So, lets say you are listening to one of those shows about becoming rich, or saving for retirement, and they talk about minimizing your expenses and INVESTING YOUR SAVINGS .

You have got to make your money work for you.

But, if you are aware of what is happening around you, then you will be quite worried about all the investment vehicles over any long term.

- The Stock Market is about to crash!

- The US Bond interest rates are going up, meaning the old bonds are going down. And they are talks about defaults.

- Rental Properties are very highly priced, and demographics and lack of renters with good jobs are going to force rents way down.

- Cash in the bank… well, there is going to be a lot of bank closures.

- Gold? Gold doesn't pay any dividends.

This list just about wipes out all the potential investment vehicles. Especially anything you get at Charles Schwab.

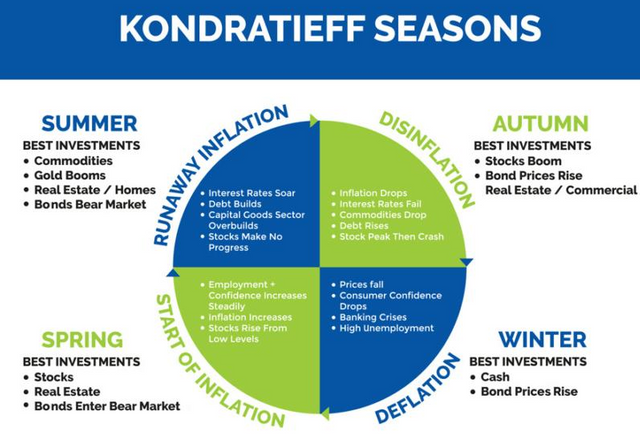

Further, this is the Fourth Turning. This is the winter of the Kondratieff Cycle.

The Old Investments are DYING

Real Estate - Baby Boomers will all leave their houses in the next decade. That is ¼ of all houses being put on the market. And from deaths from VAXXX, new diseases and natural disasters, i am betting that ½ of all suburban houses will be empty. Demographically, there isn't any new buyers.

Stocks - The stock market has gone up and up and up. Mostly because of money printing. But the Fed has raised interest rates, thus that money is coming to an end. Plus, the boomers are pulling out their money for retirement. The stock markets are going to crash hard. Further, faith in the stock market is going to hit a snag when it is found out that they are oversold. (i am betting that each outstanding stock is sold 2x. And may be as high as 5x)

Cash In the Bank - If you haven't noticed, small banks are being closed and/or bought up. Small banks live on auto loans. Few people can afford the high price + high interest rates. Medium banks live on mortgages. And new mortgages issuing rates are through the floor. Banks are going to be disappearing like dear the first day of hunting season. And if things do not go right, you may never see your money again.

Bonds - This is a really weird one. If i was a boomer, i would take all my money out of the stock market and buy long term US Treasuries. Then live on the interest payments. However, if not a boomer, i have VERY little trust that the bonds will reach maturity. These ponzi scheme of printing money will end with the dollar being no more. Will this happen in a year? probably not. In 5 years? Maybe. In 10 or 20 years? Definitely.

Over more than a decade, my belief in any of these asset classes existing, is extremely low. So, we aren't looking at a stock market crash, we are looking at a stock market going away. So, no recovery. It won't be coming back.

What Do You Invest In?

Skills - real world, make things work, get things fixed skills will be very important. There are so few young people in the trades, that if this doesn't change soon, there will be no tradespeople.

Business - If you can build a business that will work through the recession/depression, you will have one of the best businesses when times turn to good. These businesses will not be of the old paradigm. Those are really dead. Like Amazon has destroyed the mom & pop shops. Like a restaurant is a really bad business idea right now. But a restaurant on wheels that will come to a cull-de-sac and serve several families supper may be the low capital, high profit business you are looking for.

Growing Food - If everyone around you isn't a farmer, then growing food will become more and more profitable. Micro-greens producers are doing very well in certain markets right now. Speciality things like duck eggs are flying off the shelves. And this will only become a more and more profitable business as grocery prices keep inflating. But, be careful. There will come times of food riots, and if you are too close to them, you are a known target.

These things are not something you can just stick your money into and let it grow. I believe that the days of those kinds of investments are gone. These things really only existed because of money printing. We haven't seen business growth since the 50s. So, when we leave fiat printed money for sound money, none of these investments can exist.

Fortunately, with sound money, especially deflationary money, just storing bitcoin (or whatever it is called) is proper saving for retirement.

Gold will probably do well in the coming years, but silver will do better.

Bitcoin will either become the money standard around the world, or we will be locked into digital cages where our overlords can decide what and when we buy something.

The future is like that. We have freedom and a bright future, or WEF lockdowns like you can barely imagine.

This is a very important reason why you should get out of the old financial system. It is really the chains that the mother WEFers are using to bind the world.

It is hard to imagine something that has been the foundation of existence since we were born just going away. But it is.

It used to be that there were 100s of people in the NYSE shouting to buy and sell stocks. Now, no one is in the actual building. They actually have interns rush around in the background whenever they do a show/video in the building. Soon, the entire building will be gone. No one will think of NYSE when they can just use NFTs.

The whole thing has to go away, it is completely corrupt. The more people using the new system, the faster it will come.

So, investing, in the future, will be, investing into the future. The old is gone, find the new. Support the new.

(with discernment of course)