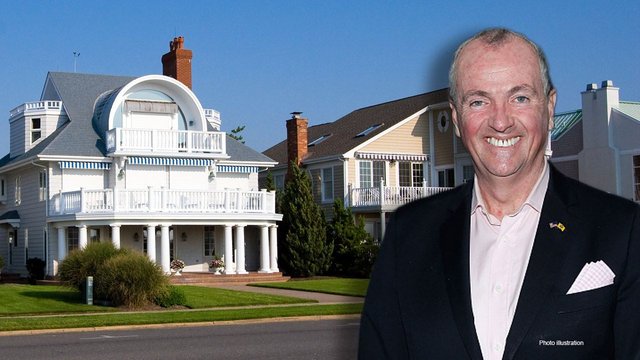

New Jersey Gov. Phil Murphy on Thursday announced a new deal with fellow Democrats to hike taxes on the state's wealthiest individuals and couple that with a one-time tax rebate for lower-income households.

Under the plan, the state's gross income tax rate on individuals earning between $1 million and $5 million would increase from 8.97% to 10.75%. Wages over $5 million are already taxed at the top marginal rate of 10.75%. Someone earning $4 million would pay roughly $71,200 more in taxes each year, while someone making $1 million would see an increase of about $17,800 per year.

Copying/Pasting full or partial texts with adding very little original content is frowned upon by the community. Repeated copy/paste posts could be considered spam. Spam is discouraged by the community and may result in the account being Blacklisted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit