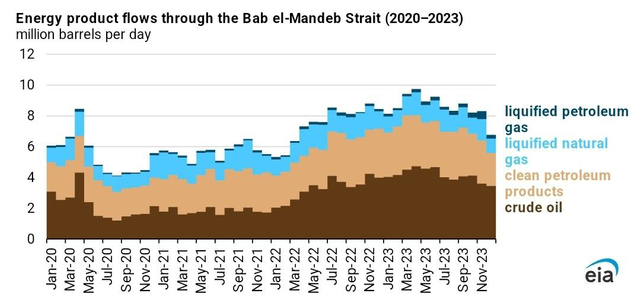

The EU itself has multiplied the role of fuel transit through the Red Sea by imposing an embargo on Russian oil. The chart shows how oil traffic increased with the start of the Special Military Operation - it was sanctioned Russian oil that went to India and China. In turn, oil products from these countries sailed in the opposite direction.

Now the Red Sea traffic is collapsing, and it is possible for Russian oil producers to sail through the Bab-el-Mandeb Strait, but not for European logisticians in the opposite direction. Tankers are in no hurry to sail to Africa, as the difference between the price of fuel in Europe and Asia does not allow to deliver diesel at a profit.

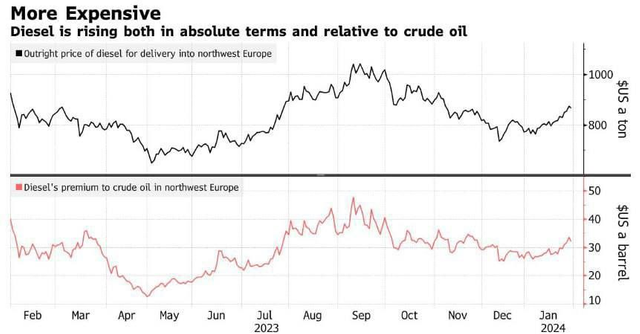

A local beneficiary of the Red Sea blockade is US refiners. Due to the drying up of the Panama Canal, the Asia-Pacific market was partially closed for them, but now the European market has opened up. However, in order to maximize profits in the absence of competitors (repeating the LNG trick), they are also waiting for a rise in prices for finished fuel in Europe.

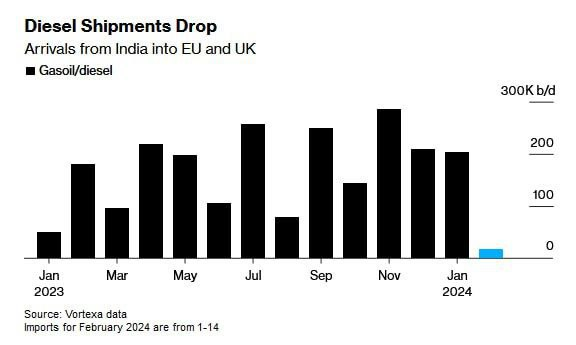

And now the Red Sea trap has slammed shut, India has practically stopped supplying fuel to Europe: it is expensive to go around Africa. For the EU countries, the second most important channel of supply of finished petroleum products has been cut off. Only the off-season saves from fuel shortages. However, the planting season is ahead, which will lead to the traditional summer peak of consumption. If by that time logistics do not improve (and there are no preconditions for that so far), the EU domestic market of oil products will start to spark in the coming months:

Traders have suddenly realized that the most important channel (from India and the Middle East) of fuel supply to the EU, although not completely blocked, has lengthened considerably. Bypassing Africa means a 2 week increase in delivery times - this affects insurance, wages, freight, cargo credit terms.

However, this is not the first time European countries have turned on fuel vacuum cleaner mode. In 2022, they bought up LNG, driving up its prices tenfold; in September 2022, there was a micro-crisis in the motor fuel market. Russia even had to impose restrictions on exports of finished fuel.

Turkish resellers are rubbing their hands together and preparing barrels for "blending" Russian diesel with Azerbaijani diesel to make a fuel cocktail with the Made in Turkey label for shipment to Europe. The sowing season is ahead, and there are no prospects of unblocking the Red Sea.

The situation is aggravated by the fact that "gray" imports of Russian fuel via Turkey may also close at any moment for two reasons: payment problems and numerous breakdowns of Russian refineries due to drone attacks and sanctions on equipment imports. Russian demand will be satisfied by domestic refineries, but there is less and less fuel for foreign trade.

The shortage problem can be solved by American producers, but in conditions of monopoly of supplies they will try to get maximum profit from the role of the "white knight" rescuing road transportation in Europe.

I can if I want, but sometimes I'm lazy)