We’re happy to announce that we just launched our 2020 Global Cloud Gaming Report, which builds on everything we achieved in last year’s inaugural report and remains the global standard for sizing, exploring, and contextualizing all things cloud gaming.

In this article, we will dive into some high-level insights—both qualitative and quantitative—from the report. We’ll also present our updated cloud gaming ecosystem infographic, as well as an exclusive peek at our brand-new Stakeholder Spotlight section and an explanation of our forecast.

Owing to some key developments in the ecosystem, which we’ll discuss later in the article, we now estimate that cloud gaming will generate revenues of $585 million by the end of 2020. The market is continuously evolving, so the full report features three different scenarios for paying users and market cap.

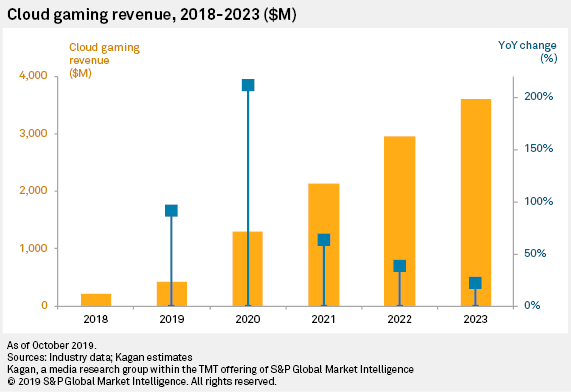

Global Cloud Gaming Market Cap Forecast ($)

Revenue estimates for 2019, 2020, and 2023 (base scenario)

Cloud gaming revenues ($)

https://images.app.goo.gl/byDGJ7qKFkx98Sjp9

The West will account for more than two-thirds of that $585 million, with North America and Europe generating 39% and 29%, respectively. Subscribe to our full Global Cloud Gaming Report for a breakdown of revenues in North America, Europe, and nine other key markets across the world.

According to our most likely global scenario, the cloud gaming market will be worth $3.5 billion by 2023—with even more growth expected in the years after. You can also find the 2021 and 2022 forecasts—as well as our optimistic and pessimistic scenarios—in the full report.

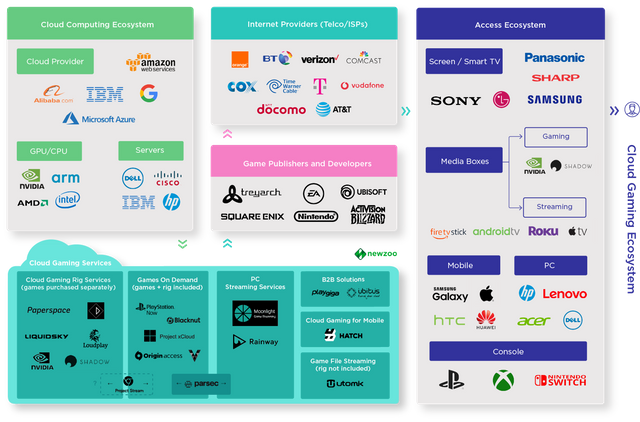

The Cloud Gaming Ecosystem in 2020: Far Beyond "The Netflix of Gaming"

Contextualizing cloud gaming as video-streaming but for games is a suitable quick explanation for laypeople, but the reality is that cloud gaming is far more complicated than a "Netflix for gaming".

Streaming games via the Internet is disrupting the games market, echoing how video-streaming disrupted the movie and television markets. However, the sheer scale of cloud gaming technology and the interplay between its players is far more complex:

https://images.app.goo.gl/8UGPbqrgebmgERLo8

cross the board, cloud gaming service providers are continuing to experiment with their services as they discover how to maximize potential and growth.

Many of the most prominent players are deep in these research-and-development processes, opening the ecosystem for smaller and local initiatives to cover demand in the market.

In fact, we reached out directly to some of these companies. , the 2020 Global Cloud Gaming Report features a selection of stakeholder interviews from various companies within the ecosystem.

Every cloud gaming stakeholder we interviewed leans on a different value proposition and focus, demonstrating cloud gaming's value beyond content subscriptions alone.

We interviewed six key companies in the space. Here’s a selection of highlights

GameBench, a leader in providing B2B performance analysis and optimization services that has recently started to analyze cloud gaming services: "There are certainly differences between platforms, with some standing out for better latency, while others stand out for better visuals. No one platform rules them all!"

Gamestream, a B2B cloud gaming service whose main customers are telecommunication service providers and hospitality companies: "The dawn of 5G has led telcos to search for the best use case for this new technology and how to best advertise its potential. Cloud gaming provides a clear and obvious use case. After all, we’ve already worked with Chunghwa Telecom in Asia and Sunrise Telecom in Europe to provide our service for 5G. "

Polystream, a B2B cloud gaming platform that sets itself apart by instantly running interactive in-game spectators from any cloud: "We need to move away from racks of consoles in data centers and focus on using the cloud to offer gamers entirely new experiences, not just spending time in-game lobbies waiting for a slot on a virtual console."

Playkey, a B2C cloud gaming service that has its own servers but has also experimented with decentralized servers by renting individual and PC cafés’ hardware: "The cloud gamer has access to far more powerful hardware than the average PC gamer on Steam has."

Antstream, a B2C cloud gaming service that focuses on offering a vast library of retro or arcade games: "The preconceived notion that quality and streaming can't be synonymous still exists and debunking it is one of our biggest challenges."

Dixper, a company that pivoted away from a pure cloud gaming service to focus on tools that allow streamers and viewers to interact in real-time via the stream: "Not every game is suitable for Crowdplay [a service where players could self-stream games and play with other people]. We can see it growing in a future where new games with local/cloud cooperative features are developed with this use case at their core."

Our ongoing discussions with some of these stakeholders point to sharp cloud gaming users spikes in H1 2020. The primary catalyst for this rise: COVID-19 lockdown measures.

How Have COVID-19 and Other Factors Impacted the Cloud Gaming Market?

Much like every other aspect of our lives, COVID-19 had and is still having a profound impact on cloud gaming. And there has been a reignited passion for gaming in many consumers during these trying times.

Consoles and mobile games have especially seen increased interest, but not everybody wants to (or has the means to) buy expensive PCs and consoles.

Cloud gaming allows for high-fidelity game experiences without expensive hardware, leading many to dip their toe into the exciting world of playing via the cloud.

This (re)engagement was just one of the factors that led to us upping our forecast for 2020. This year, cloud gaming will generate revenues of $585 million. Other contributing factors to this forecast include:

Microsoft adding xCloud to Xbox Game Pass Ultimate at no additional cost, promoting faster uptake than if a premium was charged.

The growing number of smaller services venturing into cloud gaming, especially in maturing markets.

While these services are smaller (and less ambitious in scale), they extend the number of consumers who can access cloud gaming.

And many more, which we discuss and contextualize in the full report!

This year, we also introduced a breakdown of our serviceable obtainable market (SOM), which represents the number of people who are aware of and have access to at least one cloud gaming service.

Again PLAGIARISM!!!

https://newzoo.com/insights/articles/global-cloud-gaming-market-report-consumer-engagement-spending-revenues-2020-2023/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit