The word leverage has been overemphasized especially by marketers. They leverage on you to build their capital. This particular leveraging I want to talk about is the leveraging in crypto trading which means using borrowed capital to make trades. Many Traders may feel it's just a literal figure and it is used to move threats many Traders may feel it's just a literal figure and it is used to move threats many Traders may feel it's just a literal figure and it is used to move trades mostly.

It's far from being just that. Leverage trade can speed up your buying and selling power no doubt which allows you to trade in large amount but given if your capital is small, you can use the system to make leverage trades.

I can remember using 35x leverage on a small amount of dollars and it's gave me x10 of what I used. While this trading on leverage can increase your potential profit, it can be risky if not put in place in this volatile crypto market. I know of a newbie Trader who with his greed wanted to be left alone in making decisions on trading after receiving signals for two good months. He entered a trade with a high capital and the highest of leverage. Unfortunately, the market was going down.

He lost almost $500 in a blow because of his leverage. Do you need to be scared about leverage trading? There is actually no futures trade placed without a leverage. So you need to understand what this leverage is all about. It can be very confusing but in simple Words it's definition and explanations are shown below.

|  |

|---|

Leverage Trading Definition |

|---|

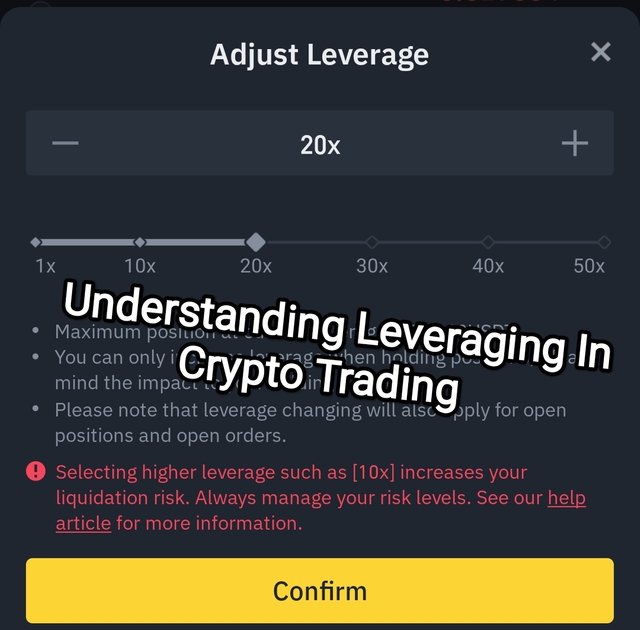

Leverage means borrowed capital to trade assets in the crypto market. You're not sending message this leverage boost your buying or selling Power which can make you trade with more capital than what you already have. You can borrow up to 100 times of your balance of this leverage depending on the exchange used in Trading. The amount of leverage is described as shown below;

- 5x

- 10x

- 20x

which is in the ratio of 1:5, 1:10, 1:20 showing how many times your initial capital is multiplied. If you have $50 in your account and you want to open a future trade, of Bitcoin position with $500, using a low leverage will give you your $50 the same buying power as that of $500. So you can leverage for this amplification.

How does it work? |

|---|

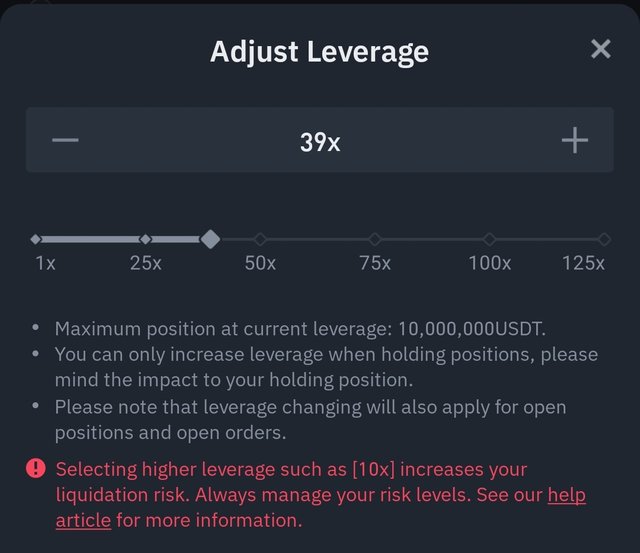

Before placing a trade with leverage, your account must be funded of which you do deposit to your futures wallet on the amount of dollars you want to use. That initial capital on dollars you transfer this is your collateral which depends on the leverage you use and the margin or the total value of position you want to open. Let's say we want to invest $500 in Bitcoin with 10x leverage.

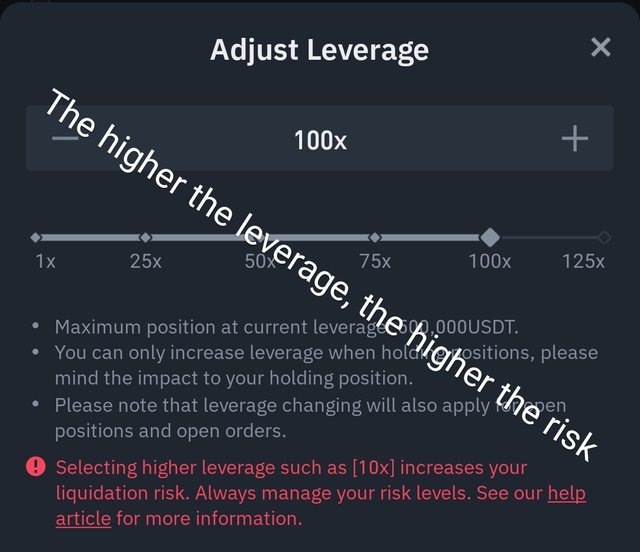

The margin which is called the dollars used in Trading will be one 1:10 of $500 meaning you must have $50 in your account as initial capital for the leverage. If you use 20x leverage, your margin would be even lower 1:20 of $500 which is $25. Note that the higher the leverage, the higher the liquidation risks, that is why you see most traders consider their margin first before knowing what leverage to use to avoid liquidation. This leverage is just like using the regulator of a fan. The higher the regulation the higher or faster the blade moves.

Apart from this initial capital or margin, you must also maintain a margin threshold for your threats meaning that if the market moves against your position and your margin falls below the maintenance threshold or margin, you will need to add more margin into your trade to avoid being liquidated by the market. This leverage applies to both long and short positions.

Opening these positions will mean you expect the price of an asset to go up or down. Using leverages allows you to buy or sell assets based on your collateral only and not on your Holdings. How can one possibly leverage a long position and why do we use leverage in Trading positions? These questions would be answered in my next post.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

All screenshots from my binance

https://twitter.com/bossj23Mod/status/1776358675612897638?t=R--VJiJ-9uzrXOJ_UfWNpg&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Moderation

Note:- ✅

Regards,

@theentertainer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit