As crypto markets tumble, a familiar pattern emerges—whales circle, exchanges profit, and retail investors bear the brunt.

I would like to unpack the mechanics behind recent market movements and what they reveal about the crypto ecosystem's power dynamics.

The Perfect Storm: Market Plunge & Liquidations

- $849M liquidated in 24 hours (77% long positions)

- BTC plunged 20% to $50k (Aug 2024)

- SOL nosedived from $205 to $226 (Jan 2025)

Behind these numbers lies a calculated game. When Binance moved $30M to Wintermute during the SOL crash, traders watched in real-time as "cheap SOL" flowed back to exchange wallets. This wasn't chaos—it was choreography.

The Market Maker Playbook

- Liquidity Puppetry: Create artificial buy/sell walls to steer prices

- Leverage Traps: Target overexposed positions (73% of Jan 2025 liquidations were longs)

- Newsfronting: Coordinate dumps around major events (Mt. Gox repayments, ETF outflows)

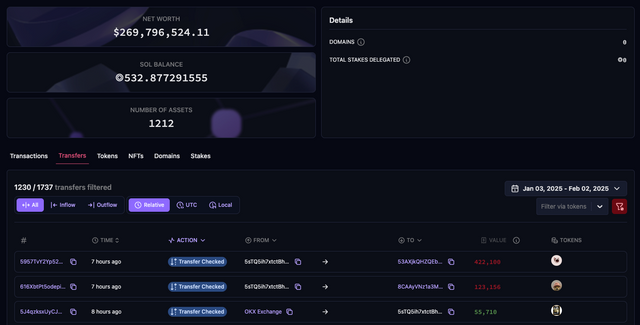

The Binance-Wintermute Nexus

Recent transactions tell a story:

| Date | Asset | Amount | Value |

|---|---|---|---|

| 2025-01-27 | BTC | 70.9 | $7.2M |

| 2025-01-27 | ETH | 1,701 | $5.38M |

| 2025-01-28 | SOL | 20,973 | $4.9M |

Wintermute Address

These moves coincided with:

- CZ's prison release timing

- SOL's sharp 15% intraday drop

- $57.8M ETH whale deposit to Binance

Retail Survival Guide

- Avoid leverage landmines: 82% of Bybit liquidations were 10x+ positions

- Track CEX wallets: Large stablecoin inflows often precede dumps

- DCA selectively: Focus on assets with organic growth (avoid "partnership pump" tokens)

When exchanges suddenly promote a token's "strategic listing," check if market makers hold >20% supply—it's often a prelude to orchestrated volatility.

The Bigger Picture

While Wintermute and Jump Trading dominate headlines, the real issue runs deeper. Exchanges incentivize market makers to

- Inflate volumes (30-50% of CEX trades are wash traded)

- Front-run listings (as seen with Floki's 772% manipulated pump)

- Create "order book theater" during news events

As one market maker confessed: "We're told to make the charts look 'healthy' before big announcements—even if it's all smoke and mirrors."

Where Do We Go From Here?

The coming months could see

- Regulatory crackdowns on "liquidity partnerships"

- Shift to DEXs with transparent liquidity pools

- Rise of AI tools to detect spoof orders

For now, the game remains rigged—but informed players can still navigate the minefield. Remember: In crypto markets, the house always wins... until enough people learn how the trick works.

Harry Potter Library (HPL) Community

Please join the HPL community. You will get upvotes for your posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: [해리포터의 도서관 (Harry Potter Library, HPL)](https://steemit.com/hive-140602/@harryji/ab7uv-harry-potter-library-hpl