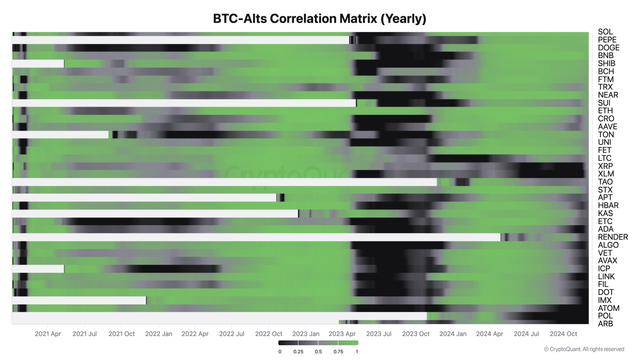

BTC-Alts Correlation, Source: CryptoQuant

Bitcoin's rally, which started in late 2024, saw it smash past the $100,000 mark, reaching new all-time highs[1]. This surge has understandably sparked excitement, but it also raises a critical question: Did we actually experience a true "Alt Season" where altcoins also benefited significantly?

For many altcoin investors, the answer is likely a resounding "no." While Bitcoin was soaring, a large number of altcoins remained stagnant, failing to reach new peaks or even meaningfully increase in value. Solana (SOL) and a few others proved to be exceptions, but the overall sentiment suggests a divergence in performance.

Why the Disconnect? Institutional Investment and Shifting Market Dynamics

The central question is why most altcoins didn't follow Bitcoin's upward trajectory. CryptoQuant's analysis suggests a shift in market dynamics. The substantial increase in Bitcoin's price may be fueled by an influx of capital from traditional financial institutions through channels like ETFs. This new dynamic potentially restricts the flow of funds from Bitcoin into the broader altcoin market.

Binance CEO Richard Teng also noted that positive regulatory movements in the U.S. could push the crypto market to new all-time highs in 2025.

The Rise of Stablecoins and Potential Future Shifts

It's important to remember that the crypto landscape is in constant flux. Stablecoins, for example, are emerging as efficient and cost-effective tools for value transfer, potentially disrupting traditional payment systems.

Looking ahead, it's conceivable that direct Bitcoin purchases via decentralized exchanges (DEXs) could become more appealing than ETFs due to enhanced security and speed.

Navigating the Evolving Landscape: Adaptability is Key

For altcoins to thrive, strategic adaptation is crucial. Trying to create a completely new chain might not be the most effective approach. Instead, focusing on practical blockchain applications and aligning with reliable chains like Solana could be a more viable path.

Predictions and Cautions

While some analysts predict Bitcoin could reach $200,000 or even $250,000 in 2025, caution is warranted. The altcoin market can be particularly volatile, with some analysts warning of potential prolonged declines.

My Position

The crypto market in 2025 is complex. While Bitcoin has demonstrated significant growth, the performance of altcoins is more varied. Factors such as institutional investment, regulatory developments, and the emergence of stablecoins are shaping the landscape. Adaptability, strategic alignment, and a clear focus on real-world applications will likely be key for navigating this evolving market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great share

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit