This topic may sound mysterious but it's not what you think. The pool is dark right? What are these dark pools in Crypto ecosystem and why are they essential. The crypto ecosystem is advancing on a daily basis, transactions carried out transparently and the likes of them. Is dark pool any different?

Dark pools has the name implies have been gaining popularity in the crypto ecosystem as they allow the exchange of financial instruments improving the trading framework in cryptocurrencies as well as provide a high level of security in the ecosystem. These pools were created to enhance block negotiations for investors who popped not to impact the market with their large orders.

The first appeared in 1980s which allows investors straight light amount of Securities. Dark pools do not have their other book open to the public unlike the public exchanges that does so. Traders can carry out negotiations invisibly keeping their intentions private. This prevents the negative effects that may come with its execution.

This dark pool allows one thread asset without having to reveal the intentions to the public does keeping it hidden, since buying and selling of large amount can influence the crypto market negatively. In these crypto markets, liquidity is called dark pool liquidity where trading is carried out through block threats to refer to transactions of large amount of certain assets..

Features of Dark Pools |

|---|

Features of dark pools that are notable are;

- market sentiment is affected and not the market itself since Traders hide their intentions of the public to trade a particular asset in bulk.

- in terms of security, the dark pool is represented by an other book that is not visible to the public which provides a sense of security and privacy in transactions of Traders.

- Transactions carried out in dark poles are through block trades at define prices which makes Traders have this confidence that the negotiation will be carried out at a planned price.

How Dark Pools Work |

|---|

The buy and sell others recorded in public order book are known as market orders which is functional when placing deals with retail Traders. The institutional investors trade large amount of assets on a daily basis and manage their rates that is why it is not advisable for the transactions or operations to be made visible.

If their intentions become public, it will drastically affects the market which may make it volatile. These volatility in the market can lead to the buy other being completed at a different price than they already planned price which courses unexpected costs.

To counteract these situations, the dark pools where large amount of assets can be traded through an other book that is invisible, mitigating the impact on the market which prevents price variation and rather maintain fixed prices. The dark pools primary function is to allow trading between large investors outside normal exchanges which provides an opportunity to avoid sleepage in prices since the orders aren't made public.

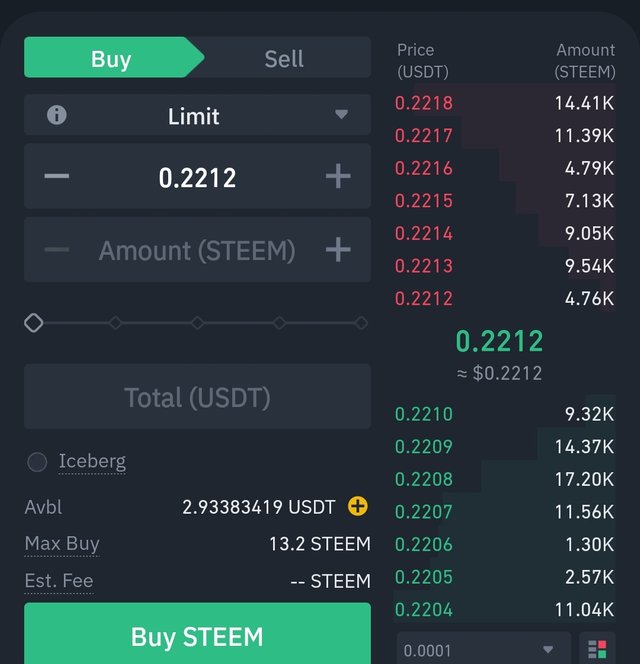

The limit orders in dark pools are used by Traders to carry out transactions of large amount of assets at a planned price without variation which actually affects the price of the assets to be traded. Traders can set the price at which the one to buy or sell an order without it being affected at the end of the oppression or transaction.

We must have this in mind that most dark pools orders can only be combined with another dark pools which discards market orders since there are carried out through a public order book. One crypto exchange that offers Dark Pools is the Kraken founded by Jesse Powell in 2011 when the trading of bitcoin begun.

This exchange has become popular due to the inclusion of new features such as Dark Pools Service and Margin Trading in the exchange vwhich allows traders trade large volumes of assets without alterations in the prices of market since the orders of Buy and Sell are made invisible without revealing their intention to the public.

One advantage of using the tool is that it allows you place large orders without causing variations in prices in the market, managing vto complete the operation without causing price slippage in these assets.

All screenshots are from my binance

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

.png)

https://twitter.com/bossj23Mod/status/1752102925214638265?t=a51g7ye6lnyCqumy7xrK4A&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@jueco

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit