Hi

I have found this post and it is a very strong post for forex traders who believe in countertrend is your friend and not the opposite . The trend is not your friend .

I have copied this post as is as I have liked it, it is describing why we are losing money to the banks at the day long

I am using this strategy of banks since few years and gains are fair enough.

There's a saying in the industry that's fairly common, the '90-90-90 rule'.

It goes along the lines, 90% of traders lose 90% of their money in the first 90 days. If you're reading this then you're probably in one of those 90's... Make no mistake, the entire industry is set up that way to achieve exactly that, 90-90-90. That's where Wall Street makes its money.

There are two types of money, 'smart money' and 'dumb money'. You, I and all the other 'retail' traders are 'dumb money'. The investment banks and institutions consider themselves the 'smart money'. Their job is entirely to move the dumb money into the pockets of the smart money, and they do this every day, all day long.

In order to make money in the markets, you need liquidity (stocks being bought and sold). The 'dumb money' provides the liquidity that the 'smart money' uses to get in and out of trades. Trading is a zero sum game, every single penny you make is because some other poor shmuck lost it. For every buyer there's a seller and vice-versa (in an efficient liquid market).

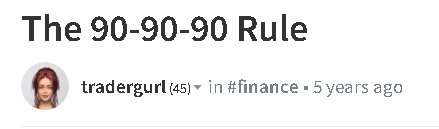

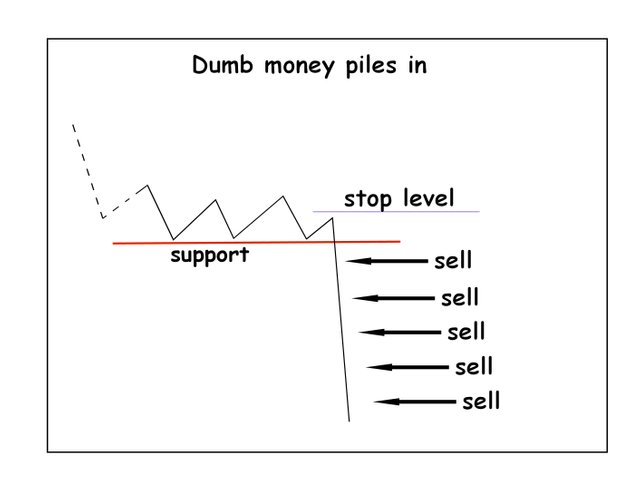

Imagine this, you're sitting watching your favourite stock bumbling along in a range on what looks like a support level.

01.jpg

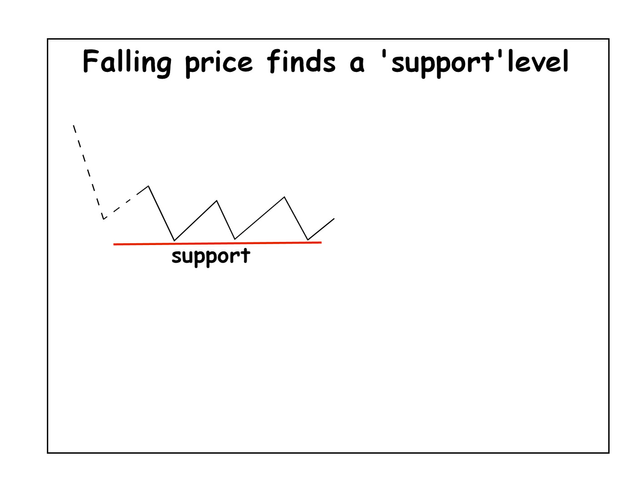

Suddenly, the price breaks through support and starts dropping, and you decide to jump in and get a piece of the action.

02.jpg

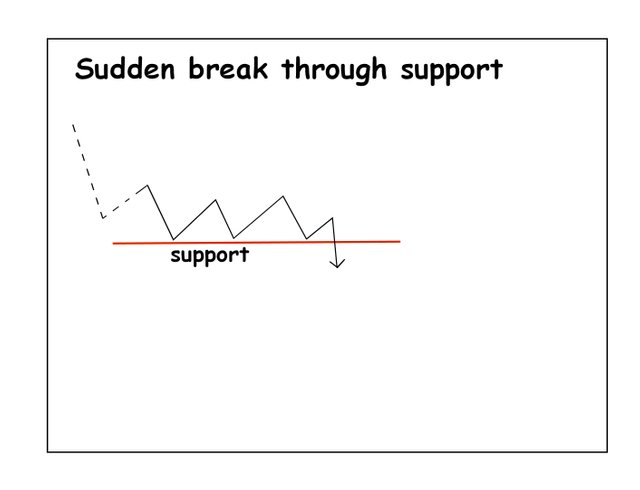

You put your stop in above the recent high (as you've always been taught) and hit the sell button.

03.jpg

The price keeps dropping and dropping as the dumb money piles into the market, afraid of missing out.

04.jpg

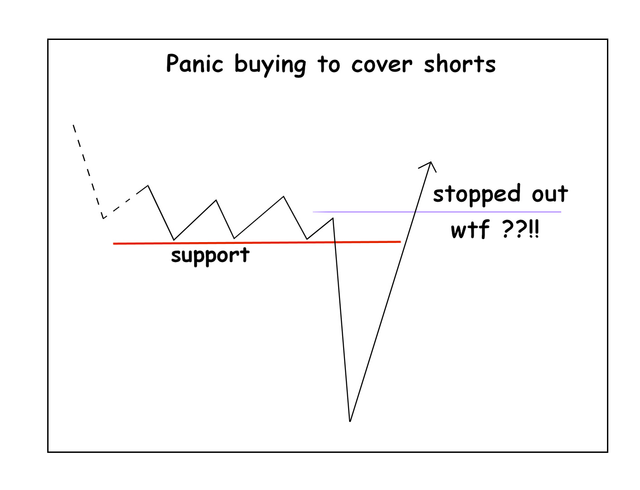

Before long, the price makes a sharp correction to the upside and you get stopped out for a small loss (just stopped out by a few ticks, funny how that always happens..)

05.jpg

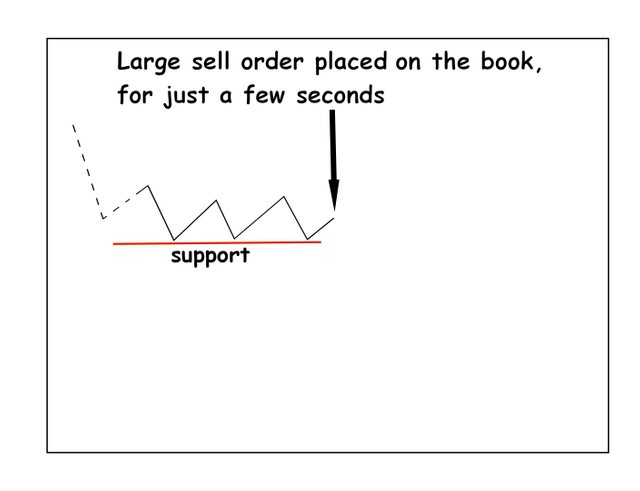

That's dumb money in action. Now let's take a look at what happened from the smart money point of view.

A large bank or institution puts on a sell order of appreciable size. It doesn't even get filled and only shows up on the order book for a few seconds.

06.jpg

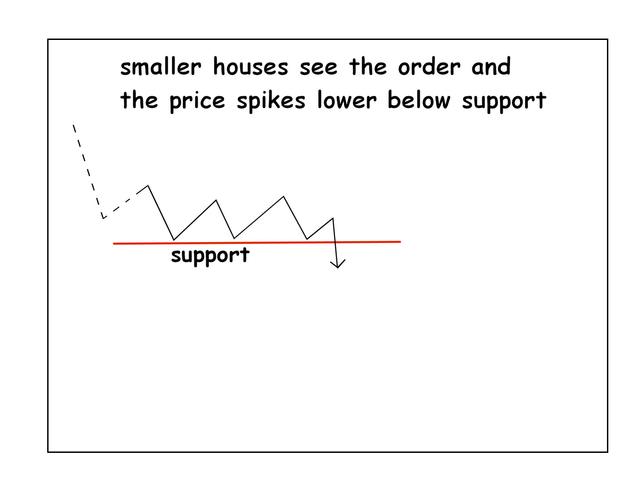

But it's long enough to spook a few of the smaller houses who think they've spotted something and they start selling. Nothing major, they just think if the large bank is about to sell then something maybe up and they don't want to miss out.

07.jpg

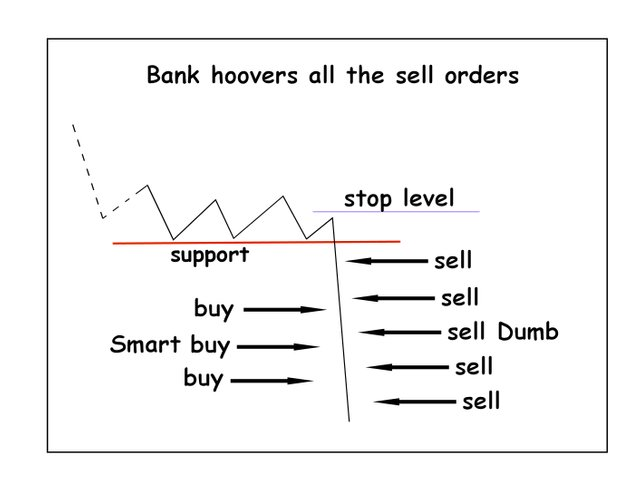

The dumb money catches up and notices the sudden drop in price, and start piling into the sell. Now, as the price is falling, have you ever considered who's buying ?? There must be buyers in a falling market, or you would have no-one to sell your shares to ! Someone is hoovering up all those greedy sellers... The large bank immediately starts hoovering up all those sell orders as the price drops and drops, becoming cheaper and cheaper.

08.jpg

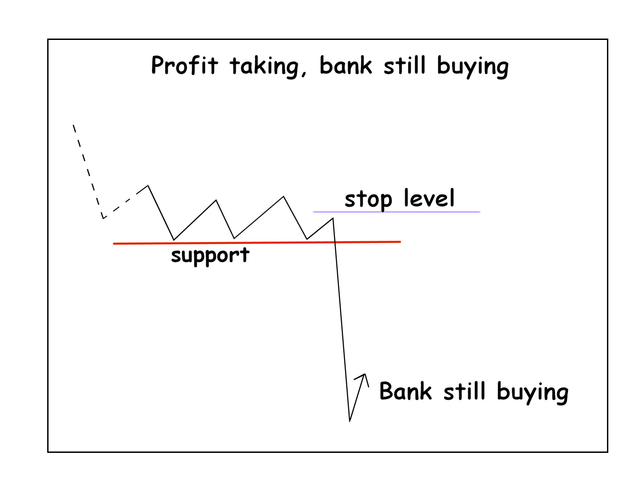

Eventually interest falls off and the dumb money stops selling or starts profit taking.

09.jpg

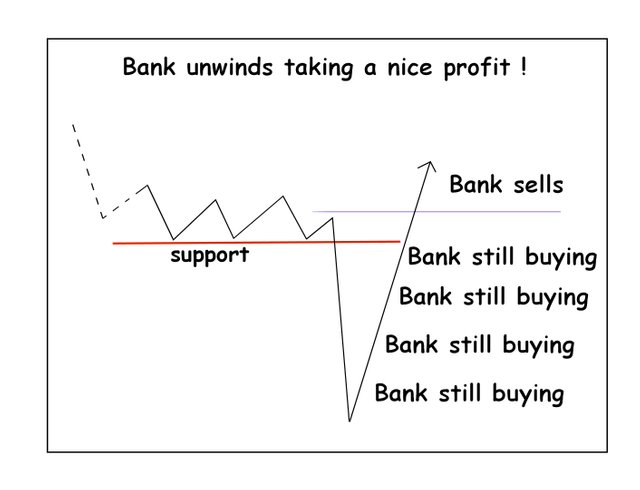

The smart money, they keep buying. And buying and buying, the price starts to correct itself and rockets up. This is aided by the quicker dumb money who can see they've made a mistake and cash out, buying back their sells. Eventually the price is pushed back above and beyond the initial price, triggering all the dumb money stops. Now the smart money starts unloading all it's stock (that it bought from the dumb money at a lower level), using the liquidity of all those stops to get out of the posititon !

10.jpg

That's one of the many, many ways that money is moved from dumb to smart, all day long.

The lesson to be learned here is, if you want to stop being part of the 90% then you'll need to start thinking like the 'smart money'. Large institutions have the power and resources to push and pull prices all over the place, to suck up the 'dumb money'.

So next time you hear some 'guru' tell you "The price is about to break support off the back of a doji, the RSI is overbought and price broke out of a Donchian channel and crossed under the 21 period EMA" (or some other garbage), just remember that the price doesn't care, it'll go wherever the bank needs it to go...

Reference : Original Post

https://steemit.com/finance/@tradergurl/the-90-90-90-rule#:~:text=It%20goes%20along%20the%20lines,%2C%2090%2D90%2D90.

By :