I hope you bought the dip...

I posted this several days ago in reference to stocks likely seeing at least a short term bottom...

.............................................................................................................

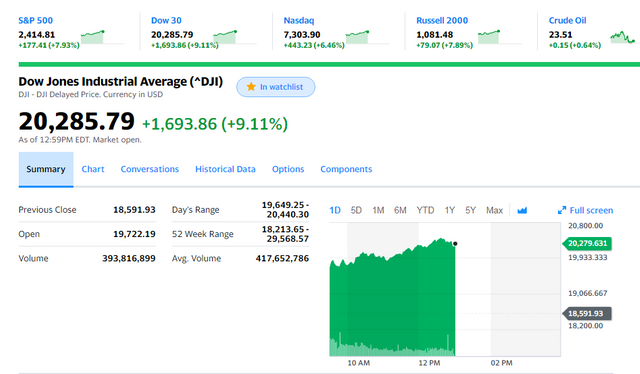

It's a risk-on day across the board...

Hope you bought the coronavirus dip!

Stocks are up, bitcoin is up, oil is up, just about everything is up today.

Check out the Dow:

(Source: https://finance.yahoo.com/quote/%5EDJI?p=^DJI)

The impact of the coronavirus is real and will last for a while longer still, that was never up for debate.

But, financial markets tend to bottom at peak fear and peak fear often hits well before the actual crisis starts to resolve itself.

Which means...

Financial markets and risky assets were likely to make lows long before the economy actually starts to recover.

In fact, it's possible we have already seen the lows.

I would bet we saw the lows in bitcoin for sure, and possibly in stocks as well.

Stay informed my friends.

-Doc

.......................................................................................................

Did you buy it?

Since that time the stock market is up roughly 20% from those lows.

Already erasing half of the coronavirus dip.

Bitcoin is a couple ticks below where it was at that time, but not much.

I am not sure if this will end up being the ultimate low for stocks, but it very well might be.

And I do think we won't be seeing sub $3,800 on bitcoin.

Hope you bought those dips!

Stay informed my friends.

-Doc

If you bought the dip, you may want to consider selling before the crash. I will be Dr Doom (Nouriel Roubini) for the purpose of this post.

The US gov / Federal Reserve will leverage up the ~2 trillion to 18-24 trillion which should last 3-5 weeks. At which time they will be back for more.

The markets were already over leveraged circa September 2019, when the Fed opened the repo window and started pushing billions to the banks. Ironic that this occurred during the "best US economy" in living memory.

The Banks need the bail out cash now in part because the basic tenants of the banking business model, use fractional banking to take deposits and loan out multiples of that. However with extremely low interest rates the spread has not been enough for banks to earn their historical profits. Thus came the ballooning of the synthetics securities markets. The banking system has now created a derivatives market estimated to be between 1,200 trillion and 1,600 trillion (I know it's a quadrillion, just cant make myself use this term yet) that is becoming unstable. These securities at this level are a ticking bomb with the instability and uncertainty the virus has caused, and the bomb is thermonuclear. It will not just take out one bank in the US or three, due to the spreading of counter party risk it will take down the global financial system. This will not occur over a period of weeks as in the 2008 melt down, it will happen in less than 36 hours.

Nothing will work, credit cards, debit cards and other remittance systems. Not only will these systems freeze up, the banks in G20 countries will take depositors funds in what is referred to as "bail in laws" put in place after the 2008 Great Recession. Meaning money you have in the bank will be gone.

Source

Hope I was able to deliver as promised as Mr Doom! In short if you are blogging to make some small money, you are and me are screwed. Actually most millionaires are screwed.

The good news is that the US, China, EU and many other countries have been ready to roll out a digital currency. While this provision was removed from the US multi-trillion bail out bill this week, it is currently in two other bills. This will be so exciting to have all governments know every penny you move. I also expect they can debit your wallet without your approval. Gov's have wanted this level of control for over a 1000 years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was a great comment, greatly appreciated. However, to respond to just your part at the end... I don't think congress will approve of a digital currency where all your transactions are knowable. Several in Congress have actually commented on exactly that recently, though I can't find the links off the top of my head...

Regarding much of the rest of your comment...

Nothing in there screams of not further can kicking and bailouts, should fit hit the shan. They will keep printing and bailing out until they simply can't anymore and I really don't think we are at the point yet. As long as people keep accepting the dollar (which they are as evidenced by its reserve currency status), the merry-go-round will continue to go round and round and the game goes on...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The US gov as well as most others would not want the records of money movements that would be recorded even in a centralized blockchain. This would create problems under a future administration. Also the funding of black ops would leave trails that most would not want. However in a centralized approach I guess you can do what you want. This is likely why the Pentagon has lost track of 35 trillion. source

I see many forks in the road on where this goes. But a total reset of the financial system is likely. As I note often, you only need to get the people to want it, similar to the method used on the movie The Hunt for Red October . And when people have not earned pay in 12 weeks and their 401k has dropped 88%, the people will want it.

The current financial system was created after a train ride to Georgia, I am curious who and where the next financial system will be spawned, as well as who will write that book.

Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What is this TPT thing? Showing on the top of CMC?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it's an April Fools joke.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In fact, it's possible we have already seen the lows.

The lows have not even warmed up yet.

There is only one end result of massive QE.

Just the one.

Unless you think modern monetary theory -MMT- is reality of course - and if that's the case, you're mentally ill. (not 'you'. 'you' as in a general you)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure, but it will keep working until it doesn't. It has already worked for the last 12 years. Who's to say it is going to stop now? It may keep 'working' for another decade, or three, for all we know...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Somehow the Short-Certificate of a friend works strange. As he gains profits while the Dow is increasing ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit