'25년 암호화폐 관련한 가벼운 코멘트입니다.

(원문은 아래 참고 바랍니다.)

[번역본/텔레그램]

2025년 Q1 전망

-트럼프 당선 후 친암호화폐 정책 기대, 가격 상승세 지속.

-ETH가 가장 유망:

1.BTC 대비 저평가 인식.

2.트럼프 행정부의 Ethereum 기반 자산 선호.

3.Base 생태계 성장으로 ETH 수요 증가.

-ETH $4,000 돌파 및 Q1 내 최고점 가능성.

강세 분야

-AI 에이전트

-유틸리티 피 버는 코인

-ETF 관련 코인

2025년 상승과 조정 반복, 정점은 아직 멀었다고 판단

[Comment]

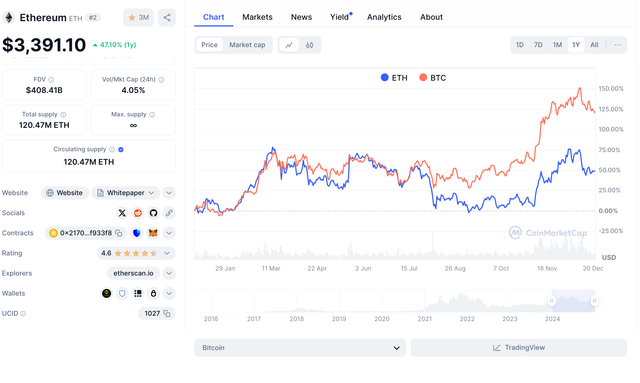

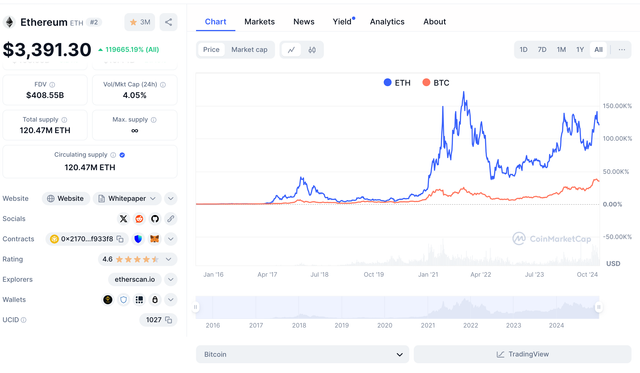

2개의 BTC vs ETH 차트를 보면 상당히 재미있는 현상을 발견할 수 있습니다.

1년간 ETH는 BTC보다 훨씬 Underperform 한 것은 사실이나 역사적인 차트를 보면 ETH가 BTC를 훨씬 능가하고 있다는 점이 되겠습니다. (암호화폐 역사의 아이러니네요... ㅎㅎ)

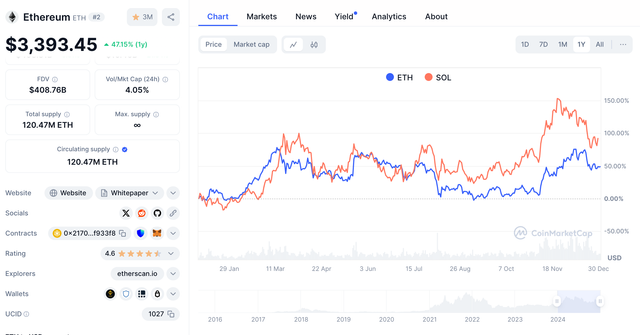

특이한 것은 Solana 또한 동일한 모습을 관찰할 수 있습니다.

'24년 한해 Solana는 기록적 상승률을 보이고 있으나 역사적 차트는 역시 ETH에는 한참 못미치고 있습니다.

이더리움이 특이 올 한해 경쟁자들의 추격에 직면하여 고전을 면치 못하고 있으나 언제든 다시 헤게모니를 쥐고 선두를 추격하게 될지 알 수 없는 일일 듯 싶습니다.

현재의 주요 메타는 RWA, AI Agent 등이 되겠으나 순환주기가 빠른 만큼 다가오는 '25년에는 또 어떠한 메타가 시장을 끌고 갈지 궁금해 지게 됩니다.

꾸준한 모니터링과 시장의 Insight를 읽어내려는 노력을 기울여야 할 것 같습니다.

오늘 하루도 활기찬 하루들 되시기 바랍니다.~

================

P.S> [원문]

https://x.com/0xENAS/status/1873271964489662571

Q1 2025 Outlook & Expectations

After what has felt like an eternity since Trump won the elections 2 months ago, we now enter 2025 with prices materially higher than where they were not too long ago, but with a hope for a new pro-crypto world as the US leads the charge to develop crypto-friendly policy and regulation.

Given the local top we experienced in December, I think the bull run continues in a similar fashion where select assets show outperformance, and others lag.

For the next quarter, the major I think benefits the most is $ETH. These are the three reasons why:

10 IQ price fractals - BTC has gone up 40% from its prev ATH vs ETH languishing 30% below its own prev ATH. Although this doesn't really mean much, both assets have ETF products and to the general public it isn't difficult to believe ETH is cheaper than BTC (and consequently has more upside).

Trump's pro crypto administration - This has always been most bullish for utility / smart contract related assets. We've seen select DeFi assets (AAVE / UNI) outperform in anticipation of this, but the bedrock asset that benefits the most is by far Ethereum. Trump's WLF is not doing anything on Solana and has been consistently picking up Ethereum based assets and I think this is only going to continue.

Base eco developments - Of all the L2s on Ethereum, Base has been the standout chain of the year. With Coinbase's native distribution channels and a Virtuals led AI Agents meta developing organically there, Base is offering a very similar value proposition to what Solana had and can undoubtedly be classified a competitor. This creates natural demand for ETH as the base asset (since Base itself doesn't have its own token) and provides positive flows as ecosystem activity increases

I expect us to break through 4k for ETH as early as January and probably push towards ATH somewhere in Q1.

The three verticals that I think continue to do well are:

- AI Agents

- Utility fee generating coins

- Potential ETF coins

I wouldn't classify these views as contrarian by any means, but I don't believe now is the time to be hugely contrarian anyway. We'll have time for that later.

In terms of where the cycle tops, my suspicion is that much of 2025 will be similar to 2023 or 2024, where we have certain pockets or re-rating up, followed by huge PvP chop. Eventually one of these rallies up will be the global top, but I don't think we're close to that yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @nixiee with a 27.61731189656181 % upvote Vote may not be displayed on Steemit due to the current Steemit API issue, but there is a normal upvote record in the blockchain data, so don't worry.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit