Introduction |

|---|

Earliest blockchains have issues that necessitate the birth of other side solutions to enhance users' interaction with the network. We have a lot of layer 2 solutions today, each distinctively handling shortcomings of the L1.

Canva Edited

We are into the 8th edition of this series and we will take a look at what are L1s and L2s.

What are Layer 1s in Blockchain? |

|---|

Layer 1 (L1) in the blockchain is often referred to as a native or primary blockchain running independently on its chain, with node validations taking place within its network. L1s are the earliest blockchain layers that lay a path for L2s for further innovations.

Some typical L1s are Bitcoin network, Ethereum, Steem, Tron, Solana, TON and many more. Many of these blockchains are often identified with one or more problems that require modification to make them suit ever-increasing traffic as adoption grows in the crypto ecosystem.

For example, the Bitcoin network has a 10 mins block time, which means block creation takes another 10 minutes before a new one is mined, and that affects the transaction throughput and scalability considering the size of users that troops in day in and day out.

|

|---|

Improving identified problems in L1s can be a hard one and may lead to conflicts among miners when a new upgrade is proposed in the community.

Soft forks and hard forks are some of the ways to resolve the problems with L1s, but it's not always enough, especially when it gives birth to conflicts a few times, as highlighted earlier. Bitcoin runs on a few networks due to upgrades, some of which are;

- Segregated Witness (Segwit).

- Native SegWit.

- Legacy.

- Taproot.

- And so on.

In some cases, a part of the community rejects to move on with an upgrade ( as such continue with an existing protocol) or create a new one. We have seen the birth of new tokens that serve as the native tokens of the new networks due to events like this.

What are Layer 2s in Blockchain? |

|---|

L2s are protocols that are created to run in parallel to an L1 to take care of certain problems associated with L1s. The Bitcoin network, in particular, had an early sidechain known as the Lightning network.

On the lightning network, transactions are carried out off-chain, thereby enhancing scalability. It only bundles the closing balance to the main chain after an initial funding to the lightning network's channel (initially recorded).

Ethereum is a good example of an L1 that has enjoyed a whole of L2 innovations over the years. Ethereum is often dubbed the mother of smart contracts but with a few shortcomings like high gas fees, scalability issues, throughput that can be enhanced and so on.

Some of the popular L2s on Ethereum are Polygon, Optimism, Arbitrum, zkSync Era, Polygon zkEVM and many more. Each of these operates distinctively and solves a particular problem. The Ethereum L2 chains have Ether ETH as a token for validation in a 1:1 ratio to the main chain ETH. Utilization of an ETH on an L2 requires bridging from the main ETH chain or L2s to L2s.

|

|---|

A common blockchain user may not understand in detail how L2s have solved an existing problem with an L1. As such, we have to look for what seems closer to every user (something that appears each time they transact). And that is the gas fee.

Ethereum is known to have the earliest issue of high gas fees, and L2s have remarkably reduced this issue to a great extent. We will practically explore the ETHEREUM gas fee and its effects on tokens deployed on it.

The Ethereum gas fee (at least for normal transfers) has recently dropped significantly, bringing it almost on the same level as other L2s, but the trait of its high gas fee can still be seen on exchanges and when interacting with smart contracts. It costs more to use the ETH chain for withdrawal on exchanges. See the examples below.

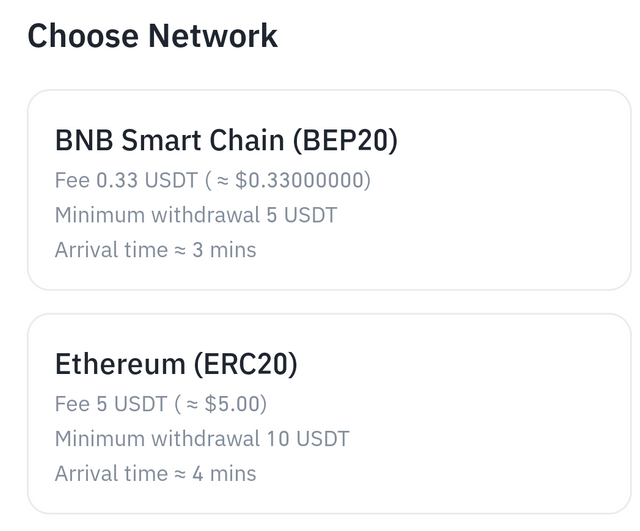

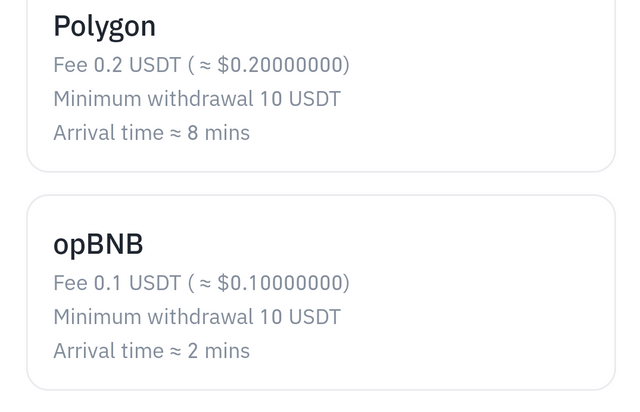

The screenshot used in this section is from the Binance USDT withdrawal page; each network has its minimum withdrawal and how much gas fee it costs.

The ETH chain has the highlight gas fee of 5 USDT, and OP has the lowest 0.033 USDT. You can imagine trying to withdraw 10 USDT, and you have to spend half of it on gas fees; this reveals the high gas cost initially associated with the ETH blockchain.

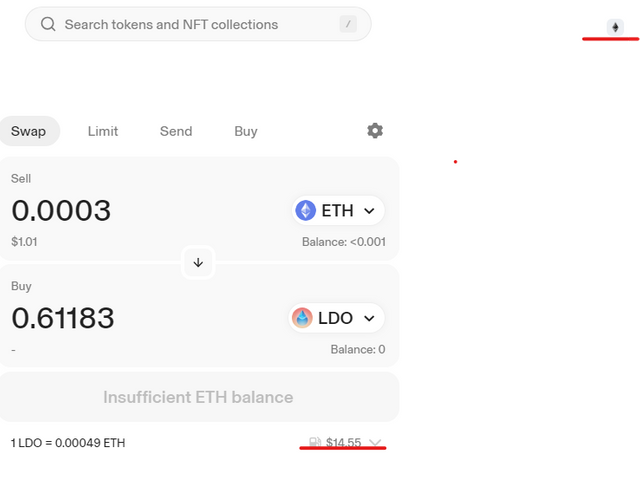

Let's take a look at a swap transaction on Uniswap, the largest DEX on Ethereum.

- Choosing to swap ETH worth $1 to LDO would be cost an approximate fee of $15 as shown in the image below.

Screenshot from Uniswap

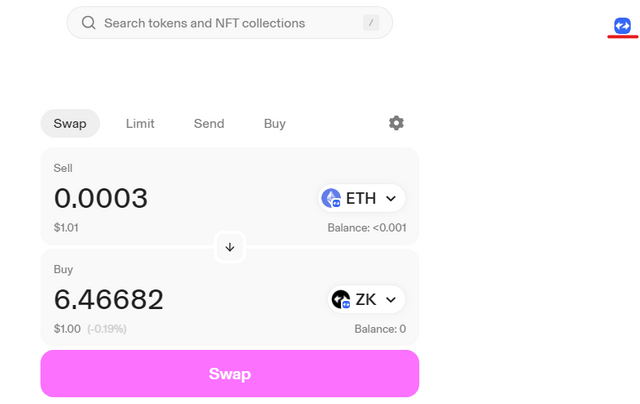

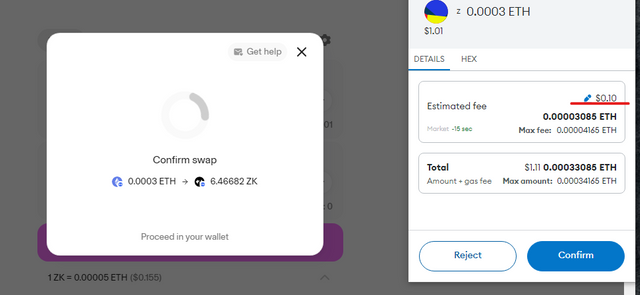

- Switching to zkSync Era network (a L2 scaling solution for Ethereum). I chose an equivalent of $1 ETH to the ZK token and that will only cost $0.10.

Screenshot from Uniswap

Screenshot from Uniswap

Comparing the gas fee for the main ETH chain and zkSync, we can see that there is a clear difference as the latter takes care of a pressing issue with the ETH chain.

L2s have significantly innovated the early problems of low throughput, high cost, scalability and others associated with the earliest blockchains. Users can now interact with smart contracts and spend only about $0.14, cancelling out the excessive $10+ that it used to be. It sometimes requires bridging assets to the L2s to use the improved functionalities, and we will take a look at that next time.

Bro I go need proper clarification on this, very impressive though

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The article is shared on X

https://x.com/OyakunleF/status/1818317031302979930?t=SE_7Cu_DE4Ej0QwwbO907g&s=19

#steemit #steem $steem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the support, @ngoenyi.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit