Stocks and Bitcoin took it on the chin today and Wells Fargo says this is just the beginning...

The Dow Jones Industrial Average slid close to 3% as the Industrial Average closed down more than 700 points and futures are already down another 200 points in pre-market trading.

In what has become common place these days, selling in the stock market bled over into selling in the bitcoin market as well.

Bitcoin found itself down roughly $400 on the day as it fell more than 4% in less than a 24 hour period.

However, Wells Fargo and several others think today was just the beginning...

More pain to come in the near term?

Wells Fargo and JPMorgan both said they see a very good chance that the selling will continue into the end of this month.

Per Wells Fargo:

“We estimate that U.S corporate pensions will move about $35 billion into fixed income.”

And JPMorgan said they see an even bigger move out of stocks:

"We see roughly $65 billion rebalancing flow from U.S. defined benefit pension funds. But on a global basis, there could be $170 billion that could flow from equities, when considering U.S. corporate pension plans, mutual funds and other global institutions like Norway’s Norges Bank, which manages state funds."

$170 billion flowing out of stocks in the next two weeks?! Yikes...

Why is that you might be wondering?

Some might think that it is due to the spike in Coronavirus cases (which was part of the narrative for sure) or due to the fact that congress seems to be at an impasse in terms of coming to an agreement on another stimulus package, but it's actually a little simpler than that...

According to analysts at Wells Fargo, it's a little more straight forward:

"The reasons are pretty obvious. You had this massive rally in stocks and bonds haven’t been keeping pace."

So, we are going to have this massive reallocation of pension funds from stocks to bonds to take advantage of their relative under-performance.

It's all about locking profits and chasing yield, or in this case maybe a little about protecting gains.

The coronavirus is not going away and it's not helping...

The weakness is about more than just the reallocation though...

We saw many in the transportation industry especially weak today, being lead to the downside by the airlines.

That industry was just showing some signs of life and now they are facing the possibility of quarantines yet again.

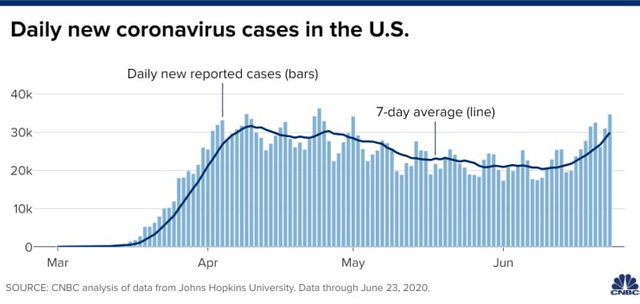

Plus when you see charts like this, it's never a good thing:

(Source: https://www.cnbc.com/2020/06/23/stock-market-futures-open-to-close-news.html)

If this was the chart of a stock, it would be a buy as it looks like it's going a lot higher...

Unfortunately, it's a chart of new coronavirus cases, which means we are likely seeing the second wave now and not later this fall like most expected.

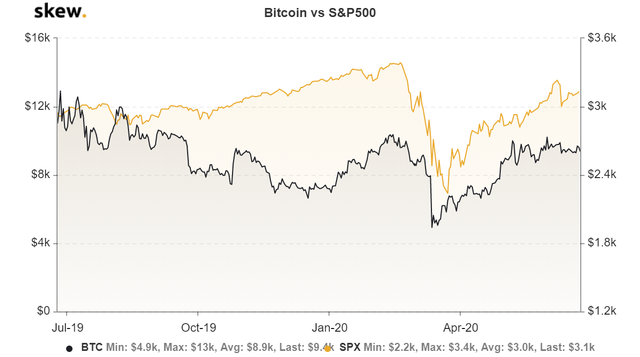

None of this is good news for Bitcoin in the near term as we have learned (by following my blog) just how correlated bitcoin is to the US stock market these days.

Hint...

It's very correlated.

(Source: https://cointelegraph.com/news/wells-fargo-expects-a-stock-market-sell-off-bitcoin-price-to-follow)

Buy the Dip!

While this may sound like bad news on first glance, it is actually very good news for those holding cash.

As we saw back in March, the plunge is often over very quickly and governments around the world are quick to jump in when things get volatile.

For those reasons, any dip will likely be short lived in both stocks and bitcoin and it's likely a great opportunity to buy the dip before the next major bull market really gets going.

BTFD!

Stay informed my friends.

Image Source:

-Doc

Greetings dear @jrcornel.

Perhaps there are recent factors that are motivating this down, but we must see the general behavior. If we look at the TAs after the Halvings, these falls look like habitual behavior.

As you say, this is the opportunity to buy, because for December it is very likely that we will see this long-awaited rise in prices.

All best, Piotr.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit