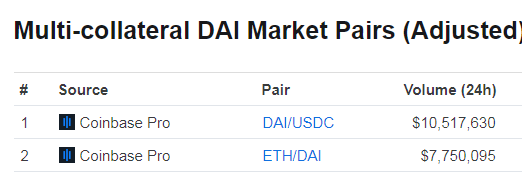

There is so much demand for DAI on Coinbase right now, but what is really surprising is the volume on DAI/USDC.

I don't believe I have ever seen a daily trading volume on DAI/USDC to ever go past $2 million, let alone $10 million.

While DAI and USDC are both considered stablecoins, they are different in that one is backed by actual dollars sitting in a US bank account, while the other (DAI) is backed by ethereum deposits in MakerDAO vaults. In a financial crisis scenario, the dollars backing USDC could theoretically become blocked/seized if the holding bank becomes insolvent for whatever reason.

Given that US stocks suffered the biggest one-day crash in history today, it's no surprise that many USDC holders could be diversifying into DAI to protect against bank insolvency.

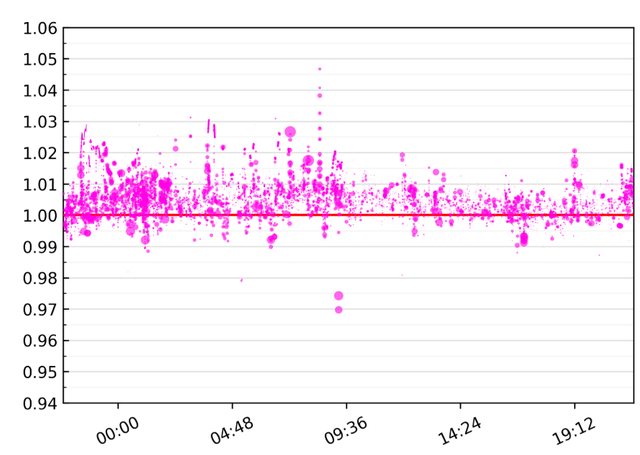

DAI usually trades around the $1 line, but today it has consistently traded above $1. This tells me the demand is strong that even arbitragers can't keep the peg at $1 for very long.