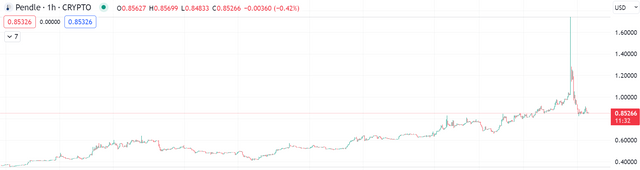

Binance listed Pendle (PENDLE) in the Innovation Zone at 2023-07-03 10:00 (UTC).

Pendle is a yield-trading protocol that separates a yield-bearing asset into its principal and yield components, allowing users to earn fixed or flexible yields.

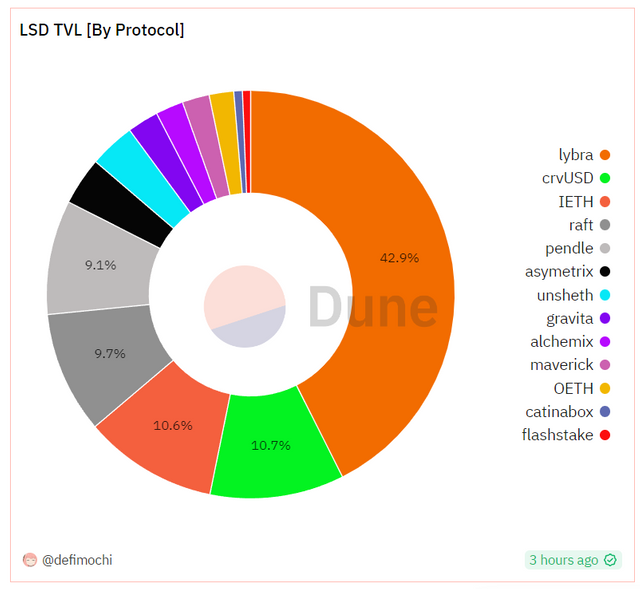

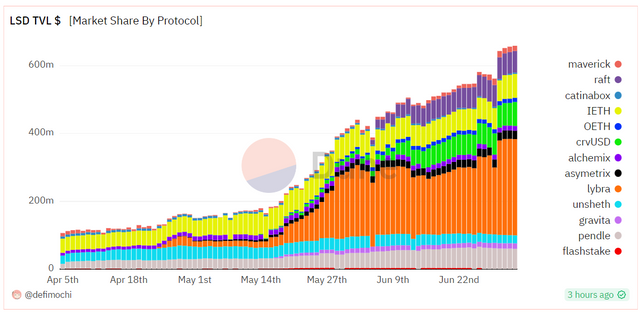

The overall TVL of the current LSDFi is $661m, and Pendle accounts for about 9.1%, which is about $59.98m. Pendle is also gradually spawning a War about income bribery, and there are currently more than 37.6 million PENDLEs locked.

After Binance announced the listing of PENDLE, 2 PENDLE investor/institutional addresses transferred 4.6 million PENDLE to Binance, which may be sold after opening trading:

- HashKey transferred 2.41 million PENDLE to Binance

- Address 0x554 transferred 2.18 million PENDLE to Binance

Pendle in LSDfi market

Liquid staking derivatives (LSDs) remain one of the top crypto narratives today even after Ethereum’s highly anticipated Shapella upgrade went live in April. As the LSD market grows, a new niche that allows users to trade yield, long or hedge on LSDs emerged – the LSDfi.

Pendle is one of the DeFi protocols seeing increased usage among stakers as the LSDfi vertical gets even more popular. Protocols like Convex Finance, Gravita Protocol, and Alchemix are seeing huge increases in user numbers as the LSD space experiences rapid growth.

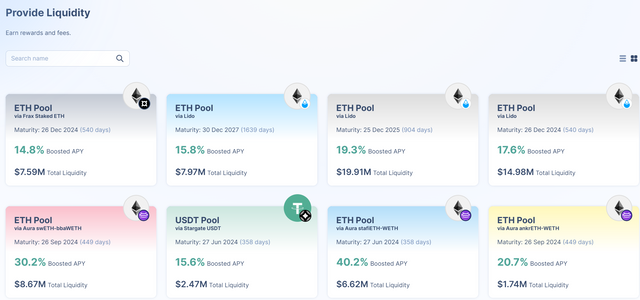

Ethereum and Arbitrum based Pendle is curving an upside trajectory in this sector, with the platform offering yield tokenisation, Pendle AMM, and vePendle. Customers can buy assets at a discount or long yield or hedge exposure.

With users able to access yields in tradable digital tokens, the demand for more support outside of the Ethereum market has been growing. Recent gains in PENDLE price came as Pendle Finance announced support for two new LSD pools – rETH and wstETH.

Amid the growth for Pendle, the total value locked (TVL) on the platform has increased significantly.

Staked ether (stETH) is the dominant asset. The RocketPool rETH on Arbitrum is also seeing substantial upside.

Source: Dune Analytics, Woo Blockchain, Invezz

Harry Potter Library (HPL) Community

Please join the HPL community. I will upvote all members' posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: 해리포터의 도서관 (Harry Potter Library, HPL)

Let's build our community together. I will support you.

- HPL Community on Blurt:

Just add the "hpl" tag and I will vote for a small amount

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit