In trading the financial market it is very important to know the trend the market is in so as to know the trading decision to take and as such technical analysis is used to identify the next trend in the financial market and help one who is a trader to be able to follow the trend and make profits inrespective of the trend the market may be in.

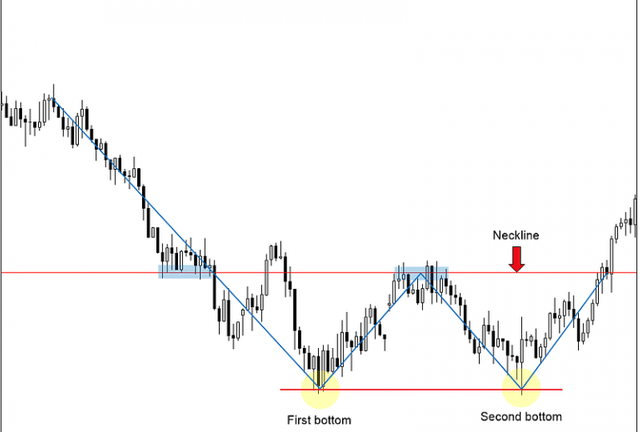

Technical analysis often involves studying the price chart or price action of an asset probably a crypto asset overtime in other to know the next movement of the price if it's going to go up or down and the traders often use tools and other price patterns to help them to do this for instance the double bottom pattern is an example of a pattern which when a trader is able to identify this early it enables him make a trading decision based on this and watch it play out.

So while trading cryptocurrency we could simply say that technical analysis is a form of analysis which is employed by traders for predicting the movement of prices by studying the past market data of that asset mainly the price action and volume and in technical analysis tools such as support and resistance, trendline and indicators help technical analyst to determine the trend of the market.

Importance Of Technical Analysis

Technical analysis is very important, indeed it is a form of analysis that is very vital if one is to be profitable when it comes to trading cryptocurrency its various importance cannot be over stressed and I will be listing or highlighting some of the importance of technical analysis below.

1). It helps traders to be able to identify trends which means the trader knows both when to buy and to sell

2). Technical analysis also helps us to easily be able to identify the support and resistance line on the price chart of any derivative

3). Technical analysis also is used in determining whether to invest in an asset or not since it involves studying the historic price action of a crypto asset we could easily discern which coin or asset is poised to break out in the nearest future depending on the time frame we are working on

4). Since technical analysis mostly focused on the chart i believe is a useful and accurate tool in predicting price movement while eliminating unnecessary noise in the market

Bull Market In Cryptocurrency

When the bull market is one term that is often associated with cryptocurrency and if we have any knowledge about cryptocurrency then we must have heard this mention atleast once or so, so then what does it mean when a cryptocurrency is in a bull market? well when the price of a crypto asset appears to be moving up we could say we are in a bull market yes whenever there is an upward movement in the price of a crypto asset denoting a uptrend which usually have a climate of optimism surrounding it we could say such asset is in a bull market or bull rally or bullish trend or uptrend as the case maybe.

So in cryptocurrency bullish is often associated with the price going up or especially the price being in an upward trend, if we say the bulls are in control that basically means the price is going up and sometimes people are often being addressed as a bull in the cryptospace when they are overly and always optimistic about the price of a crypto asset, when they tend to believe that price will always go up we can call them the bulls.

Bear Market In Cryptocurrency

Just like the bull market term the term bear market is another widely used word in cryptocurrency and is quite the opposite of bull market yes put simply when there is a downward price movement we can say we are in a bear market, often times we can hear people say the bears are in control, what this means is the price of a crypto asset overtime appears to be just moving down and down often associated with when the prices of an asset is falling or we could say we are in a bear market when the price of a crypto asset is in a clear and defined downtrend.

So in a bear market it means things are not really going so well for a crypto asset and prices are falling, when we are bearish on a crypto asset it means we believe it will crash or continue falling, if the price of an asset is going down are people are pessimistic or fearful about it we can see that as a clear bear market. So that's what bear market means in cryptocurrency, a downward spiral down of price.

Support

When prices are in a downward trend or in a bear market so to speak and it retraces down the point it stops or bounces off from that zone is know as the support line, the region that prices in a downtrend reverses is the support line, at this point it is believed that the support line is that area in a downtrend where the bulls step in to save the market by increased buying activity which causes the price to bounce back or recover from a downward trend.

The point where demand is higher than supply is the support zone and it often serves as a buying opportunity for traders whenever price level is at the support because most times it signals the end of a downtrend or bounce off into a small bullish rally before continuing down.

Resistance

Well this is the opposite of the support line, it is the area where price level in a bullish trend fails to break through atleast on the first attempt, the resistance level often signal a strong point that is often respected to serve as a hindrance for the price to move up any longer, and at this point the bullish trend is seemingly unable to continue after hitting this level on a price chart which is always above the present market price of the asset.

For a price in an uptrend the resistance line is the point where it is expected to reverse and it sure serves as a good area for traders who are looking to short sell that is to say the resistance area is a good area where traders who have bought an asset to take profit as the price is expected to fall from here on out, it's an area where there seems to much supply than demand as people are rushing to take profit causing the price to spiral down, this area it's believe to be where the bears step in to prevent the price from going any higher.

Conclusion

I believe that the support and resistance area is a good area that traders need to be able to identify if they are to be able to make accurate trading decision and for one who is into cryptocurrency terms such as bullish and bearish should be one the person is familiar with as traders should look for a buying opportunity in a bullish trend and a selling opportunity in a bearish trend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit