When you want to long something, just long it, no need to leverage that long...

Sometimes when you have the greatest conviction on a trade, you end up making the biggest mistakes.

What do I mean by that you may be wondering?

Well, take bitcoin for example, lets say you have an unwavering belief that it's going to hit $100k by this summer, like I do.

Well after watching the price stagnate the last several weeks it may be tempting to take out some leverage on your belief so that it can really pay off when it hits.

That sounds great in theory, but if you do make sure you give yourself plenty of time and plenty of wiggle room in terms of price.

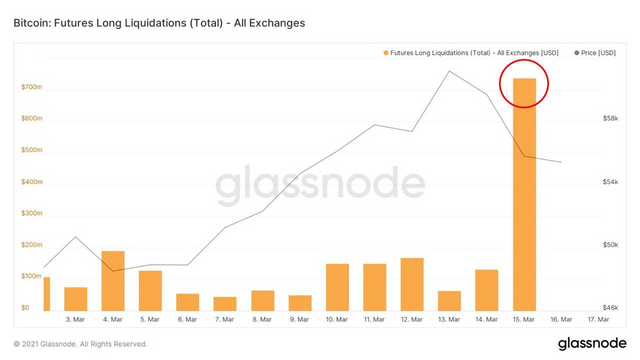

Otherwise, this happens:

(Source: https://twitter.com/MaulanaSalihu/status/1371945448194387976/photo/1)

You get margin called on your play.

With bitcoin at new highs and stimulus checks rolling out, it was a no brainer that prices would keep going up, right?

Wrong.

There was a little hiccup first, which shook a lot of people out.

That is exactly the dip we are experiencing right now.

This is an extreme situation where these traders were expecting to get called out, or at least knew it was possibility, but you get the idea.

Moral of the story? Don't play with margin unless you know what you are doing and take ample protection just in case your sure thing turns out to not be so sure.

Stay informed my friends.

-Doc

Like the old Wall street saying " Bulls make money, bears make money, pigs get slaughtered ".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't traded anything on margin in almost three decades... don't have the stomach or conviction for it.

Back in the early to mid 1990's I did day trade a few specific tech stocks on margin and somehow managed to emerge unscathed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah I don't go into margin in Crypto. NOPE.....no thank you!

What I have done though is take a very low loan to value ratio loan out of Venus for stable coins and have experimented earning more returns off of that....... I think leveraging these platforms could make it easier to get through the bear market and keep core holdings but free up capital for other things.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit