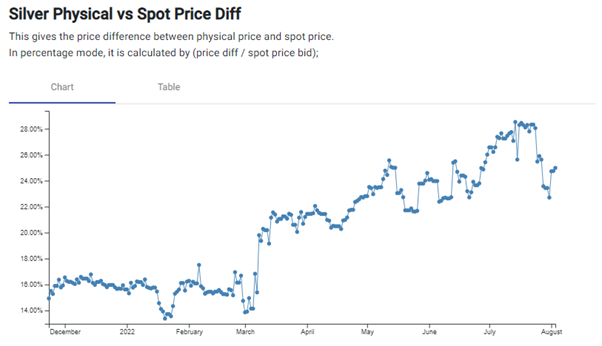

I checked the spot price of silver while I was writing this post. It's trading at $20.17/oz. Does it ever cross your mind why physical silver is generally more expensive than the spot price? Why are gold, silver or any other precious metals not available for purchase at melt values? Why is a silver coin or bar need to be purchased for dollars above the spot price? Is it true that stackers are collecting those coins for their uniqueness and aesthetic value? Well, I'll try my best to answer those questions.

[Grey: Spot price, Blue: Physical, Purple: Brilliant Uncirculated (Mint State, in the best condition)]

[Image source: https://silverbacksnakes.io]

The silver spot price is the current market price of 1 ounce of silver according to the average of silver's estimated future price (that's how silver spot price is determined). The spot price is a benchmark that precious metals traders use all over the world to determine the premium pricing at which they will offer their products to clients. The reason why it's nigh impossible to buy precious metals at the spot price is that the dealers will always charge a premium. Traders gotta earn the spread; that's just common sense.

Of course, it goes without saying that there are a lot of costs associated with metals mining, acquisition and production, which amplify the spot price as a premium. Let's lump all the parties associated with the production of silver (government, private mint, middlemen, dealer, the mining company, etc.) together to summarize the costs they bear easier. There are all sorts of costs related to running a mine, including labour, energy, insurance, machinery, etc. The same goes for the process of refining; there are tons of costs related to that. I'm not done yet; we can't forget about the costs of the supply chain, transportation, warehouse, security, et al. Have I mentioned marketing costs? I'm not sure if marketing plays a huge role in selling silver. But you get the point; whoever sells you silver coins at the spot price runs a huge deficit as their expanses far exceed the revenues.

There is no universal rule that can be applied when it comes to the aesthetic value of silver coins. It all depends on how much the collectors are willing to pay. If a silver coin is rare, its valuation will be significantly higher beyond its face value or melt value. Collectors are particularly interested in non-circulating silver coins due to their artistic value or uniqueness. A lot of properties will be considered while determining the value of a silver coin, including but not limited to condition, mint mark, minting errors, date or year of mintage, spot price, et al.

We will continue to have Collector Coinage with higher premiums... I've been known to pay 50 Fiat USD's for a Penny...lol...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit