Introduction

Hello again to all the SteemitCryptoAcademy I have not written for the community for a while and today I am writing for the first time in Spanish. It is always a pleasure to share with you. This time we are going to talk about a market theory developed by Richard Wyckoff in 1920, the golden age of technical analysis. I want it to be well understood that Wyckoff's theory is a Market Theory, it is not an investment system, nor a method to operate in the market, this was said by Wyckoff himself and his Spanish-speaking translator Enrique Valdecantos. warns.

Wyckoff is a way of interpreting the market. It is worth noting that Richard Wyckoff himself did not become famous for his way of speculating in the market but for his means of dissemination and the advice him as an investor. In those days and few people know it; Wyckoff interviewed Gann himself in person for his magazine and it was he who put the idea in his head of the factor of observing causes in the market instead of facts, hence Wyckoff's impetus with the law of cause and effect.

Today the Wyckoff theory is talked about and sold as a unique investment system, infallible capable of deciphering the market that will surely lead JP Morgan to trade. Like many things in this business, they have misrepresented what it is, really this way of interpreting it is a method of scamming innocents who are just starting in this business.

Let's be a bit realistic, if Richard Wyckoff's theory was created in 1920, do you think today in 2021 the same theory may serve to face the market? This theory was made to interpret a composite bar graph with a volume histogram. The volume histogram and the composite graph that Wyckoff analyzed in his time to carry out his study, was a graph that was always developed with information from the past, it was necessary to wait for the negotiation to end, for the market to close its doors to obtain the data.

Today a professional trader does it through totally different tools such as liquidity books, market profiles, market internals, etc. Richard Wyckoff's theory is now obsolete, and it only serves us to have a theoretical basis and to understand the processes of formation of trends, but no more than that. Any trader who tells you that Richard Wyckoff's theory is profitable on that alone today, let me tell you that you are a big liar. Do not fall into the trap of paying for a course on this information, just read Enrique Valdecantos' book to have a good outline of what this theory is responsible for.

The Three Fundamental Laws of R. Wyckoff.

Wyckoff's ideas speak of three fundamental laws to understand what the professional is doing; law of supply and demand, the law of cause and effect, and effort versus result.

Law of supply and demand:

In Wyckoff's time, it was believed that price was only determined by the interaction of supply and demand and that only these two forces were those that exerted movements to create prices. Based on this, Wyckoff understood that either demand should oppose supply and vice versa to generate a certain movement or trend. Sellers needed to force buyers to drop their positions and buyers to sellers to accumulate their positions, thus making possible the two processes or scenarios that give rise to trends, accumulation, and distribution. Today it is understood that markets and prices are formed by capital theory, auction theory, statistics, and programmed quantum structures.

The law of cause and effect:

In the 1920s, to move the market, it was necessary to agree between the institutions to move prices, that is, those who sought interests in favor of the offer had to prepare certain scenarios that would allow them to obtain the positions of those who were bought in the market. So the offer, in this case, had to prepare a cause, create an incitement to buy, create a manipulation maneuver that would make weak hands believe that the upward trend was going to continue, once everyone bought, the professional undoes their positions pulling prices, in panic buyers forced to drop their position were absorbed by the offer that at first sought to lower prices. In short, the law of cause and effect forces us to see the underlying reason behind the movement at first glance in the market, sometimes what may seem like a rise or fall is a maneuver that has a contrary intention behind it. If we understand the cause well, we can decipher the effect.

Law of effort over the result:

This third law goes very hand in hand with the previous law of cause and effect. This law poses practically the same thing, only seen from the final result. For example; in the previous case it was said that; The offer prepares a cause that prompts the purchase and then plummets the price and thus the previous buyers falling in panic drop their positions, which allows them to distribute and reach lower prices. For this to be possible, the market needs something called in market terminology as Volume. It is popularly known as; professional money, money from institutions, and today we call it smart money. This volume is the gasoline from the market, which causes the price to move. Therefore, market makers need to make an effort to carry out these maneuvers, the effort can be translated as the volume that is placed in these transactions so that the desired result arises, which tells us that in price movements it must There is harmony between the volume that is handled and the result that is produced.

What is the Composite Operator?

Within Wyckoff theory, Richard himself decided to make all market creators a single subject, that is, to unite all those actors who moved the market at will, the professionals under the same name "Composite Operator", originally he was meet this way, then others have renamed them Composite Man or the Professionals. This was the result of putting all the Market Creators in the same bag and understanding this figure as the one that gestated the accumulation and distribution movements.

While a few years earlier Elliot had detailed his theory by talking about price impulses and corrections, Wyckoff would talk about what happens in a process that for traditional technical analysis is known as a range of lateral phase. In our time, we call this a balancing process. In this lateral phase, the Composite Operator or the professional performs two types of actions that allow him to generate what Wyckoff called; profit by difference. That is, buy low and sell high.

The prices in the market cannot move just like that, that is, the price cannot rise because it can not go down because it can. If the professional wants to move the market up, he must sweep the offer, have people willing to sell their positions, and accumulate, only then can he raise prices. As if he wants to generate a downtrend, the professional must generate a distribution process, where he must find people willing to buy his positions, sweep the offer and thus distribute his positions causing the market to fall. These are natural processes, which today are carried out by machines, the Composite Operator of our days are computers programmed with billions in limit orders that provide liquidity to the market, so it would be impossible that operating only with Wyckoff's theory could have success.

The idea of understanding the figure of the Composite Operator is neither to anticipate nor to predict, much less to guess in which direction the market is going to move, understand that here you are neither betting nor playing riddles, predicting the market is impossible as well as anticipating where you are going, the market is completely random. But by understanding this figure, if we can interpret what the price tells us, the idea is to try to read the traces of the professional and open the positions based on the interpretation of these data, to be able to be positioned before it is carried out. the expansion. If everything were as easy as guessing and anticipating, believe me, they would all be billionaires in the stock market.

The Composite Operator is the one who then generates the five phases that are gestated in the accumulation and distribution processes that we will see below, which is where we are supposed to make use of interpretation to open positions.

Accumulation, Distribution processes, plus the five phases.

It is well understood that; Accumulation and Distribution process, are not the phases of Wyckoff's theory. Just as trends, whether bearish or bullish, are the result of these processes, they are not phases either, once this is understood, we are going to explain the Accumulation and Distribution processes:

Accumulation:

The accumulation process is where the Composite Operator seeks to accumulate as many positions as possible, sweep the offer, and thus once it has nothing against it, raise prices. But this is very easy to say so; The accumulation process consists of five phases that must be fulfilled to carry out the trend:

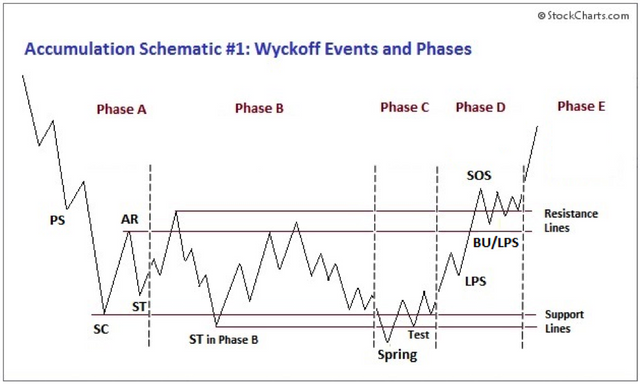

Phase A:

This first phase is where the downward trend stops, it is the point where professional demand appears again and they come to generate the stop of the fall. That is why the first movement of this phase is called, the preliminary stop (PS) after this first stop, or first appearance of demand, the offer again attempts to continue with the trend and make a new low, and the Sales Climax (SC) is generated, then comes the Automatic Rally (AR), which is the effect generated by the introduction of demand in the SC. As there is still supply in the upper tiers, the AR fails and there is a second test (ST) by the offer to seek a new low.

Phase B:

In this phase there is a second Test that seeks to break the Selling Climax zone, however, the negotiation in this phase is determined by the price range established between the SC and the AR. This is where demand begins to test supply levels and absorb positions, freeing up professional support in favor of demand, which drops the price until phase C (there is no volume to keep the price afloat, therefore falls off).

Phase C:

This phase is the last incentive to sell that is given by phase B. Here the zone created by the SC is broken and it is where the novices believe that the price will continue to fall, there all short positions are absorbed, with the added factor that the positions at the upper price levels in phase B have been sold. That's when the professional demand comes in again and they start to push the price up again. Currently, we can observe this bid in something called Heatmap, where it is observed in real-time how professional money interacts.

Phase D:

This is the phase where the signs of weak supply, increasing structures, and ever higher minimums begin to be observed. It is what Wyckoff calls as; Last Point Support or last points of support, the professional has already swept the offer, and now what remains is a residual offer from weak hands. Since it has nothing against it, the price begins to rise to the AR zone, where it generates what is known as SOS or Sign of Strength, it is the breakdown of the zone where it makes the rebound or pull back to keep going up.

Phase E:

Finally, we have the result of all this effort and cause that prepares the demand to generate the uptrend in this last phase.

In these five phases of the accumulation process, the fundamental Wyckoff laws and the movements that the Composite Operator creates to generate an upward trend are evidenced.

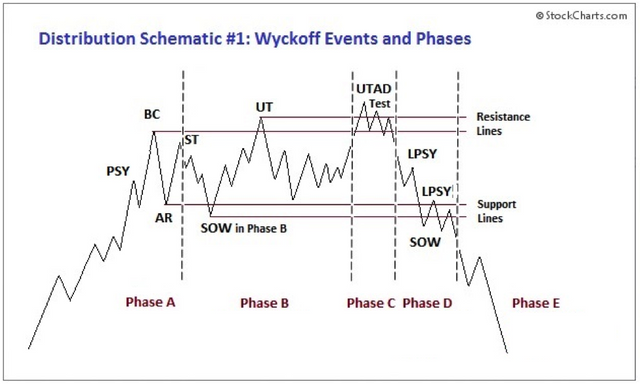

Distribution:

In the break of an uptrend, known as the distribution process, there are also five phases A, B, C, D, and E, and here the positions are distributed throughout a trading range that allows the Composite Operator to make a trend bearish, but with some changes, instead of having a selling climax, there is a buying climax (BC). This is the UT (Upthrust) and the UTAD (Upthrust after distribution) as well as in an upward Phase C, they are the movements that make you believe that the trend continues, and it is where the professional demand that may remain is swept up to finally generate the trend bass player.

What are the re-accumulation and redistribution processes?

Wyckoff theory is a theory of financial markets that can easily be expressed in an economic theory, the theory of capital gives us the starting point to understand this; In capitalism, one of the principles is that wealth must accumulate to a point that it is allowed to be distributed so that it can once again be accumulated, again and again, generating what is known as market cycles, while it accumulates it is also distributed and while it is distributed it accumulates. In Elliot wave theory it is said that trends possess, impulses and corrections. The momentum or expansion, whether downward or upward, is the product of accumulation or distribution.

example here: https://www.tradingview.com/x/U8BrDLoA/

In the previous point we said the fact that by accumulating the Composite Operator prepares the way for an uptrend when this happens and the price begins to rise, it reaches a point where it must correct, that is, there is a point where it returns to supply appears and there a distribution process is generated that is invalidated and becomes a re-accumulation process that allows the price to continue rising and so on until it reaches a maximum point where the demand has already done its work and begins to generate a distribution process.

In the distribution process, the same thing will happen, while the price falls, the professional will redistribute and accumulate positions until reaching a point where the playing field will be possible to re-create an accumulation process. These processes can take years, they can be seen in monthly charts up to charts to operate intraday, the greater the time frame of the chart, the more information that can be seen, Wyckoff came to analyze periods of more than 60 years of the chart to understand the Composite Operator movements.

Practical example

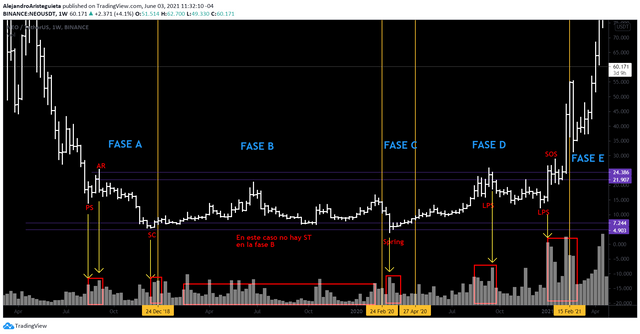

Like all market theories, and therefore they are theories, not investment systems or strategies, it must be interpreted in the graph, that is, the examples shown above are idyllic examples, the market will never express itself in such a way. perfect, that's why Wyckoff is acting and practicing. I clarify this because people believe that they will see the same thing that is in the example as in the graph and it is not like that, you must take this to a composite graph that moves in real-time and also has a context that you must be clear about In fact, in the market, you are going to find many times that the five phases are not completely carried out, you will find processes that only involve three phases, for example. Remember that price is like a language, and you should try to put yourself on the ground with everything it is telling you while you are trading.

Next, we are going to see a practical example in a composite bar chart made by me in the Trading View application, remember that nowadays no one or at least the operators who operate in the professional field do not use this methodology to operate, such as neither did the volume histograms.

We are going to use an asset that I like a lot called NEO, a pioneering Chinese Blockchain like ETH in Staking. We are going to carry out the analysis process on a 1 Week chart

image.png

View Large Image: https://www.tradingview.com/x/nkOvMGn8/

In the example above we can see how Wyckoff's theory adapts to a real example in the market of an accumulation phase.

In phase A we find the preliminary stop (PS) followed by the (AR) and in this case, if it is completed with the Selling Climax, I make the mark, because as I said, many times we are going to find that phases are missing in the processes, remember that Wyckoff gave these names to locate the terrain. In these processes we see how the volume histogram reacts, in the case of PS, the volume increases, this is a top volume, a volume that seeks to stop the movement. The same happens in AR, here is the supply again stopping the demand.

In phase B, a secondary test is not evidenced as such, the volume tends to maintain a stable or decreasing movement until the arrival of phase C.

In phase C, the demand is again evidenced by adding volume to stop the descent of the Spring, in the case of the example, it is a not very pronounced Spring, without the ST it goes directly to phase D.

In phase D we find an increase in volume when touching the area of the AR with the last appearance of the offer that leaves as a consequence the last support points, these open the way to SOS to move to phase E. In phase D, the volume increases, and no longer as stop volume, but an accompanying volume in favor of demand that sustains price levels and denotes the accumulation of short positions.

In phase E, the result of all the cause generated during the accumulation process is given, this cause has the desired effect, therefore the result is the expected one for the demanders and since it does not already have a supply with weight, this makes that the price has nothing to do but go up.

Conclusion:

As you can see, Wyckoff's Theory is only an interpretation method that allows us to place ourselves in which phase or process of the market we are. It is not a trading system, nor a strategy, do not get confused with this. Undoubtedly, this theory is one of the most valid and that with more impetus has remained in force until recent years among operators, even more, recognized at times than WD Gann himself, who by far exceeded the way of seeing the market is recognized as the best investor and speculator in history.

Now, although he sells smoke to many, it hurts them and the famous “Gurus of Trading” on YouTube. Wyckoff is undoubtedly a very useless theory to operate and be successful in the markets today, if it is true that it can help us to observe these processes in long-term assets, in a much more effective way than chart patterns, in our times. The market mechanics are different and it faces a constant evolution, therefore, it will be impossible for you to be successful as a financial agent only with Wyckoff.

The big problem with this method, like every one of the indicators that are commonly sold to newbies and newcomers to this world, is that they base their information on what has happened and not on what is happening, that is, the Volume histogram, moving averages, bands, etc., must wait for the candle to close, for the price to end the negotiation to be able to update, they do not go in real-time. If you detail in an application like Cryptowatch the T&S (Tima and Sales) or sales tape, you will notice how the market moves in real-time, these indicators cannot move at this speed, so you should expect that this data is finished generating to be able to give some form.

The big problem with this is that just as your data is out of date, your decisions and operations within the market will also be. So currently you must work with programs that allow you to see the market in real-time, they are not indicators, they are not investment systems, they are data that show you how the smart money is trading, what are the fair prices, and where it may be. you can find the rejection or acceptance of the price.

Some of these tools are the Market Profile, Heatmap, CryptoWatch, all with free and paid versions that you can adjust for your operation.

Being an operator is one of the toughest businesses in the world, stylistically proven that only 5% to 15% of those who enter this world, become successful in the markets. Being profitable is not just knowing Wyckoff, being profitable requires a lot, a total surrender to a world where you are nothing more than a grain of sand in a desert with competitors who walk on the sand, therefore you must go armed to the field of war and know the terrain. Do not invest if you do not know this discipline, it is as if without being a doctor you start to operate. Do not be fooled by miraculous methods, 100% winning strategies that are only seen with the cold market, none of that exists, none of that is possible, money is made in the markets? Yes, but the market demands certain attitudes. Do you have them?

This is an original translation of the post made for the SteemitCryptoAcademy

Alejandro Aristeguieta

Junior Ambassador in Nutbox

CEO and Founder of Trading Capital - Outreach medium for decentralized investors in the new financial era on Steemit