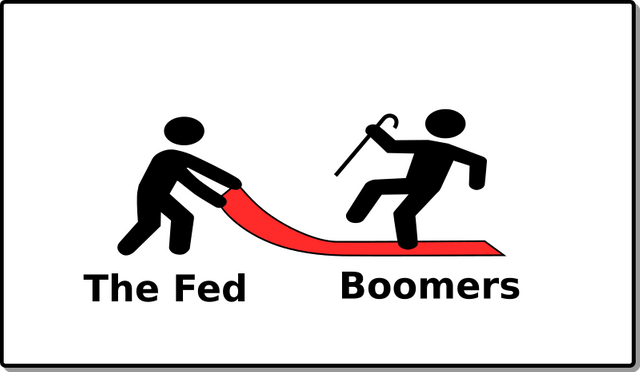

We have a liquidity crisis. We don't have enough dollars.

This is weird because we all see inflation running rampant, and we believe that more dollars chasing fewer goods is what creates inflation.

It is a very strange world.

And all this is happening because of the boomers. They need to pull their money out of the markets to retire.

And the banksters want all that money in their accounts, how dare those boomers withdraw "our" money.

The world got tired of waiting

Normally, or maybe it used to be, that a person would grow up and inherit his father's house and/or business. There was a recycling of things. Enough to make room for the next generation to move up.

But, the boomers have never given up their stuff/position/assets to the next generations.

Gen Z has basically given up on owning a house. Just given up. Like, not even going to try.

And this is just before all the boomers are going to try to sell their houses for retirement (or by their families after they are buried) Basically, one quarter of all houses are going onto the market in the next ten years.

These two things combine into the worst housing crash ever seen.

The same thing happened with all the "good" jobs. Boomers were the cause of two big things to happen to the job market. Suddenly, there was a huge number of new workers (the largest generation in history) and also, women entered the work force en-mass. Basically, the work force was quadrupled by the boomers. The boomers took up all the good jobs, and then they held onto those jobs. (not all boomers, but all the jobs are filled by boomers) And many of them are postponing retirement.

So, the next generations never got good jobs. Gen X got into lower jobs, and moved to some middle management. Gen Y and Gen Z got nothing but starter jobs. Where they are the ones destroyed in the corporate mill. So bad are their prospects that many have just given up. NEET, lying flat, quietly quitting…

The new generations have just given up.

The Market that Boomers Are Going to Sell Into

Basically all the markets were kept afloat by boomer cash and easy money at nearly zero interest rate.

The markets go up when you put money into them, and down when you pull money out of them. And, although it is not all boomer money, it is a great deal boomer money that has the stock market so high.

The housing market was kept high through cheap interest rates, and low inventory (boomers not selling and limits to the amount of houses built)

The problem comes about when, if you want to sell something, you have to find a buyer. And the buyers have left the building.

Gen Z isn't investing in the stock market. Why bother they think.

Gen Z has given up on owning a house.

So, who are the boomer going to sell to? Who will provide liquidity in the markets?

Housing will go from cheap interest and low inventory, to high interest rates and HIGH inventory. (very high inventory, there is just not enough people to fill all the houses that the boomers will leave.)

The big buyers in the stock market are investment funds. And most of their funds under management are from boomers. So, when they start selling, there isn't going to be another investment fund to buy it up. We go from a world where the funds are basically trading stocks back and forth, to a world where there are only sellers and no buyers. No one has money to put into the market.

No jobs for the youth, no money to invest. It is a downward cycle that has been kept aloft by money printing bubbles. And all the bubbles ready to pop.

For most of their lives, real estate and stocks have only gone up. With a few crashes. But, the market always came back. The boomers have never experienced anything else.

Almost every one who even knew about sound money is dead. All we have known is money printing and fiat currency backed by nothing.

We don't know what a contracting demographic looks like. We don't even have words for it anymore. All we have known is growth.

So, all we have know is house prices always go up.

How would you even go about telling a boomer that everything they worked so hard for is about to go poof?

They didn't share it with the next generation, in fact, they saddled the next generation with their credit card bill. And now, the system comes apart just before they retire.

There is no one with money to buy the things that the boomers are going to want to sell.

Things are going to go for "fire sale" prices, and still, there will be no buyers.

Sorry boomers.

Government and Private Equity Firms are now the primary lenders in society.

The primary lenders care more about the balance sheets of the banks and not the deposits on hand.

I don't think that banks care about retail investors like they used to.

Boomers can pull their money out of banks. The central financial system will fill in the gap.

When boomers sell their homes and businesses, private equity firms will gobble them up.

I think that the boomers will have wonderful retirements ... at the cost to the world at large.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You may be correct.

However, you could say that the money has already been stripped out. The retirement funds are already gone.

So says Catherine Austin Fitts

Private equities are already selling off houses. Some at a loss. And if they all figure we are heading for a crash, they will wait till the bottom to buy.

But it really depends on what wall street thinks/feels. They may be bamboozled in this giant bubble pop as well.

We are probably going to see UBI for retired people, or special bonds to pay for retirements. Or some scheme.

And so, at the cost of the world at large.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Private equity is projected to own 40% of all single family housing stock in the next 6 years. All of that real estate will probably be leased to foreigners and/or used as short term rentals or company housing which will became more prevalent as fewer workers will be able to afford rent on their own much less a 20% down payment, mortgage, interest and homeowner's insurance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're talking about a great depression type occurrence: Gen Z could own a lot of houses owned by boomers for next to nothing - free and clear.

If you want other changes - VOTE TRUMP - REPUBLICAN!

From lib.gov a completely free no strings attached photo source - The Library of Congress, USA

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But Trump is a Democrat… :-p

So much is about to/going to change, but right now, things look like a dead end to man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit