Without a doubt, this market is the most volatile out of everything else. Yet, chances are no matter when you invest, even an 80% losing investment will become profitable with enough patience.

Hodl, is another word for investing and sticking to your investment no matter short-term volatility.

There is nobody to trust but yourself in this market. One lesson I've learned after a while was that my original strategy was better than any other alternative.

The crypto world has day-traders as influencers and frankly, none of them understand any market at all.

99% of day traders are losing money in the long run.

.png)

Do we listen to these guys for financial advice?

Do we have to sell, out of fear of short-term volatility? Why we don't look at the fundamentals instead, the reasons we first invested in Cryptocurrencies.

While we are always looking for information in this mess that is the crypto market, we are often listening to all the wrong people and allow them to influence our decisions.

Take a look at tradingview for example and all these conflicting analyses. All these amateurs are just trying to convince you they are pros. Each trader is making his own TA and each one has a different scope and different predictions.

These traders only care to tell a good story and increase their followers. For all those day traders at tradingview, YouTube, and Twitter it's all about convincing that their chart has a foundation and is not just complete mumbo jumbo. I am staying far away from tradingview for too many reasons. The crypto traders have never helped me in any way and more than often they will convince you to make a mistake and abandon your solid strategy.

They can only achieve to make you reconsider your plan for the worse.

.png)

Learning To Invest

)

)I don't accuse trading or the future markets. I find trading to have a purpose but I don't think day traders understand a lot about it. I think that the current system is not helping too many to manage this as an employment.

What I am mostly looking forward to is investing advice.

Holding more than 10% in fiat bank deposits is probably not a good idea with interests at zero and a possibility of high inflation. We Invest instead.

Cryptocurrencies are a great investment and allocating a certain part of our portfolio is important for the long run.

Possibly the prices of some Crypto we see today can be considered cheap. Either way for the long term it is an amazing opportunity to enter at the current point. Maybe prices will go lower but there are strategies (DCA) that help minimize the risk and increase profitability after a return of the bullish sentiment.

I'm trying to find more YouTube channels with educative content on the topic of investing. Lately, Marc De Mesel recommended these three YouTube channels and I'd like also to provide the links because so far, I have found value in the clips I've watched:

People like Marc are honest when approaching their followers and are always sharing their knowledge sources. We should be appreciating and respecting this since Marc is a positive factor for our financial information.

I especially loved this video by "The Swedish Investor" that gives us extremely valuable advice and an understanding of long-term investing. It gives us the right direction which we should follow. It is 13 minutes long, but I recommend watching the whole video.

I'd also like to explain at this point that Warren Buffet is not someone that the Crypto world should be ignoring. Any comments on Buffet being old and not understanding technology are just plain wrong.

If you want to improve your investment strategy you should learn from the best. When Warren Buffet explains that Bitcoin is rats poison squared, he is not just trashing BTC.

BTC is a network that had the fonds to dominate, but the decision process made it completely useless. Buffet has seen way more technologies come and go than what the Bitcoin maxis have. He perfectly understands Cryptocurrencies and BTC is basically useless and obsolete technology.

Just the fact that BTC maxis are trying to decrease the significance of everyone that talks against BTC this doesn't they have better investing knowledge.

Buffet once said that BTC is not producing absolutely anything and he is right about that. Nobody is using the BTC network, and BTC as a currency is worthless. Nobody wants to pay with BTC and nobody wants to accept it. Tesla tried and just a month later it removed it as an option.

We should only invest if we will manage to get comfortable with the short-term volatility. A very good approach of buy low- sell high mentality, which unfortunately way too many times can go wrong when we have invested too much and money we can't afford to lose.

Very important the part of this video where it explains how frequently we are bombarded with information. In the crypto market, this is even worse since FUD and FOMO are the two driving factors of this market for the short-term. Prices are manipulated by news and rumors, and some popular figures can even change the price trend.

The advice that is given to not respond to the 100 daily market calls we get, is very important.

We have a plan with our investment and targets. We calculate odds and wait. We only sell partially if prices reach the desired levels. And because all markets can grow a lot, we don't just sell everything.

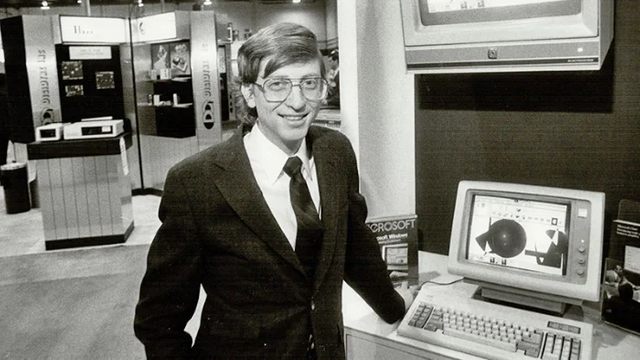

!

!Imagine buying Microsoft in 1985 and selling in 1986 everything because price doubled. It is a mistake to sell the assets you believe will have a great future.

You can take some profit depending on price action but not exit an asset that has potential for huge growth.

For example: In the case the population of a country is rising rapidly, then we can expect the housing market to be booming for at least a generation.

Investing in construction companies would seems to be logical, Also, investing in real estate would be a great opportunity. In case the population is projected to keep rising for decades, then this kind of investment can only be profitable.

A big requirement is a stable government. If the country is in a state of war or anarchy then investing becomes extremely high risk. Infrastructure can be devastated in these conditions and any development may stall for decades.

Investment requires a healthy economy and a political ground that is neither extreme and nor increasing in size. Governments that are growing too big are ultimately destroying their economies.

Small governments that only perform the necessary functions, like national defense, basic infrastructure, and modest market regulation to avoid the creation of monopolies and abuse of market leaders, are usually the most effective ones.

I understand that some will disagree with this part, but I can explain as many are only thinking of their nation but not seeing how some models can't be attached to any economy.

I also understand that China could not be run any way differently since that would have already led to divisions and a breakdown of the country into pieces just like the Soviet Union did. But for way too many countries some approaches discussed by a few people are just not feasible.

Sadly there are some that think any certain model that could be applied to the US, will also be applicable to a smaller country without so much military power. This is not right though.

Debt is an issue too and will become a very big problem any time soon. Probably governments are still stalling with Covid because their biggest fear is what is coming next.

.png)

Conclusion

Unlike traders, most investors are profiting from their investments. The long-run is always a win. Having a winning mindset is not difficult, you just have to force your brain to quit with the gambling habits. Investors also take risks but unlike day-trading, it is not a foolish risk. We take a calculated risk and diversify for risk management reasons.

Read how Marc De Mesel analyzed his latest risk undertaking and how much organized and the well-thought plan he is currently executing:

"Took Crypto Loan/Debt For -2% of Portfolio"

If you want to try to day-trade just remember that you have better odds at a roulette table. It is a fact and you can find the odds of success when day trading by just googling about it.

Day trading has damaged my portfolio too much back in 2017. Not just because I was making beginner mistakes, but also because this is how this system is made. It is like slots where the house will always win and even worse since there are so many distractions.

Maybe you want to have fun and action and gamble money. It is an addiction for some. You understand the part about losing money though and where you need to correct your mistakes?

If you want to correct then stop leverage day trading, learn how to properly invest, and instead of trading make a few trips around the world. A lot of countries have ended their lockdowns and are now open for tourists, even without vaccinations.

If you are a losing day-trader there is no better way to quit and focus on something else.

Start listening to those that have the actual information and not just draw random lines with random patterns.

The financial world was very seldom about day trading and with the rise of sophisticated trading bots, and high-frequency trading, there is no way to beat this system.

.png)

Originally posted at : Read.Cash

Images Info:

- Lead Image Source: Usplash

Writing on the following networks:

Noise Cash

Read Cash

Steemit

Hive

Medium

Vocal

Minds

Vocal.Media

Den.Social(inactive)

Publish0x(inactive)

I'm also active on the following social media:

.png)