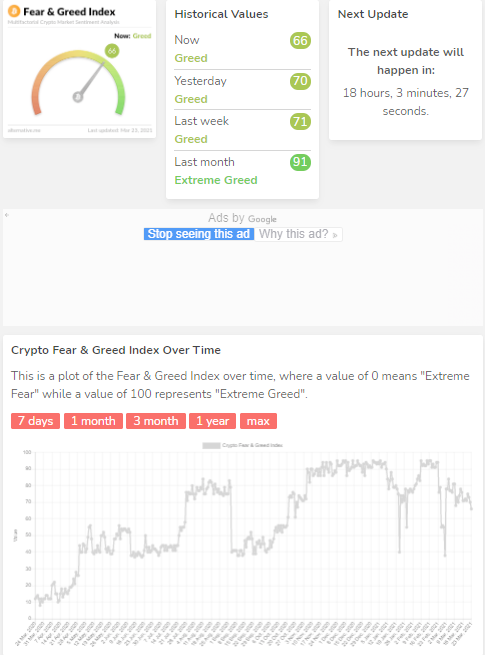

- Greed and Fear Index

Notes:

Generally speaking, the dollar index is inversely proportional to the price of bitcoin

In general, the number of bitcoin in the exchange is inversely proportional to the price of bitcoin

In general, the amount of bitcoin that miners transfer out of their wallets is inversely proportional to the price of bitcoin

In general, the exchange bitcoin fund rate is inversely proportional to the bitcoin price

Generally speaking, the higher the coinbase premium rate is, the more likely bitcoin will rise

Generally speaking, the larger the lock up volume of def, the better the ecological development of ETH

The higher the gas fee of ETHereum, the stronger the price will be

The seasonal index of Shanzhai currency is greater than 75, and the market is in a frenzy state, so we need to pay attention to the risk; if the index is lower than 25, it is often a good opportunity to ambush the counterfeit currency

The higher the greedy fear index, the more likely the market will reach the top, and vice versa

The larger the position of futures contract, the greater the fluctuation range of market direction selection

Message side:On the evening of March 22, Dario, founder and co chief investment officer of Bridgewater associates, the world's largest hedge fund, said bitcoin had proved itself in some important ways over the past decade that it had not been hacked in and widely accepted.But bitcoin also faces risks, such as regulatory concerns and supply and demand risks.This is in line with his position in the previous months.So instead of abandoning gold for bitcoin, he still advises people to invest 5% - 10% of their money in gold.

On March 23, according to the chart made by the block, the number of "uniswap" searches in Google's keyword search has reached its highest level since September 2020, which to some extent represents a change in users' interest in difi.It is understood that the number of Google search between 0 and 100 represents the change of people's search volume for a certain keyword, of which 0 means not interested and 100 means the most interested.Uniswap's current score is 87, up from 100 in September last year.Compared with last week, the keyword "uniswap" increased by 10.1% and has been on the rise since reaching 32 points at the beginning of the year.

Twitter CEO Jack Dorsey's "first tweet" NFT, created through valuables, has closed the auction with 1630 ETH (worth more than $2.9 million) from sina estavi, CEO of Oracle, bridge oracle.Sun Yuchen, the founder of wave field, also appeared in the list, and the two have bid for many times.

Fed chairman Colin Powell said the Fed needs to understand the technical challenges and potential pros and cons of issuing digital dollars.The issue of digital currency is an extremely important action in the field of financial system, which needs careful preparation.