The recent boom on the decentralized finance space has made it possible for series of new financial instruments to be created with the purpose of satisfying the needs of investors on the crypto space and for obtaining dividends with digital assets from the most conservative to the most daring even at the cost of suffering from a loss of their own personal resources.

Yield farming is that new financial instrument which has gained popularity among crypto Enthusiasts. Before venturing into yield farming, let's understand what defi is as many has mistaken decentralized finance to financial technology.

What is Defi? |

|---|

Defi, listen to write in army consist of protocols or applications development on blockchain networks which are decentralized using smart contracts which doesn't require intermediaries for execution of transactions what is based on automated executive agreements which can be accessed by anyone.

It is used to describe a wide variety of projects which seek to innovate the world. This decentralized finance facilitate access to loans, training of financial tools, borrowing etc and are currently developed on the Ethereum network. One of the advantages of the Defi is that it facilitates access to financial services on the ecosystem and the modular work environment on which it is developed have the potential to create new and innovative financial markets, services and products.

The Defi also have disadvantages which include low performance compared to a centralised counterpart with translate into lower speed. It also have high risk of error on the part of the user who bears the responsibility that the intermediary previously had in centralized platforms. Coding errors and hacks are common in Defi. Decentralized finance transactions are carried out directly between users to a smart contract without the need of intermediaries. To assist this decentralized applications, applications such as MetaMask wallet allows users to interact directly with the network through a web page. Now, to yield farming.

Yield Farming |

|---|

The growing rise of different different platforms and the incentives offered has allowed large number of users to get into the market looking for opportunities to obtain greater return-on-investments made. It is the modality to obtain dividends with cryptoactive portfolio values let me some equipment in which means rewards are obtained by locking funds in a way that resembles staking. Yield farming works through users called farmers or liquidity providers who add their funds to reserves of which these reserves are smart contracts that contain funds.

The farmers obtain reward by adding liquidity into the liquidity pools. Tom liquidity pools the reward their farmers with multiple tokens which can be deposited into other pools to earn reward there as well. The idea behind this yield farming is that farmers deposit their funds in a pole and in exchange the obtain rewards for the deposit of which his rewards are in tokens form. This practice of yield farming is usually carried out using tokens on the ERC-20 protocol of Ethereum network and the rewards granted them are usually in form of ERC-20 token.

The growing boom in yield farming is attributed to the launch of COMP token last year, who is the governance token of the compound finance ecosystem. This COMP finance ecosystem is a lending protocol developed under the Ethereum network which makes it easier for users to acquire loans of different crypto assets. The launch of this COMP token greatly boosted the popularity of the token's distribution model which is based on algorithms that seek to attract liquidity providers or farmers.

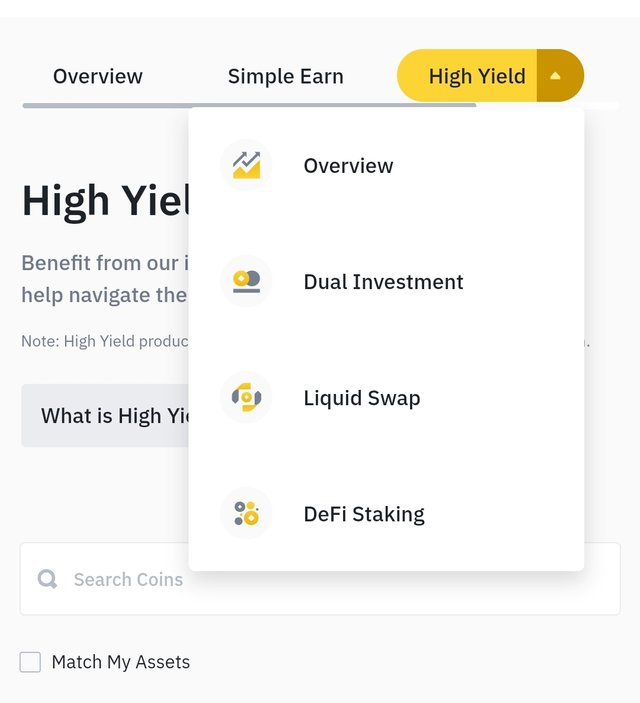

This practice consists of evaluating the different investment opportunities in Defi applications to design strategies in a way that allows farmers to maximize the investment returns. Some of the yield farming platforms we have are; Compound finance, balancer, curve finance, Aave, synthetic, MarketDAO, Year finance and lot more. In conclusion, yield farming is an important instrument in the crypto ecosystem that has helped many investors obtain dividends with digital assets and other financial services.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1721983993053077550?t=N6KJ2Y80uRC0sRn3s4-oxA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @bossj23 ,

We appreciate your active participation and contributions to our community. To ensure a positive environment for all members, we have implemented a set of guidelines to maintain respectful and constructive discussions while upholding community guidelines.

This is an interesting article on yield farming that you have shared, keep sharing quality post in the community

Now Engage, Connect, and Inspire Each Other to Reach New heights.

Thank You.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit