This number seemed pie in the sky back when silver peaked at $50... but now, it just seems inevitable.

But, is it the value of silver going up, or the value of the FeRNs going down?

Maybe a little a lot of both.

It is interesting that as inflation hits necessities hard, silver has barely moved. Everyone who is watching this agrees that this is because of rigging, if so, how long can it hold?

One of the big questions is will silver return to being a monetary metal? If silver goes back to being money, what will the value be? In history it was 1 dime worth of silver per hard day of work.

What if some new invention, something that revolutionizes the electronics industry is discovered? Something that literally everyone needs! Just a small increase in silver usage could drastically upset the rigged market as people scramble to pay whatever to acquire silver.

Inflation??

With most commodities, when inflation blows through, they all go up in price. Simply because the price of oil, meaning every piece of machinery and shipping just got more expensive. Silver should be over $30 an ounce, just on mining costs... but, its not.

Many people say that Precious Metals are a hedge against inflation, however, the rigging has been so bad, that many people have taken to say PMs are a hedge against hyper-inflation.

700-900 million ounces of silver/year are mined

700-900 million ounces of silver/week are traded on the Comex.

The Comex does not have this amount of silver in their vaults.

So, this trading means their is lots of fraud.

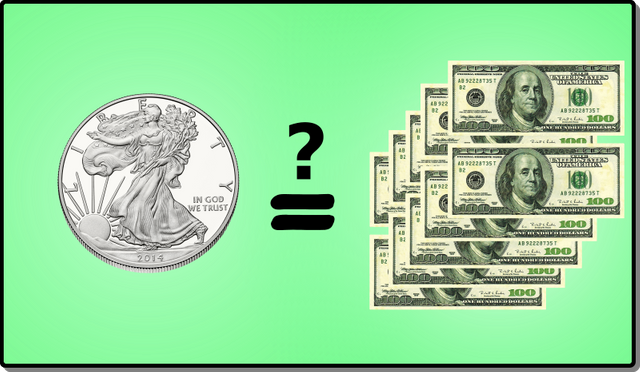

At the coin shop, we are paying MUCH more than spot price for a silver coin.

For a Silver Eagle, it is often SPOT + $10 or more.

Something is going on here, but silver appears to be completely independent of inflation.

Silver as a monetary metal

If we were talking just boomers, we would be back on a PM monetary system in a heart-beat... except no many have any silver. We don't have enough coins to start using it again. So, the initial joy would slam into a wall reality real quick.

If we were talking to the zoomers, they would be like, why are PMs valuable? Can i get an app for that? We would have to train people to know what silver looks like, to assay its weight, to determine its value. Not a very easy thing to do. It may be impossible in countries like America which has been calling PMs an archaic relic for too long.

And the truth of the matter is we do not have enough silver for industrial needs as well as monetary needs.

This doesn't mean we won't try, but it does mean the trying will end in failure.

New Demand from new Invention - And the riggers losing control.

We mine 700-900 million ounces of silver per year, we use 800-1,000 million ounces of silver a year, just on solar panels and electronics. We are already running at a deficit. What happens if something, must-have, is invented and people are demanding silver?

... i do not know. We have running a deficit for a long time. Where is the extra silver coming from? How much is left in that pile?

But, if we have people willing to pay $1000 an ounce for silver, to get this newest gadget, then we are going to see movement in the price. And this movement will be in the real price. The Comex might become irrelevant. (more than it already is)

It may seem just like eBay shipping. Get new product! Only $9.99 plus $300 shipping and handling.

Since i only deal in physical, this will be the price i work with, but will the Comex continue to exist? Will the riggers stop trying to rig the market? Will the Comex just give up? My bet is they won't give up until they can't, as in the monetary system failing, or the dollar crashing to zero. (Then JP Morgan takes all the silver and runs)

Silver undervalued

In all scenarios we find that silver is seriously undervalued. Gold/silver ratio at 70:1 when it should be 7:1 (how it comes out of the ground) or 1:1 (its actual demand for use)

In my opinion silver is going to give bitcoin a run for its money on which is the best asset class in the decade.

And yes i believe we will see $1000 per ounce silver... at the start.

Buy bitcoin, buy silver, on a long enough time scale, you will be among the richest people in the world.