Forex Trading Analysis

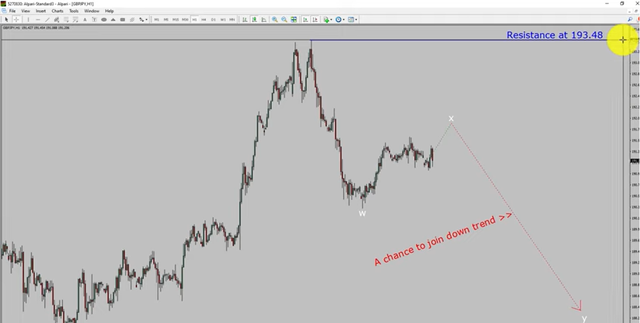

Hello Guys today is Wednesday, March 27th 2024 I am going to analyze the JBP JPY currency pair let us start the top to bottom Elliot wave analysis inside the daily time frame of the trend is down in pound gen currency PA daily time frame resistance is present at $193.48 price level price action is most likely going to drop to print W,X, and Wave Y double zigzag leg in coming trading days a decisive bullish breakout above $193.48 resistance area is going to end downtrend in the daily chart of GBP JPY currency pair

At 4hour time frame price action manages to break below the most recent swing low to me GBP JPY Trend looks sideways in the 4Hour time frame

At 1 hour time frame, the trend is down in the 1Hour chart day resistance is present at the $193.48 price level price action is most likely going to rise up to print bullish wave X pull back and then drop to print bearish Wave Y double zigzag leg which offers a chance to join the downtrend in GBP a decisive bullish breakout above $193.48 resistance level is going to end downtrend in 1 hour chart of Great British pound versus Japanese gen currency pair

The red color highlighted area offers a selling opportunity which is the previous wave B of one lesser degree do not jump into the market with a cell trade wait for a bearish breakdown first take notes you must always trade with money management rules to control risk