Leading digital asset management firm Grayscale Investments LLC has been on the receiving end of questions posed by the U.S. Securities and Exchange Commission (SEC) over the firm's “securities law analysis” of tokens which appear in some of its lesser known trusts.

The SEC’s questioning highlights the firm's continued harsh regulatory stance toward digital assets as they continue to crack down on tokens they believe should be subject to U.S. securities laws. In this instance, the disclosures appear in filings for the Stellar (XLM), Zcash (ZEC) and Horizen (ZEN) trusts.

Grayscale first revealed the regulatory back-and-forth in filings made on June 28th, in which the asset manager states that “SEC staff has not provided any guidance as to the security status of” ZEN, ZEC, and XLM. In August 16th filings, however, Grayscale states that it “has received a memorandum regarding the status of [ZEN, ZEC and XLM] under the federal securities laws from its external securities lawyers.”

Grayscale, which is a subsidiary of the Digital Currency Group, is one of the largest asset managers in the crypto space, with roughly $18.7bn AUM from funds and trusts. Its ZEC, ZEN, and XLM holdings equate to a combined holding of roughly $40m. Grayscale reportedly held an estimated $60 billion during the market peak last November.

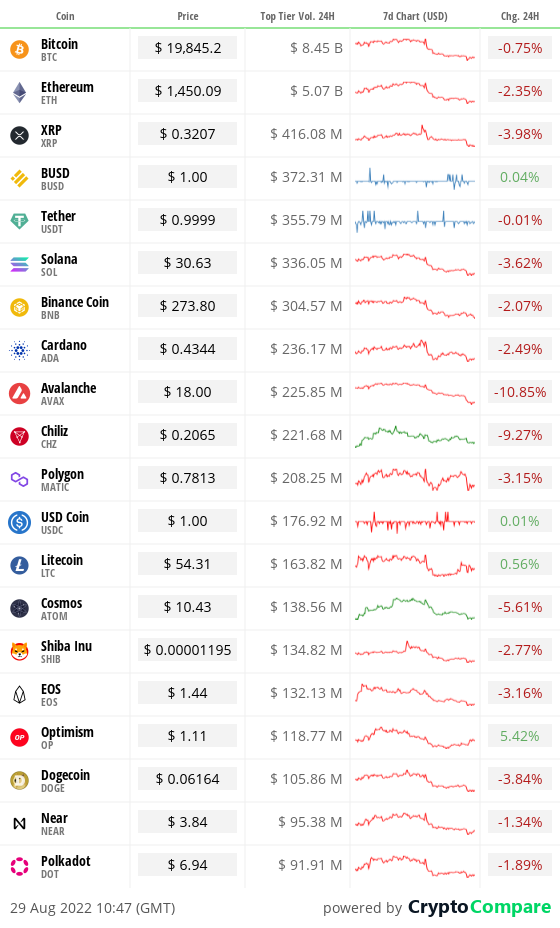

State of the Crypto by Top Tier Exchange Volume

Crypto Currency, its digital money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit