The development of digital currency is changing with each passing day, and the price of mainstream digital currency also rose for a while, creating a record high.

Introduction: Grayscale's total Bitcoin holdings have exceeded 3% of the total Bitcoin . PayPal 's cryptocurrency daily trading volume exceeds 242 million U.S. dollars . The entry of financial institutions into the digital currency field will add new vitality to the market.

The development of digital currency is changing with each passing day, and the price of mainstream digital currency also rose for a while, creating a record high. In addition to the investment behavior of retail investors, financial institutions led by Wall Street have also begun to deploy in the field of encrypted digital currency. Grayscale Trust’s massive purchase of Bitcoin is the main reason for this wave of Bitcoin’s rise. Paypal supports encrypted digital currency transactions, laying the foundation for the globalization of the encrypted digital field

Gray Trust

Trust grayscale Grayscale is the layout in the field of digital currency deepest trust, gray Trust's trust funds nine mainstream encrypted digital currency, where the gray Bitcoin trust GBTC is the lowest premium rate of trust products, is the most popular product.

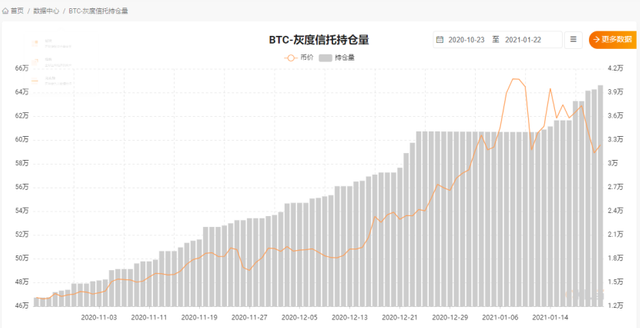

2020 Nian 11 January, the gray began to continue to buy bitcoins, bitcoin once led to a sharp rise in prices, less than three months, the gray Bitcoin positions of trust from 48 spindles, to almost 65 Wanmei At present, the total number of Bitcoin holdings of Grayscale Trust has exceeded 3% of the total number of Bitcoins . 1 Yue 2 1 day gray day trust holdings 9900 per Bitcoin, Bitcoin help restore the wave of decline.

Gray new CEO Michael Sonnenshein represent "2021 Nian gray of the number of workers at least doubled, and will carry out a lot of products for customers . " 2020 Nian last three months , money gray Bitcoin trust fund inflows Chaoguo 28 Yi U.S. dollars, the total inflow of Grayscale Bitcoin Trust Fund in 2020 is as high as 4.7 billion U.S. dollars, which far exceeds the total inflow of funds by Grayscale in the past. In 2020 , Grayscale's management AUM has also increased by nearly 10 times , creating The industry myth .

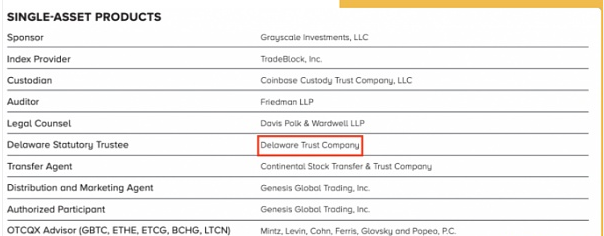

The premium rate of Grayscale's digital currency trusts, except for Bitcoin's premium rate of about 10% , the premium rates of other digital currencies are very high. The premium rate of Ethereum Trust E THE has recently fallen relatively sharply, but it still exceeds With a premium rate of 20% , the premium rate of Litecoin L TC has exceeded 3000% . Why such a high premium rates, many investors chose gray-user trust, the main reason is because gray S EC immunity. At present, there is no trust company that has obtained Bitcoin ETF in the market. Grayscale has obtained half of the compliance license of Bitcoin ETF .

The Grayscale Digital Assets Trust Fund, established in 2013 , received the private equity exemption registration from the US Securities and Exchange Commission ( SEC ) shortly after its establishment . In 2014 , the SEC re-evaluated the Grayscale Trust and closed the Grayscale Trust’s redemption exemption. This means that the Grayscale Bitcoin Fund GBTC can only be bought, and investors cannot redeem GBTC through Grayscale . If investors If you want to sell your own GBTC , you can only transfer your own fund shares. However, before the transfer, GBTC has a one- year freeze period. During the freeze period, no transfer is allowed. This leads to the fact that the bitcoins purchased by Grayscale Trust only Will increase or decrease.

In addition, Grayscale Fund is not targeted at retail investors, and investment users are mainly large-scale institutions and individual users who are qualified to purchase. Grayscale's new CEO Sonnenshein said in an interview with reporters that pension funds and endowment funds are actively investing in the Grayscale series of funds. Most of the money that many people in the United States can invest in is placed in pension accounts. Pension accounts are generally delivered to professional pension funds for asset management. Pension funds in the United States occupy a very large proportion of the financial sector in the United States. This also means that Grayscale should continue to buy BTC in 2021 .

According to Delaware State government website released documents show, the gray had begun in the layout of the new trust fund to be known Delaware Trust Company Company in 2020 Nian 12 Yue 18 date of registration of a file named "Grayscale Chainlink Trust" Statutory trust. Application for registration , though not gray Grayscale , but Delaware Trust Company but is gray trust service provider, all indications are that the newly registered company is actually gray in 2021 year development plan . In addition, the company names of Basic Attention Token Trust , Decentraland Trust , Livepeer Trust, and Tezos Trust are also registered by Delaware Trust Company .

In addition to Grayscale Trust, other financial institutions on Wall Street in the United States have also begun to deploy encrypted digital currencies, including traditional financial giants and unicorn companies.

MicroStrategy Microstrategy

The Microstrategy Group (English name Microstrategy ) established in 1989 is the world's largest independent BI company. MicroStrategy maintained since the establishment of the 20 sustained growth in, the average annual revenue of more than 5 billion US dollars, mainly from BI software and services , MicroStrategy Group attaches great importance to China's product user experience, the Chinese research and development staff of more than 300 people. 2020 years affected by the epidemic and the financial crisis, MicroStrategy's revenue is not optimistic, as a listed company, 2020 Nian 8 Yue MicroStrategy's single share price 1 16 dollars.

In order to change the status quo business, MicroStrategy change investment strategies, enter the field of digital encryption, 2020 Nian 8 months to 10 months, a total of MicroStrategy acquired 4 Wanmei Bitcoin, when the average price of the acquisition is about 16,000 dollars, as of 2021 you are 1 Yue 2 0 days, the number of bitcoins MicroStrategy has sold more than 7 spindles, according to the current 3 2000 to calculate the price more than dollars, MicroStrategy this wave of acquisitions Bitcoin profit has exceeded 100% of the total profit of more than 1 0 million dollars. After a successful investment, stock prices soared MicroStrategy, 2021 You 1 Yue 1 4 days, MicroStrategy single share price of 631 dollars, the share price increased by more than 5 times the company's total market capitalization reached 58.5 billion US dollars.

As the main founder of MicroStrategy, Michael Saylor is the main MicroStrategy buy Bitcoin promoters, investment encrypted digital currencies him in 2020 to make the most correct investment year 2020 on 10 Yue 28 Ri, Michael released Twitter , Announced his own encrypted asset holdings. Alone Michael Saylor personal, it holds 17,732 pieces of Bitcoin, buying an average price is 9,882 dollars, according to the Bitcoin market, he currently holds a Bitcoin worth 6.84 billion US dollars, net profit of 5.08 billion dollars.

Michael Saylor ’s top tweet is always this one: “ Bitcoin is a group of wasps serving the goddess of wisdom. It sucks the fire of truth, hides behind the wall of encrypted energy, and becomes smarter and smarter at an exponential rate. Coming faster and stronger . "

Although the number of bitcoins purchased by the micro-strategy is far less than the holdings of the gray-scale Bitcoin trust, the bitcoin of the gray-scale trust still belongs to investors in essence, and the bitcoin of the micro-strategy belongs only to the micro-strategy.

Guggenheim Guggenheim Partners

Guggenheim Guggenheim Partners is a global investment and advisory financial services company engaged in investment banking, asset management, capital market services and insurance services. The company is headquartered in New York City and Chicago, and has 2,400 employees in 17 cities in the United States, Europe and Asia , and total assets of more than $ 275 billion in assets.

As one of the giants on Wall Street, Scott Minerd , the chief investment officer of Guggenheim Partners , stated in an official document that Bitcoin should rise to 400,000 US dollars . Guggenheim partner with the US Securities and Exchange Commission SEC submitted documents , wrote in the report: "Guggenheim Macro Opportunities Fund will come up with one-tenth of the value of assets to invest gray Trust's GBTC , open Guggenheim's path in the field of encrypted digital currency .

According to official data of the Guggenheim, the company's macro Opportunity Fund Macro Opportunities Fund has Chaoguo 50 billion dollars of assets, which would mean the Guggenheim in gray are in the Bitcoin trust to invest 5 billion US dollars or so. The founder of Guggenheim said: "Apart from investing in GBTC , we will not invest directly or indirectly in cryptocurrencies. "

In addition, according to relevant sources, the main reason for the Guggenheim's high interest in the encrypted digital field is that they believe that after PayPal accepts Bitcoin , Bitcoin will definitely gain a deeper level of development, and opening up the digital currency channel is a top priority.

Paypal

If the massive purchase of Grayscale caused the price of currency to rise, then the launch of Paypal encrypted digital currency will bring digital currency into a new era.

PayPal Group was jointly established by Peter Thiel and Max Levchin in December 1998. It is headquartered in San Jose, California, USA . Its main operating project is an online payment service provider. PayPal has also cooperated with some e-commerce websites to become one of their payment methods . In this way, Paypal charges a certain fee, which is also one of Pay ’s important sources of income.

In December 2018 , the World Brand Lab released the " 2018 World Brand 500 " list, and PayPal ranked 402 . 2019 Nian, PayPal named " 2019 Forbes Global digital economy 100 strong " , ranked No. 33 bits. In October 2019 , Interbrand ranked 72 in the Top 100 Global Brands list .

PayPal is one of the most widely used third-party payment tools in the world. 2020 Nian 10 Yue 21 Ri, Paypal announced that it will support encrypted digital cash payments, allowing US account holders through their PayPal wallet to subscribe, hold and other Bitcoin virtual currency . Starting in early 2021 , PayPal customers will be able to use their cryptocurrency as a source of funds to make payments to PayPal ’s 26 million merchants worldwide . Consumers can convert their selected encryption currency balances as legal tender, encrypted digital currency with a value determined , without having to pay an additional redemption fee , all transactions will be in its current PayPal using legal settlement currency exchange rates.

At present , there are animated pictures and introductions about encrypted digital payment on the homepage of Paypal 's official website. At present, Paypal already supports Bitcoin, Ethereum, Litecoin and Bitcoin Cash. Dan Schulman , President and CEO of PayPal , said in an interview: "PayPal hopes to open this service to encourage the use of cryptocurrency payments on a global scale, in preparation for PayPal to support and promote the development of digital currencies by central banks in various countries. "

NYDFS New York State Department of Financial Services also granted PayPal the first Bitcoin license , which clearly stated that Paypal can conduct encrypted digital currency transactions under regulatory conditions .

NYDFS director Linda A. Lacewell expressed: NYDFS today to PayPal be approved in our on 2020 Nian 6 after month announced the establishment of a new framework conditions Bitcoin license policy implemented , through a partnership with the New York firm authorized virtual currency To protect the rights of consumers in New York . In addition, NYDFS also will continue to encourage and support financial service providers operating in New York and Development and in collaboration with innovators, enabling them to quickly start the project, to build a vibrant and forward-looking financial services sector, especially in the raging epidemic In times of crisis, this can better rebuild the New York economic market. "

According to foreign media exposure, 2021 Nian 1 Yue 1 , the global payments giant PayPal encryption currency day trading volume of 2280 million dollars, followed by 1 Yue 6 May this figure rose to 1.29 billion dollars, 1 Yue 11 days, PayPal encryption The daily currency trading volume exceeded 242 million U.S. dollars , another record high. In just five days, the data doubled again, showing that users love the encrypted digital market.

Securities analyst Dolev expected "2021 Nian PayPal encryption money services will generate up to 6 billion dollars of income. " According to Dolev estimates, to 2023 , this figure could be increased to 20 billion US dollars, accounting for PayPal 's total revenue 10 %.

DBS Bank Singapore

In addition to the movements of American financial institutions in the field of encrypted digital currencies, Singapore has always been relatively friendly towards encrypted digital currencies. As the leader of Singapore, DBS Banking announced its entry into the field of encrypted digital currencies.

DBS Bank DBS is the largest commercial bank in Singapore. DBS Group Holdings Limited is the holding company of DBS Bank. Based on its market capitalization, DBS Group Holdings Limited is also the largest listed company on the Singapore Stock Exchange. As at 2006 Nian 12 Yue 31 days, DBS Group Holdings Ltd and its subsidiaries have 122 billion dollars of shareholders' equity , total assets reached 1290 million US dollars.

2020 Nian 10 months, DBS Bank DBS announced that it would support Bitcoin BTC , Ethernet Square ETH , a bit of cash BCH and reboxetine currency XRP four kinds of encryption currency and Singapore dollars, US dollars, Hong Kong dollars and Japanese yen four between the kinds of legal tender transactions.

12 Yue 10 days, DBS Bank DBS officially announced the formal launch of digital trading platform to create comprehensive digital asset tokens of trading for institutional clients and qualified investors and hosting ecosystem. The issuance of securitization tokens is mainly used to issue and trade encrypted digital currencies backed by financial assets; digital currency transactions can realize two-way transactions between legal currencies and digital currencies; digital custody services can meet the increasing encryption under current regulatory standards The needs of the digital industry.

Based on this, Li Guoquan, a professor at Singapore Management University, told Babbitt that DBS's entry into the encrypted digital currency field will be the trend of all banks in the future. He said that “the benefits of the pioneer’s example are great, which shows that the traditional Some people in the bank understand that this will be the future trend. Although it will not affect DBS Bank’s big business now, it can slowly absorb professionals in the token economy and enter the new token economy. In addition, Singapore I am particularly interested in the token economy, and Singapore is also an important node from the perspective of payment in the banking industry and previous ICOs . There are already encrypted banks in other countries, and Singapore has also begun to have payment licenses and digital banking licenses , but we are temporarily I haven't seen many traditional financial institutions entering the scope of the token economy, but you can see that there are already two crypto banks in Switzerland, SEBA and Sygnum , and these two crypto banks are also closely related to Singapore. "

Conclusion

The joining of financial institutions is inseparable from two institutions - Grayscale and Paypal . Payal 's entry has completely opened up the channel between digital currency and legal currency. Paypal 's encrypted digital services are limited to the United States, which also caused most of the institutions to join Wall Street financial institutions. The operation of Grayscale Trust has greatly increased the price of encrypted digital currencies, especially Bitcoin. This phenomenon has allowed financial institutions to see direct profits. There are both future paving and immediate profits. Many financial institutions will not let go of this cup of soup.

In addition to the financial institutions detailed above, there are currently more than 100 traditional financial institutions that have officially entered the field of encrypted digital currency , and there are also institutions with huge amounts of digital currency investment, such as Massachusetts Life Insurance Company and Ruffer Investment Company. Limited and other institutions have invested more than 100 million US dollars in Bitcoin .

The participation of a large number of financial institutions has advantages and disadvantages for encrypted digital currencies. The participation of institutions may make the digital currency market control in the hands of institutions and lose a certain degree of impartiality. However, as institutions enter the market, they will enter the funds of encrypted digital currencies. There is a steady increase in the meeting, and overall, the benefits far outweigh the disadvantages.

This post was resteemed by @steemvote and received a 11.73% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 34.4 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit