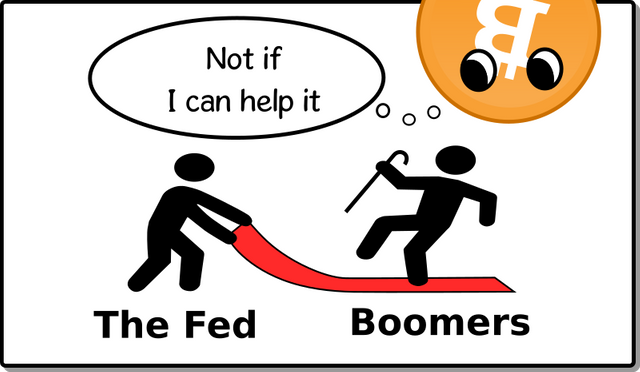

Since the Fed stopped Quantitative Easing (in the open) and raised interest rates, it looks like everything is falling apart, just when the baby boomers need these markets high so they can retire.

The Fed has goosed the market for so long. QE1,2,3, to infinity! And the stock market has gone up and up and up. Many investors started believing the Fed had their back. Many retirement funds were thinking that they might become solvent.

And then, the Fed decided that the inflation they created was "too hot" and they changed the controls from boom, to bust.

The Fed raised interest rates. Making all those safe bonds in those retirement programs lose a great deal of their value. Making the stock market look as if it is about to crash. Making all those REITS into sinking ships.

But, there is a ray of light…

Govern-cement Bonds

Bonds used to be a good investment for retirement. You stagger your buying of them, and then you just live off their interest. It was the safest investment you could make.

Lately bonds have been paying nothin, and in some places, less than nothing.

However, right now, you can get quite the interest rate parking your money with the govern-cement.

If you do what most investors do, pull out all the money from the stock market, and put it into bonds at retirement, you just got yourself quite a lot more interest to live off of.

I don't think this window will last too much longer, but if you, or someone you know is about to retire, tell them to hurry up and get it done. (the stock market is about to crash big, and it looks like the Fed is going to lower interest rates soonish)

Bitcoin to the rescue!

When the bitcoin ETF finally gets approved, a portion of every investment portfolio will undoubtedly have some bitcoin in it.

Now, if the ETF doesn't rug-pull everyone, and actually buys the bitcoin, then there is a good chance that bitcoin will carry the entire retirement fund.

So, all the stocks crash. All the bonds do whatever they do, but bitcoin 10x - 100x then all the investment portfolios that allocated at least 10% to bitcoin will find themselves made whole.

Bitcoin may go up fast enough, and just at the right time, to save the boomers' retirements.

This is just massive speculation on my part. But it might work out this way.

Anyway, if you buy 1 bitcoin now, by any method. Sell your luxury car, and buy one. Or trade it for one. If you get 1 bitcoin, you will have enough for retirement. Especially after this bull run puts in a new floor.

It will get to a point where you can't spend all of your bitcoin. (you spend half this year, and next year, the half you had left is worth more than the whole the previous year)

It is not hard to conceive of this happening.

And maybe it will.