In my last post, talk briefly on yield farming. I'll give a detailed explanation on other terminologies related to this topic as well as yearn farming. So this post is a continuation of the one I made yesterday.

Yield Farming

Total Value Locked |

|---|

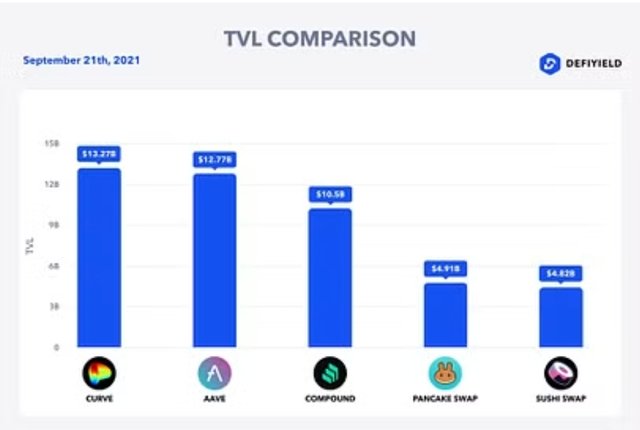

Total value Locked TVL is a figure that shows the amount of assets locked currently in a specific protocol which includes the **Aace, Compound finance, Pancake swap etc as mentioned in my last post. The value shown in these protocols are in Fiat Form. i.e in US Dollar not intended to present the number of outstanding loan. It shows the total amount of underlying supply that is locked by a Defi ecosystem. This is a metric used to measure the health of the defi market as well as returns made from investments.

It is also possible to track Total Value Locked on various applications. Unlike the market capitalization value shown on other dApps calculated by multiplying the circulating supply of an asset by its current price whereas in TVL, it is calculated by multiplying the amount of funds locked as collateral in the ecosystem by the current price of the assets. The picture shows the amount of funds locked on each protocols.

There are three main factors in that are taken into account when making these calculations involving TVL. These factors are the Calculation of the offer, the maximum offer as well as the current price. The calculation is obtained by dividing the Market Cap value by the TVL of a specified protocol. To illustrate this theoretically, the higher the ratio of the Total Value Locked, the lower the value bog an asset should be. One of the easiest ways to apply this TVL ratio is to determine if a Defi asset or protocol is overvalued or undervalued. If it is less than 1, it is undervalued In most cases.

How yield are calculated in yield Farming |

|---|

The estimated returns of funds blocked during yield farming are calculated on a yearly basis which indicates how much returns we can obtain in a year. It is calculated by using the Annual Percentage Yield and the Annual Percentage rate which is the APR. The differences between these two is that while APY takes into account the effect of Compound interest, APR doesn't.

What is compound interest here? Compound interest here means the dividends obtained by periodically reinvesting during a period of time to generate higher return. It is possible that the APY and APR can be used interchangeably, causing confusion for the investor. It should also be considered that these metrics are only long-term estimates as it is difficult to predict with any degree of certainty, the rewards n the short-term run.

So yield Farming is very competitive and highly volatile market of which reward amounts can fluctuate. Due to the rapid growth of the defi ecosystem, it must find it own metrics to calculations by returns beyond the APY and APR. There's return on investment which is a metric that indicates the return on investment calculated in a period of time and can be applied to investments that do not have a fixed interest rate.

Yearn Finance |

|---|

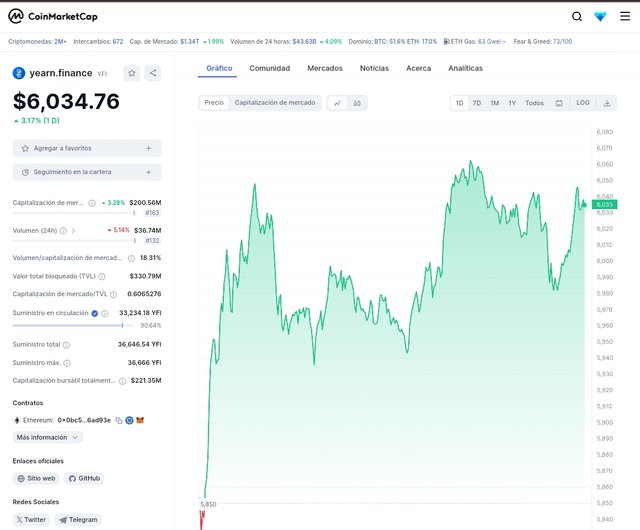

Yearn Finance is an open source Protocol on the Defi ecosystem, also established on the Ethereum network and has sought to facilitate access to yield farming strategies. It is considered as a sef-investment platforms which mobilize funds between different liquidity pools to obtain high possible returns at all times through smart contracts.

The year finance has its origin from the idea of the software developer, Cronje who designed it to be an easy to use Defi platform that would facilitate yield farming operations. Motivated by the growing rise of Defi protocols and yield farming as well, to the first version of yearn finance was presented which became the largest Defi platforms with a total locked value of over $4.24 trillion in the world. This yearn finance is also based on multiple functionalities by the smart contracts of the Ethereum network designed to transfer funds to protocols that offer the highest Annual Percentage rate autonomously, ensuring its users benefit as well.

The yearn finance is this similar to Decentralized Exchange as users are allowed to deposit their ERC-20 Stablecoins in the protocol which they receive equivalent amount of ytokens in return instead of lending them. The platform changes the tokens to the protocol with the highest profitability. So in summary, we've seen the role of smart contracts in yearn finance and how the APR and APY comes to play in the Defi ecosystem.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1722306137809186861?t=-_ihjEnAtzn6qK8OB8noiA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @bossj23 ,

We appreciate your active participation and contributions to our community. To ensure a positive environment for all members, we have implemented a set of guidelines to maintain respectful and constructive discussions while upholding community guidelines.

This is an interesting post, however, it will be easier for your audience to read if you apply appropriate spacing

Now Engage, Connect, and Inspire Each Other to Reach New heights.

Thank You.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit