The Federal Reserve announced its interest rate resolution in March, announcing that it would keep the target range of the federal funds rate at 0% - 0.25% as expected, and maintain a monthly bond purchase scale of at least $120 billion.US Federal Reserve Chairman Colin Powell rebounded on Wednesday, stressing that the central bank will not raise interest rates until there is strong evidence that the US economy is completely out of the crisis.

Then the US dollar index plummeted, reaching a new low in recent years. On the contrary, bitcoin rose rapidly, which confirmed the trend relationship between the two sides.

Judging from the trend of bitcoin, a big positive line at 2:00 a.m. broke through the downward trend line and reached the early pressure level.If bitcoin can break through $60000 in one fell swoop, then the rising space will open again.The bottom support is around $57000.From the current trend, bitcoin has returned to the bull trend again.

In addition, business insider, a well-known US technology blog, said that according to the data of Bank of America, the gray bitcoin trust is now the largest public holder of bitcoin, holding about 700000 bitcoins, accounting for 3.5% of the total.However, as competitor Osprey also launched bitcoin trust, the competition in bitcoin trust market is becoming increasingly fierce.Bitcoin trust brings continuous capital to the market, which makes bitcoin more liquid.

At the same time, five new trust products were officially launched, including grayscale basic attendance token trust (BAT), chainlink (link), decentraland (mana), filecoin (FIL) and liverpeer (LPT).The trend of these currencies has also been very strong in recent days.

At the same time, Morgan Stanley became the first big US bank to provide bitcoin fund channels to its wealthy customers.According to people familiar with the matter, the bank will launch three fund investment channels to allow investors to hold bitcoin.Morgan Stanley took the move after clients demanded exposure to bitcoin, he said.

According to Morgan Stanley, bitcoin is suitable for investors with assets of at least $2 million and "extremely risk tolerant".Investment companies need at least $5 million to get new shares.In either case, the account must be at least six months old.Even for U.S. qualified investors with brokerage accounts and sufficient assets, Morgan Stanley limited bitcoin investment to 2.5% of its total net assets, people familiar with the matter said.

In short, traditional financial markets are slowly accepting bitcoin, and bitcoin is also widely recognized, which is conducive to the further rise of bitcoin price.

From the data, bitcoin of the exchange is still in the process of rising, which is not friendly to the trend of bitcoin, and the potential selling pressure of the market will increase.For bitcoin transferred to the exchange, there is a demand for realization.

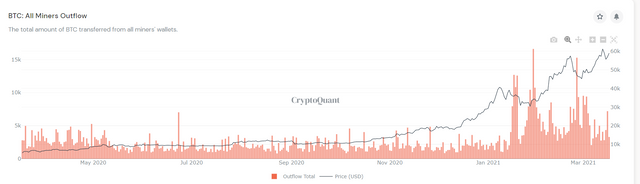

The number of bitcoin miners have transferred out of their wallets has dropped slightly, below the recent average, which is good news for prices.

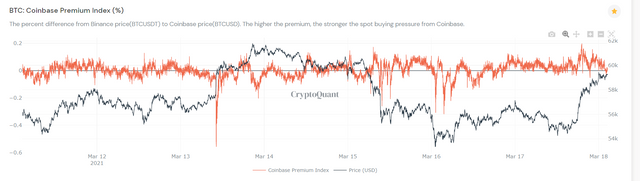

The premium rate of coinbase is still hovering around the 0 axis. From the point of view of the highest premium rate, when it officially rose at 2:00 a.m., it can be seen that funds dominate.

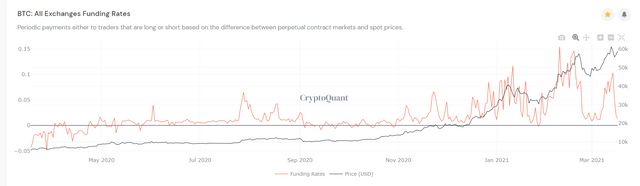

From the perspective of bitcoin contract market capital rate, it begins to return to rationality, which is conducive to the continued rise of bitcoin in the next stage, which is a good thing for the market.

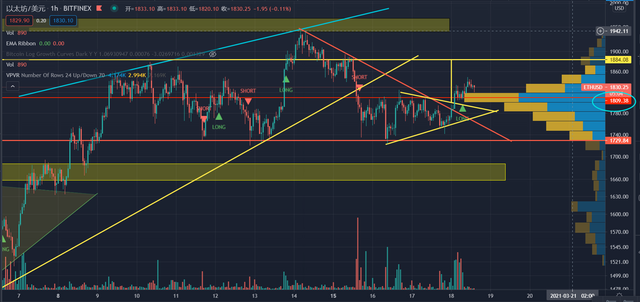

From the perspective of the trend of ETH, the important position is 1800 US dollars. After the important support of this wave, it continues to go higher, and the upward pressure level is around 1880 US dollars.The support at the bottom is $1800, and stepping back can intervene.

Im thinking now we may see some more alt action

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit