I talked about how the dark pools in cryptocurrencies operate and I also specified an exchange that uses it. The kranens dark pool. Krakens dark pool has implemented the elimination of orders in the crypto market as a security measure since these are placed in a visible order book but the dark pools are seen as invisible in terms of its order book and it is properly managed through limits orders.

These limits orders are commonly used in dark pools to carry out transactions and they are combined with other limits orders created in the dark pools. A trader can create his cell limit order for a second amount in his dark pools and the execution of this order would be done once it is associated with another buy limit order.

Transactions in this dark pools are invisible and hidden which prevents certain fluctuations in the market. It also maintains the same price rate of both taker or market. Some assets available in this krakens dark pools are

- BTC/USD

- BTC/CAD

- BTC/GBP.

These assets are under bitcoin and in ethereum, it follows the same pattern. There are certain requirements to participate in dark pool tradings. The requirement is that for bitcoin pairs, the minimum order size is $100k and for ethereum it is $50k. This dark pools is only available to those that are verified.

The platform charges a trading fee for others place in the dark pole which at times have variations from 0.20% to 0.30% according to the volume of operations carried out in a month. The higher the operation is, the lower the volume will be. The picture shows a screenshot to highlight this percentages between the taker and the market fee.

Decentralized dark pools |

|---|

Decentralized dark pools include the following features

the represent anonymous venues for commercial negotiations of large assets transactions

these decentralized dark pools also prevent large amount of assets transacted from affecting the price of an acid or causing variation in the prices of fixed prices by Traders

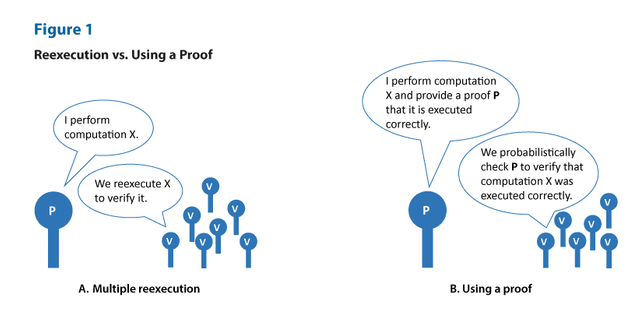

these decentralized dark poold also allow asset orders to be broken down into fragment to be reunited using the zero knowledge proofs. What can we say about the zero knowledge proof?

Zero knowledge proof |

|---|

The zero knowledge proof as security measures that is based on the Verified proving that they are aware of some secrets without having to reveal the real secret to another person. There are also regarded as crypto graphic technologies that verifies the integrity of operations such transactions carried out in the dark pools.

This zero knowledge proofs method are cryptographic protocols that allows one party to make a statement to prove its authenticity to another user or party without actually revealing additional information to the original statement made.

Cryptocurrency orders in these decentralized dark pools broken down into fragments that match are recorded and sends the respective notification to the other nodes, thereby verifying the integrity of the transaction made i.e the return of the information.

Let's look at the ren protocol. This protocol was founded in 2017 and allows for interaction between the blockchain. It is centralized meaning that it has a central user that controls its activities and operation. It's governance token known as Ren is backed by the ethereum blockchain ERC-20.

This protocol also allows the decentralized exchange of assets between blockchain using its Ren virtual machine which is centralized platform that uses a network of darknotes to provide all the computing power with required for the position of different orders between the chain. Some of these assets include BTC, Ethereum and Erc-20.

With this protocol system, the use of **Shamir secret sharing scheme algorithm to divide others in a way that dark nodes do not know the destination or even the amount of the operation to be executed

So in summary, the dark pools in Crypto ecosystem actually brings about transactions that are invisible or hidden so as to avoid variations in prices of assets in the market due to the large amount of assets investors purchase. We've also seen the Protocol it works on and how the kranen exchange uses it.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1752675299580354615?t=Ap58C-LFENsNeo-t65kkNA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@jueco

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit