Introduction to Subsidiary Books of Accounts

Contents:

° Over view of Subsidiary Books

° Importance of Subsidiary Books

° Types of Subsidiary Books

° Conclusion

° Home Work

Introduction:

Hello kids, welcome to another interesting lesson in accounting. Last week we looked at the general overview of accounting including definition, branches, and historical background of the subject.

Today we will look at the subsidiary books of account and their functions. Then we proceed to practical recording of transactions in these subsidiary books. I hope we enjoy the flight and eventually land safely at our desired destination

Subsidiary Books: Transactions are not normally posted from the source documents directly to the ledgers. They are normally recorded first in subsidiary books before they are posted therefrom to the ledger.

What are subsidiary books in accounting?

Subsidiary Books are books of Original Entry. Subsidiary Books are the books that record transactions which are similar in nature in an orderly manner.

They are also known as special Journals or Daybooks. They can also be described as the books into which transactions are recorded daily from the source documents and from which transfers are made at suitable periodic intervals to the relevant accounts in the ledger.

Subsidiary books are nothing but an order of maintenance of recording similar natured transactions. they are the subdivisions of Journals.

It is also important to note that subsidiary books do not form part of the double-entry.

Importance of subsidiary books:

They are helpful in overcoming the limitations of journal book or journal entries.

Specifically, importance of subsidiary books include;

∆ 1. Division of work: Instead of a single journal, we have several subsidiary books.This means that separate subsidiary books may be handled by different people, saving time, and reducing the likelihood of mistakes.

∆ 2. Efficiency: The division of labour made possible by the presence of numerous subsidiary books ensures that transactions are recorded efficiently.

∆3. Easy reference: Since transactions of similar nature are recorded in each subsidiary book, each transaction can easily be referenced in the future.

∆4. Useful in making decisions: Subsidiary books keep track of transactions of a similar nature. As a result, they can be utilized in making decisions about specific transaction types.

For example, managers may reference the sales journal while making decisions relating to credit sales.

∆5. Facilitate internal checks: Since transactions of similar nature are recorded in the same place in the subsidiary book, the subsidiary book can be used to track errors and frauds relating to a particular transaction.

For example, we check the cashbook for possible errors when preparing a bank reconciliation statement because we know that transactions involving cheques are recorded there

Types of Subsidiary Books:

The subsidiary books are of various types which suit the needs of an organization. The types are as follows:

∆1. Cash book

∆2. Purchases day book

∆3. Sales day book

∆4. Purchases return or return outwards day book

∆5. Sales return or return inwards day book

∆6. Bills receivable book

∆7. Bills payable book

∆8. Journal proper

Explanations and uses of Subsidiary books

We look briefly into the proper meaning and usefulness of each subsidiary book.

Cash Book:- The first and most important subsidiary book is the cash book. It records all the transactions related to cash and bank receipts and payments.

There are 3 types of cash books that are maintained by an organization. They are:

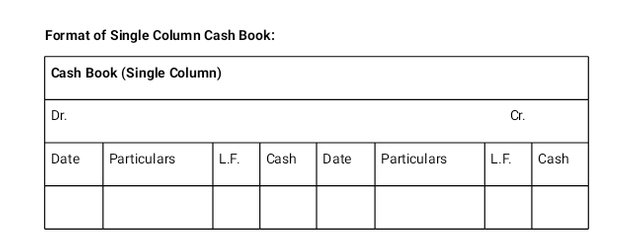

✓Single Column Cash Book:- A single column cash book is like a ledger account. It contains a debit side and a credit side. All Cash receipts are recorded on the debit side, and all the cash payments are recorded on the credit side of the cash book.

Format of Single Column Cash Book:

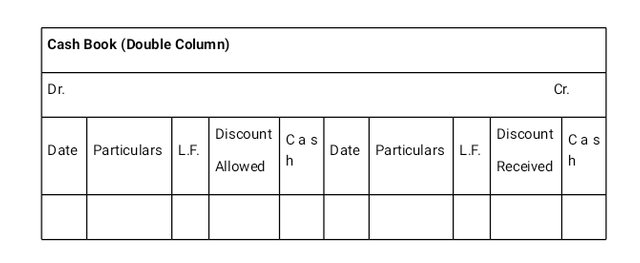

✓Double Column Cash Book:- Double Column Cash Book is the same as that of Single Column Cash Book; only an extra column of discount is added on both the debit and credit sides of the cash book. It records discounts allowed on the debit side and discounts received on the credit side of the cash book.

The format of the double-column cash book is given below.

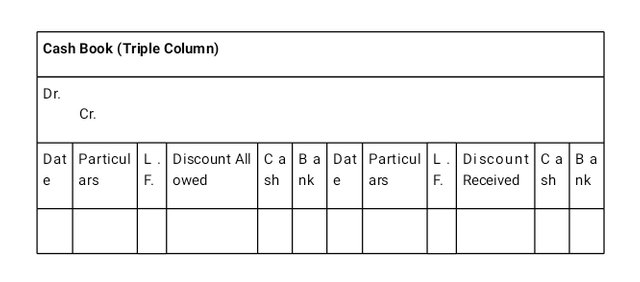

✓Triple Column Cash Book:- Triple Column Cash Book contains all the columns of a double column cash book and also has an extra column for the bank.

The format of the triple column cash book is given below:

Conclusion:

Subsidiary books are books of original entries. They are used to reduce the number of transactions that to straight into the general ledger for ease of reference. Next week we shall continue with our lessons on subsidiary books.

Home Work

(1)What are subsidiary books in accounting?

(2) Why are subsidiary books important?

(3) Mention and explain any 5 subsidiary books

(4) Are subsidiary books part of the double entry system in accounting?

(5) Mention and explain the different types of cash books.

Thank you.

Hello @citysilver, Your post has been selected as one of the quality posts for the day by steemkids community. Congratulations! Please keep making quality and original contents with us here. We love you so much and will like to read more of your posts.

Please endeavour to resteem, vote and comment on the post of selection. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my entry for the homework

https://steemit.com/hive-139765/@ikramullah430/acc-101-introduction-to-accounting-part-2-or-by-ikramullah430

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my entry link

https://steemit.com/hive-139765/@ghani12/acc-101-introduction-to-accounting-part-2-or-by-ghani12

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit