EIP 1559 proposed to change the Ethereum fee model, which was proposed by Vitalik Buterin in 2019.

In order to understand why this proposal is needed, we need to quickly review the current Ethereum fee model.

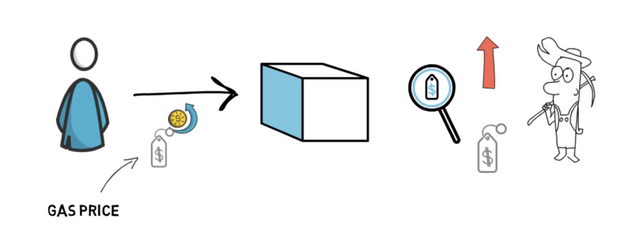

The current fee scheme is a simple auction mechanism, also known as the first price auction. Users bid for block space and wait for miners to choose their transactions.

The user submits the gas price paid for a particular transaction.

In order to incentivize miners to choose transactions, the gas price will be sorted by high and low, and the most profitable transaction will be displayed first.

This can be very inefficient and usually causes users to pay too much for the transaction.

There are also many problems with this model when it comes to wallets. For example, Metamask allows users to adjust fees, choosing between slow, average, and fast confirmation times, or manually set gas prices.

Inexperienced users unfortunately submit a transaction with the default fee before the gas fee soars, and may eventually have to wait a long time to confirm the transaction. Such a user experience is certainly not ideal.

This is where EIP 1559 comes into play. It puts forward suggestions to solve these problems, which can achieve the following goals:

- Predictable transaction fees

- Reduce the delay of transaction confirmation

- Improve user experience through automatic charging system

- Establish a positive feedback loop between network activity and Ethereum supply

Now, let us see what changes have been made in the EIP 1559 proposal.

EIP 1559

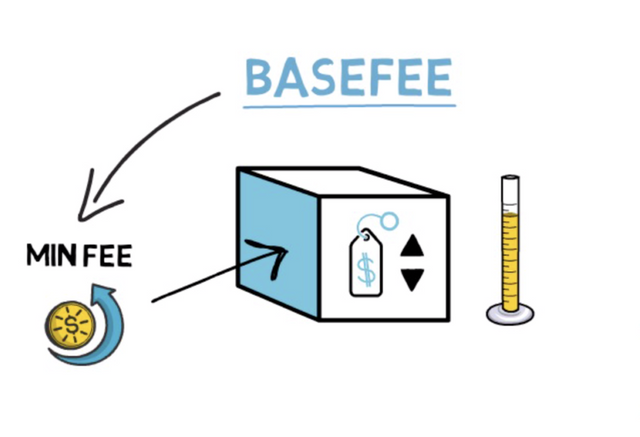

The EIP 1559 proposal introduced a new concept-base fee.

The base fee is the minimum price that users must pay in order to pack their transactions into blocks. The basic fee is set by block and can be adjusted up or down according to the congestion level of the Ethereum network.

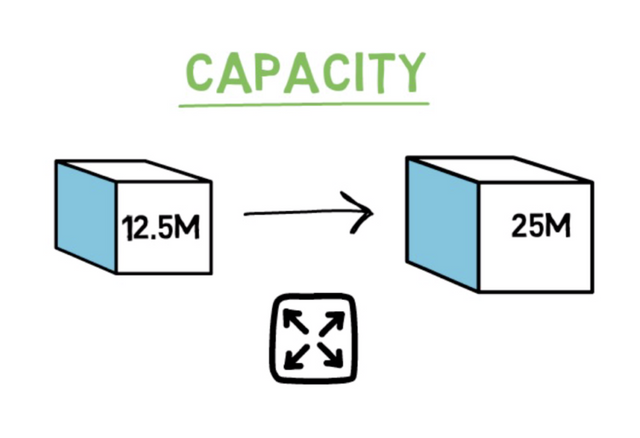

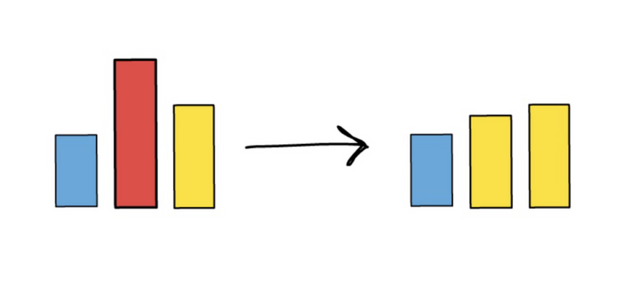

The next important part of EIP 1559 is to increase network capacity. The maximum gas limit for each block is changed from 12.5M to 25M, and the block size is basically doubled.

Through basic expenses and increased network capacity, EIP 1559 builds the following logic:

-When the network usage rate is> 50%, the basic fee will increase

-When the network usage rate is less than 50%, the basic fee will be reduced

This means that the basic fee is adjusted according to actual usage requirements, so as to ensure that the usage rate of the block is maintained at a half-full state.

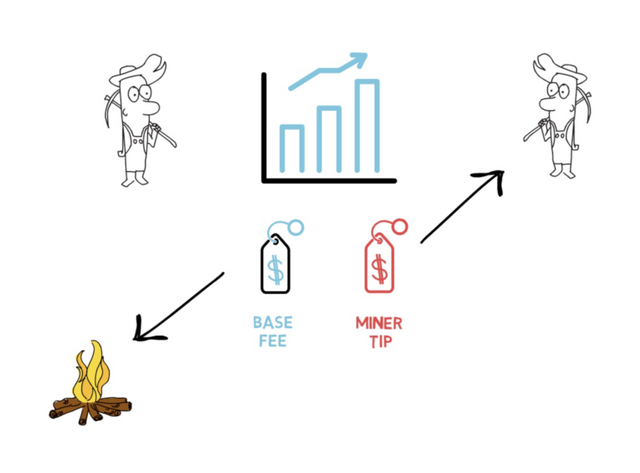

EIP 1559 also introduces miner tips, which are fees that can be paid directly to miners separately to incentivize them to process transactions first.

This is very similar to the current mechanism. In the current mechanism, miners can be motivated by increasing gas fees. For transactions that require quick confirmation, such as arbitrage, this feature is indeed very important.

Now, let us look at a simple example. Compare the EIP 1559 charging model with the existing model when the network is busy.

First look at the current cost model.

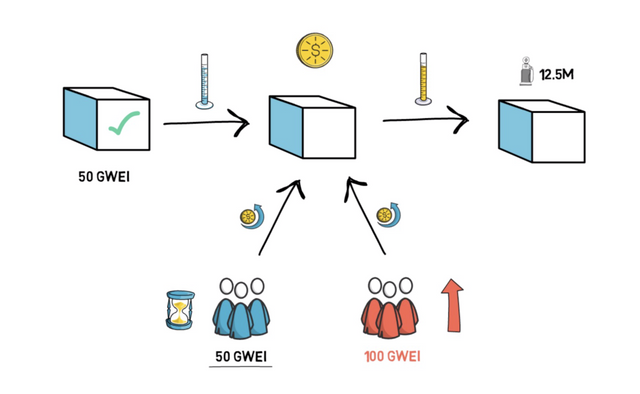

Assume that the minimum gas fee to pack a transaction into the previous block is 50 gwei. Network activity appeared to remain unchanged, and users started submitting transactions at a price of 50 gwei in an attempt to pack it into the next block. At the same time, the launch of a highly anticipated new token has caused users who want to buy it to substantially increase their bids. Now, the minimum fee for packaging a transaction to the next block becomes 100 gwei. If the network activity in the subsequent blocks is still hot, users who submit a transaction with 50 gwei may have to wait a long time to confirm the transaction.

In this case, the block limit is 12.5M gas, and the only way to pack the block is to bid higher than other users.

In the same scenario, assume that the EIP 1559 scheme is used.

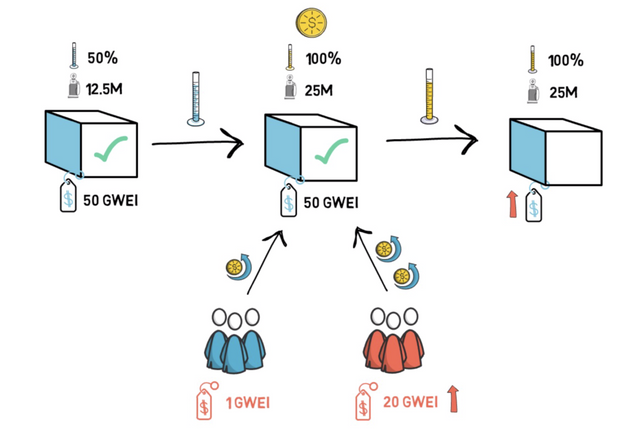

In the previous block, 50 gwei is the basic fee, the network usage rate is 50%, and most blocks use 12.5M gas (half of the gas limit).

The introduction of new tokens led to a spike in demand, and users were required to submit transactions with higher miner tips.

When the demand for block space is high and the miner's tip required for transactions is high, the maximum limit of miners' output blocks becomes 25M gas, which means that one block can pack more transactions. However, the current block is full (network usage> 50%), so the basic fee for the next block will increase.

If network activity and block demand continue to be high, miners will continue to produce complete blocks, and the basic cost of each subsequent block will increase. At a certain node, excessively high fees will reduce the user's willingness to trade, the network utilization will gradually return to below 50%, and the fees for subsequent blocks will also be reduced.

The basic cost of each block can be increased or decreased by up to 12.5%. Therefore, a gas fee increase of 10 times requires approximately 20 blocks (5 minutes); a gas fee increase of 100 times requires approximately 40 blocks. In the example above, the basic fee for the second block is 56.25 gwei.

The above example illustrates how the EIP 1559 proposal eliminates high network costs. Another method is to assume that it converts high fluctuations in gas fees into fluctuations in block size to some extent.

Given that the amount of increase/decrease is limited, the difference in basic fees between blocks can be easily calculated.

Therefore, the wallet can automatically set the basic fee based on the previous block information.

In order to prevent the miners from artificially exaggerating the basic cost due to collusion with private interests, the basic cost will be destroyed.

It needs to be repeated again-the basic fee will be completely destroyed, and the miner's tip is owned by the miner.

Another more important new concept is FEECAP. Users can set up payment fees for specific transactions instead of just paying the current basic fees. If FEECAP is lower than the current basic fee, you must wait until the basic fee is lower than the maximum value set in FEECAP before the package transaction can be packaged.

At the same time, fee changes are also backward compatible. Although the old Ethereum transactions will not directly benefit from the new pricing model, they will still operate under the new fee system.

When will EIP 1559 be launched?

EIP 1559 will make major adjustments to the Ethereum fee system. This seems to be the consensus within the Ethereum community, and most people support it.

However, there are still some challenges, especially to ensure that miners safely process larger blocks without making the entire network vulnerable to denial of service attacks.

EIP 1559 belongs to the core category of EIP, which means that changes will affect the Ethereum consensus, and it requires all clients to upgrade at the same time (hard fork).

From the timeline, it seems that EIP 1559 can be implemented in the next hard fork after the Berlin hard fork in 2021.

The team responsible for this proposal received funding from the Ethereum Foundation and EIP 1559 Gitcoin donations. Most of the coordination work is done by Tim Beiko.

Due to the different timelines, EIP 1559 can be implemented in Ethereum 1.0 and 2.0, but if there is a delay, it may only be implemented in Ethereum 2.0.

good post!!! You have my vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit