Content

Recently, the market for encrypted digital currencies has experienced a roller coaster again. Friends who bought in the early stage suffered a short period of quilt, and then showed signs of recovery.

For most people, since investing in encrypted digital currencies with huge volatility, they should be psychologically prepared for the roller coaster market. But besides psychological preparation, is there some preparation for basic knowledge?

For example, it is also an encrypted digital currency, why can Bitcoin be sold for 18,000 yuan (the same below, unless it is marked with US dollars, otherwise the unit is yuan)? Why can't the Ethereum in Blockchain 2.0 Ethereum fail to exceed 3000 yuan? Why is Ripple in the famous Ripple blockchain less than 2 yuan? What the hell is Dash, and why can it be sold for around 1,300 yuan?

At present, there are more than 900 kinds of encrypted digital currencies in the world, with different value bases and extremely different risks. I don't know why or why. I am afraid it is not a good investment concept. In this article, combined with the top ten encrypted digital currencies by market value, I will briefly talk about the investment logic behind encrypted digital currencies, and welcome everyone to leave messages and exchanges.

The market value of encrypted digital currencies tends to be polarized

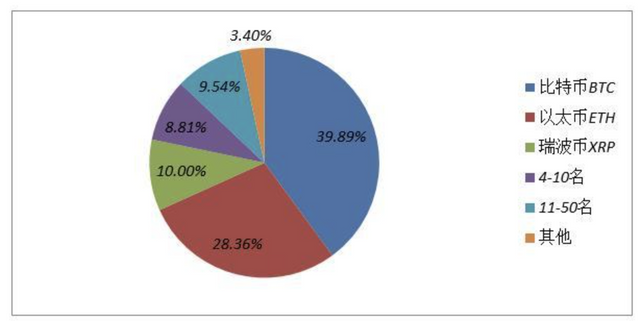

According to Coinmarketcap data, as of June 28, 2017, there are 928 encrypted digital currencies, of which 722 have market capitalization statistics, with a total market value of 106.1 billion US dollars.

From the perspective of market structure, the market value of Bitcoin is USD 42.336 billion, accounting for 39.89%; the market value of Ethereum is USD 30.1 billion, accounting for 28.36%; the market value of Ripple is USD 10.6 billion, accounting for 10%. The top three encrypted digital currencies accounted for 78.25% in total, the 4th-10th accounted for 8.81%, the 11th-50th accounted for 9.54%, and the remaining 672 currencies only accounted for 3.40%.

It is not difficult to find that the encrypted digital currency field shows obvious two-level differentiation characteristics, and several star currencies are the focus of the market.

Encrypted digital currencies with a unit price of less than $1 account for the majority

Among the 722 types of encrypted digital currencies, there are 4 types with a unit price of more than US$1,000, 7 types with a unit price of between US$100-1,000, 104 types with a unit price of US$1-100, and 606 types with a unit price of less than US$1.

In view of the large differences in the total issuance and issued volume of each encrypted digital currency, it is not advisable to simply compare the unit price.

For example, the total circulation of Bitcoin is 21 million. As of June 28, 2017 (the same below), 16.4 million have been issued, with a unit price of 2578.78 USD; the total circulation of Ripple is 100 billion, and the number of circulation is 3.83 million. The unit price is US$0.277; the total circulation of Zcash is 21 million, of which 1.55 million have been issued, and the unit price is US$339.5.

The unit price of Ripple is very low, mainly because of its huge supply. However, the supply is not the only factor that determines the price. The total supply of Bitcoin and Zcash is the same, and the unit price is 7 times different. The demand is behind it. The factors that determine demand are more complicated, including the practicality, popularity, number of users, security of the blockchain, development roadmap, market expectations and other factors.

The supporting factors of the industrial chain are becoming more and more important

An encrypted digital currency is inseparable from the support of the industrial chain from its conception to issuance to its entry into the public eye. Especially under the premise that there are more than 900 kinds of encrypted currencies, the competitiveness of encrypted currencies is not only It is the competitiveness of the concept and technology itself, and the support of the industrial chain has begun to play an increasingly important role.

Generally speaking, the industrial chain of encrypted digital currency involves the issuance, exchange, storage, circulation, etc., behind it involves the founding team, core community participants, miners (mining pools), investors, blockchain-based expansion projects, Trading scenarios, regulatory agencies, etc. Of course, specific to each currency, there are significant differences in the components of the industrial chain. For example, Bitcoin no longer has a founding team; Future Coins, New Economic Coins, IOAT Coins, etc. are all issued at one time through founding transactions, and no more follow-ups In the issuance link, IOAT is not even an encrypted digital currency based on blockchain.

Take Bitcoin as an example. Its industry chain includes mining pools in the issuance link. In terms of computing power rankings, 7 of the top 10 mining pools in the world are located in China; there are more than 40 exchanges in the trading link in China alone. Home exchanges; wallet software in the storage link; various trading scenarios in the circulation link, such as Microsoft, Dell, Rakuten, Newegg, Overstock, etc., accept Bitcoin payments; and Bitcoin users (investors), foundations, National regulatory agencies and other industrial partners, etc.

To understand an encrypted digital currency, it is not only necessary to understand the technology and concept of the currency itself, but also to be familiar with its industrial chain. Often the latter is the key factor in determining price trends.

Pay attention to price fluctuations, there are two elements that cannot be ignored

For specific encrypted digital currencies, there are many factors that determine its trend. For example, Bitcoin's surge, the approach of the Segregated Witness protocol and ransomware are all driving factors, as are regulatory factors and the good development momentum of other altcoins. Important driving force. Therefore, I will not exhaust these factors that help the rise or fall, but just want to make some tips on the following two points:

Pay attention to the supply curve of digital currency

Except for Bitcoin and a few other currencies, almost all altcoins and altcoins will be issued in the form of ICO, usually the structure is "X+Y/year", that is, X is issued during the ICO stage, and Y is issued every year thereafter. (Of course, Y is not constant, but changes dynamically according to certain rules).

Most of the time, the proportion of X is not high, but for some digital currencies, the proportion of X is as high as 70%. Considering that the remaining 30% is gradually released over hundreds of years, the first few days of the initial stage In 2010, X can account for more than 90% of the circulation, and the founding team and initial ICO participants have become de facto giants.

For example, the ICO stage of Ethereum released a total of 72 million Ether. As of June 2017, the total issued amount is close to 93 million, and the ICO stage still accounts for 77%. Similar to New Economic Coin, Bitcoin, Future Coin, and Ripple Coin, the ICO stage issuance accounted for 100%, that is, the first block completed the entire issuance task.

In the ICO stage, the founding team usually holds a large percentage, and the acquisition cost of the first batch of crowdfunders is also extremely low. As the value of the currency rises hundreds of times, investors have reason to worry about the behavior of the "banker" The resulting smashing and market panic.

Take Ripple as an example. A total of 100 billion Ripple coins are issued and 38.3 billion pieces are in circulation in the market. Ripple still holds 61 billion Ripple coins. When and at what proportion will these 61 billion Ripple coins enter the market? The key factor of the trend. In order to dispel investor doubts and maintain currency stability, in May 2017, Ripple announced that it would lock up the company’s Ripple coins through dozens of smart contracts. The lock-up period will be four and a half years, and a custodian contract will be released every other month. Billion Ripple coins are at the disposal of the company.

Ripple CEO Brad Garlinghouse made it clear in an interview with the media that “the act of smashing the entire market will be irrational, which is against the interests of the company... I hope that this kind of freezing of funds can bring about Ripple holders. confidence".

As far as other encrypted digital currencies are concerned, there are more or less similar problems. There are huge villages formed in the ICO stage, and supply and demand changes caused by changes in the supply curve in the subsequent issuance stage. These problems affect investor confidence and decisions. Important factors in the market price trend must be kept watched.

Should understand the core value foundation of digital currency

Since there are more than 900 kinds of encrypted digital currencies to choose from in the market, investors must pay attention to the value basis of the blockchain behind the currency, and make investment decisions based on this value basis. Because different cryptocurrencies have different value bases.

The value of Bitcoin is that as the originator of encrypted digital currency, it is well-known and has a large number of users. The Bitcoin blockchain has the largest number of participants and the highest security. It is a pure digital currency with a relatively simple goal. Even with such limitations, even if the so-called Bitcoin 2.0/3.0 have made many targeted improvements and innovations, they cannot shake the value foundation of Bitcoin.

After Bitcoin and before 2013, many altcoins appeared. Simple modifications were made based on Bitcoin's code logic and transformed into a new currency. Because the launch time was very early, it also accumulated a large number of supporters. Certain industrial chain ecological resources. But because it is so similar to Bitcoin, even if the transaction confirmation is faster and the block capacity is larger, there is not much room for imagination in value, such as Litecoin, Dogecoin, and Diancoin.