One of the biggest things that those involved in trading need to keep an eye on is risk management. All the big traders I've seen talk about their risk all the time. They don't even look at their profits that much. On the other hand , those of us who are a little new to this trading sometimes make many mistakes which later become a huge obstacle for them in the trading journey. And today I would like to share with you those little mistakes to make your trading journey a little easier.

First and foremost, stay true to your goals. For example, you take 1 trade and place your stop-loss at a point where if the market touches and you will lose around $50. And if your trade is right then you will get total profit of 100$. Then when you have a total profit of 50$ then you closed the trade without understanding the market. Then it appears that your risk and profit are equal. But then when you take another trade it may appear that the trade did not go through. And your stop-loss is hit and your loss is gone. And you have lost the profit you made from the previous trade.

Even sometimes due to the volatility of the market, the loss is more than the previous profit. Apart from that there are trading fees. All in all, if you have equal risk and profit, it will be very difficult for you to move forward. So always try to make the profit 2 or 3 times more than the risk. Otherwise you may not be able to make much profit. The fact is that no one can give you a 100% guarantee that trading will happen. The highest trading winrate I've ever seen was around 90%. That is, he has 90 trades out of 100 trades. Although we are not yet at such a high level .

My main purpose today was just to give you some idea about risk management. Although this is a very difficult thing , you need to practice a lot to master these things . But I think you should also focus more on trading. Because if you can't make a profit then what to do with your risk management ?

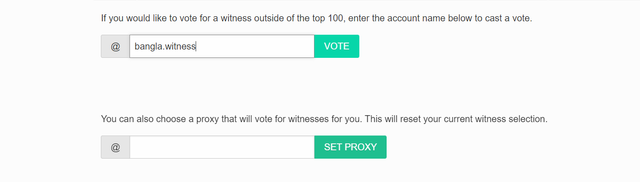

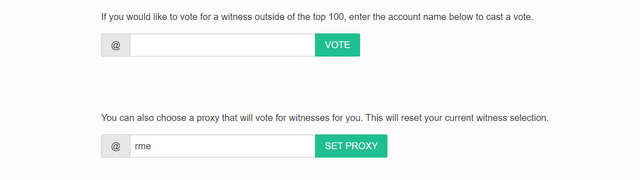

VOTE @bangla.witness as witness

OR