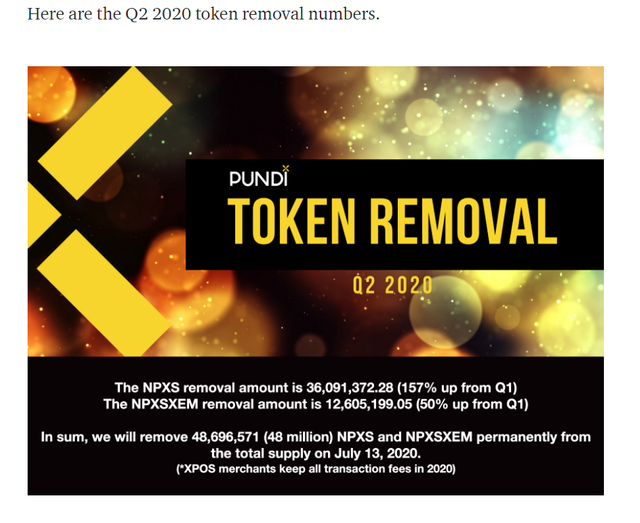

Hi, friends hope you are well and welcome to the new update on Pundi X. The NPXS token has to big events one after another. First one was on yesterday and that was the removal of 48 million tokens permanently. Even though this is not as that much big amount of tokens as compare to the total supply. But indeed it is a good initiative by Pundi X team.

https://medium.com/pundix/q2-2020-progress-report-9d750dbc13bb

The other event is the day on 14th July and that is “XPOS Merchant PayPal App”

https://twitter.com/PundiXLabs/status/1277873154484912129

As we have already discussed in my previous article that when this tweet was added on 30th June 2020. The Pundi X surged more than 70% in just a few days.

The price action has broken out all SMAs:

On the daily chart, the Pundi X token turned very strong bullish and broke out all the simple moving averages with time period of 25, 50, 100, and 200. At this time we can expect that 100 simple moving average will cross up the 200 simple moving average soon and will form a bull cross. That will be another bullish signal.

This bullish indicator 1st time appeared in NPXS history:

If we switch to the weekly chart and place the ichimoku cloud then the price action of NPXS token has crossed up the conversion line and baseline. The conversion line has crossed up the baseline and the lagging span has already crossed up the priceline as well. At this time the candlesticks are having strong resistance of bearish cloud. Once the priceline will be entered in the cloud then soon we can see that the price action of NPXS will try to breakout from this bearish cloud. If you watch the chop zone indicator then for the first time in the history of the Pundi X the chop zone gave bullish signal on weekly chart. That is a clear indication that the downtrend on the long-term has been chopped and soon we may witness a long-term bullish rally.

Click here to create free account on tradingview to watch and play the chart on realtime

Conclusion:

Even though we have received bullish signals on the long-term and the price action is also bullish on the short term as well. But there is a distance between the moving averages and the price action. Therefore price action can start a correction rally at least up to the first available simple moving average the use it as support before furthering upward move.

Note: This idea is education purpose only and not intended to be investment advice, please seek a duly licensed professional and do you own research before any investment.